Bitcoin, Ether, and XRP Weekly Market Update December 28, 2020

The total crypto market cap added $52.7 billion to its value for the last seven-days and now stands at $742 billion. The top 10 currencies showed mixed results for the same time period with bitcoin (BTC) and Litecoin (LTC) adding 14.6 and 12.1 percent to their values respectively while Ripple’s XRP lost 49.7 percent. By the time of writing bitcoin is trading at $27,277 ether (ETH) climbed further to $730. XRP dropped to $0.29.

BTC/USD

Bitcoin closed the trading day on Sunday, December 20 at $23,450. It was its first session in red since December 11 when it started rallying up from the $18,100 weekly support. The leading cryptocurrency added 22.5 percent for the seven-day period while temporarily moving above $24,000.

On Monday, the BTC/USD pair continued falling and reached a daily low of $21,872 before closing at $22,731 in the evening. The move corresponded to a 3 percent decrease in price.

The trading day on Tuesday, December 22 found buyers jumping off the mentioned level and forming a big green candle to $23,850. The 5 percent increase helped the biggest cryptocurrency avoid the short-to-mid-term downtrend reversal, at least temporarily.

The mid-week session on Wednesday, however, brought another rejection near the $24,000 level, which triggered a selloff. Bitcoin dropped down to $23,230 as bears were able to push it all the way down to $22,600 during intraday.

The Ripple confrontation with the US SEC (Security and exchange commission) started to impact not only the altcoins trading but also the market leader.

On Thursday, December 24, the BTC/USD pair moved up to $23,760 and on Christmas day on December 24 closed above $24,000 for the first time ever, also adding 4.1 percent to its value.

The upward movement was re-initiated and BTC continued to surge on the weekend of December 26-27. First, it formed its third straight green candle on the daily chart on Saturday, hitting a new all-time high at $26,497. Then on Sunday, it skyrocketed up to $28,452 during intraday, just to close with a small red candle to $26,227.

ETH/USD

The Ethereum Project token ETH closed the trading day on Sunday, December 20 at $637 after peaking at the monthly resistance situated near $670 on the previous day.

Bulls found stability at the $620 horizontal support and closed the seven-day period with an 8.1 percent increase.

The ETH/USD pair started the new trading week on Monday with a sharp drop to $607. The coin erased 4.7 percent from its value and broke below the mentioned weekly support.

It formed the exact same candle, but in the opposite direction on Tuesday, December 22, and successfully regained back its positions above $630.

The third day of the workweek came with a serious correction as the uptrend continuation could not be secured.

The ether fell all the way down to $584 and was seen as low as $550 at some point during the day. The move resulted in an 8.3 percent decrease.

On Thursday, December 24, the ETH/USD pair rebounded from the weekly support at $560 (which was also in synch with the 50-day EMA) and climbed up to $612, successfully avoiding a lower low on the daily chart.

The move was followed by another solid session on the last day of the workweek, which helped ETH surpass the mentioned weekly support and close at $626.

The first day of the weekend came with a further increase to $637 on Saturday, then to $684 on Sunday. The two sessions corresponded to a 9.2 percent of price increase. The ETH token was last seen that high in May 2018.

XRP/USD

The Ripple company token XRP closed the trading day on Sunday, December 20 at $0.555 after it was rejected at the $0.58 monthly resistance during the previous session. The uptrend could not be resumed and looks like bears were already preparing for a mid-term reversal. Still, the coin was 8.1 percent up on a weekly basis.

On Monday, it continued to fall finding its bottom near the next major support line at $0.50. The XRP/USD pair erased 8 percent from its value, but the worse was yet to come.

The United States Security and Exchange Commission (SEC) announced on December 22 that it is investigating Ripple for allegedly offering $1.3 billion worth of unregistered securities in the form of a cryptocurrency token and will soon file a lawsuit against the company.

The news hit hard the valuation of the major altcoin and it first dropped to $0.445 on Tuesday then to $0.259 on Wednesday, which resulted in a 49 percent decrease in price for the two sessions combined.

On Thursday, December 24, the XRP token was already situated below all major EMAs, still, it managed to bounce back up to $0.339 and ease the pressure, at least temporarily.

The Friday trading, however, was once again volatile and bulls were struggling to keep trading above the $0.29 monthly line, closing the workweek at $0.315.

The weekend of December 26-27 saw the “ripple” falling below that line after forming a short green candle to $0.298 and $0.28 on Saturday and Sunday respectively.

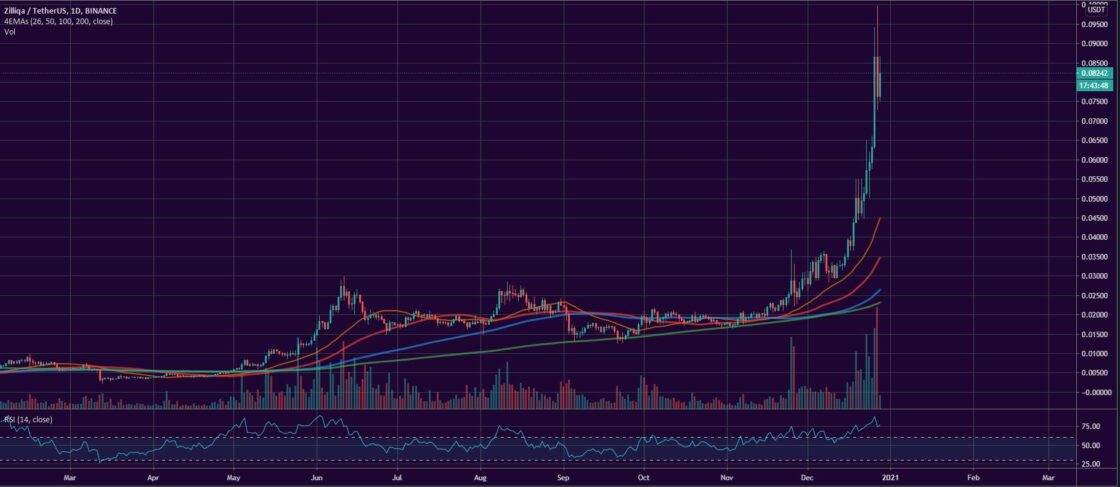

Altcoin of the Week

Our Altcoin of the week is Zilliqa (ZIL). This high-speed blockchain platform, which utilizes the sharding technology as a second-layer scaling solution, enables its users to host decentralized applications on top of it.

ZIL added 79 percent to its value for the last seven days and is 154 percent up for the two-week period since December 14. The recent surge in price helped the coin move up to #35 on CoinGecko’s Top 100 list with a total market capitalization of approximately $952 million. It peaked at $0.096 on Sunday, December 27.

As of the time of writing, ZIL is trading at $0.082 against USDT on Binance.