Grayscale’s Bitcoin ETF continues pre-halving bleed

All-time spot Bitcoin ETF trading volumes exceeded $200 billion on April 8 despite outflows from Grayscale’s GBTC and a shift in market share.

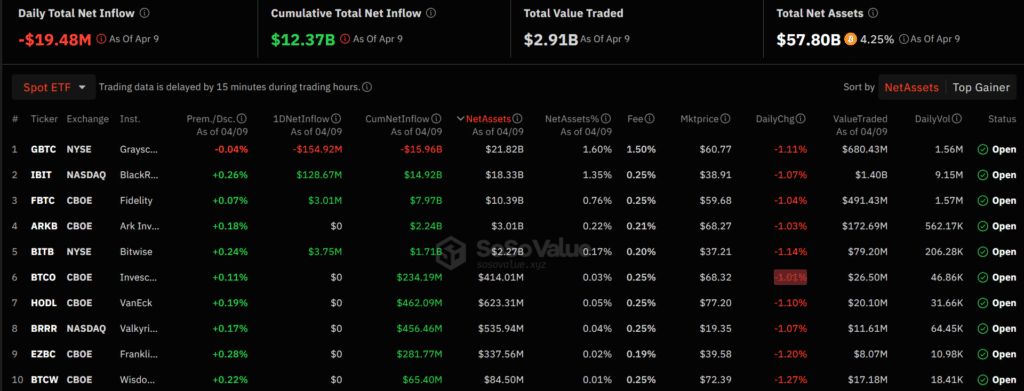

Grayscale’s converted Bitcoin (BTC) ETF shed $154.9 million, contributing to $19.4 million in cumulative outflows from all 10 U.S. spot BTC investment products, per SoSoValue. The data tracker ranked BlackRock’s IBIT fund as the largest intaker of investor demand with $128.6 million in inflows.

Bitwise’s $3.7 million followed BlackRock as the second-biggest inflow of the day, as Fidelity came in third with $3 million. Six spot BTC ETF issuers did not mark daily net inflows as products experienced volatile interest ahead of Bitcoin’s halving.

Nevertheless, cumulative trading volumes have doubled since last month, when numbers first hit $100 billion following listing approval from the U.S. SEC. in January.

Grayscale CEO: Bitcoin ETF outflows reaching equilibrium

According to Reuters, Grayscale CEO Michael Sonneshein remarked that exits from the crypto asset manager have likely reached equilibrium, due to conclusive proceedings in bankruptcy cases like Sam Bankman-Fried’s FTX.

FTX’s estate previously liquidated over $2 billion in GBTC shares, crypto.news reported. Sonnesnshein also believes a subsequent decrease in Grayscale’s fees will incentivize demand for its Bitcoin ETF as an incumbent issuer and market leader.

BlackRock seizes spot Bitcoin ETF market share

While Grayscale strategizes a pivot from fielding the industry’s highest spot Bitcoin ETF fees, the company has lost ground to new issuers. Sonnenshein’s firm commanded over 50% of the market share at the start of the year but dropped below 25% at press time.

Wall Street stalwart BlackRock has upstaged Grayscale as the Bitcoin ETF leader and now boasts around 52%, up from a 22% market share. The shift places Grayscale in second, and Fidelity’s 16.9% share in third.