Bitcoin ETFs see net inflows for a second straight week, reaching $4.7b

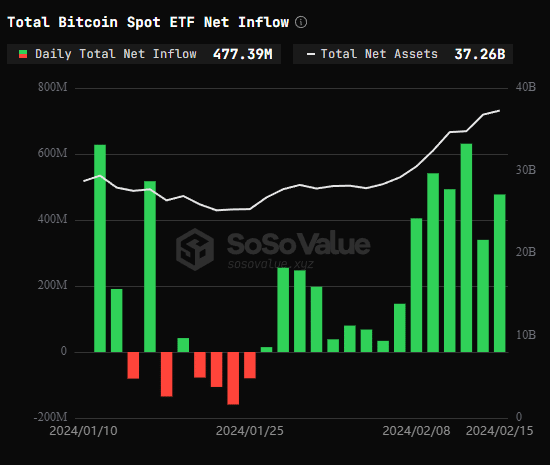

Bitcoin ETFs experienced a total net inflow of $477 million on Feb. 15th, continuing a trend of positive net inflows for the 15th consecutive trading day.

According to data from SoSoValue, the Grayscale ETF, GBTC, diverged from this trend with a net outflow of $174 million for the day. In contrast, BlackRock’s Bitcoin spot ETF, IBIT, led the market with a daily net inflow of $330 million, bringing its total historical net inflow to $5.17 billion.

The surge in investor confidence was particularly evident on Feb. 13th, which recorded the highest single-day net inflow at $631.2 million. The net inflow for Bitcoin ETFs has reached $4.7 billion, indicating a strong and sustained interest in Bitcoin as an investment asset.

The daily trading volume is still being led by BlackRock’s IBIT and Grayscale’s GBTC. Fidelity’s FBTC has the second-largest net inflow at $3.65 billion and is third in daily trading volume.

In the context of ETFs, net inflow refers to the total value of cash and securities flowing into the fund minus the value flowing out. A positive net inflow signifies that more money is invested into the ETF than withdrawn. This is generally seen as a positive indicator for the ETF, suggesting growing investor confidence and demand.

For Bitcoin and cryptocurrency markets, significant net inflows into Bitcoin ETFs are viewed as potentially positive, reflecting increased institutional and retail investment through regulated financial products.