Bitcoin, Ether, and XRP Weekly Market Update November 23, 2020

The total crypto market cap added $85 billion to its value for the last seven days and now stands at $549 billion. The top 10 currencies are all in green for the same time period with Cardano (ADA) and Litecoin (LTC) leading the pack with 52 and 41 percent of gains respectively. By the time of writing bitcoin (BTC) is trading at $18,722, ether (ETH) moved up to $593. Ripple (XRP) skyrocketed to $0.461.

BTC/USD

Bitcoin closed the trading session on Sunday, November 15 at $15,980. The leading cryptocurrency formed a second consecutive red candle on the daily chart as the horizontal resistance level around $16,150 was becoming a serious obstacle on the way to new highs. Still, it closed the seven-day period with a 4.3 percent price increase.

Things drastically changed on Monday. The market was hit by a wave of buy orders, which resulted in BTC skyrocketing all the way up to $16,713, also smashing through the next resistance on our chart – $16,650.

The BTC/USD pair continued to surge during the trading session on Tuesday, November 17, and climbed to $17,694. It grew by 10.3 percent in just two days of trading. What’s more – BTC closed above $17,150 for the first time since December 2017 and registered a new all-time high in market capitalization -surpassing the 2017 values of $316 billion. Open market interest and BTC options markets were also seeing record values.

The mid-week session on Wednesday was marked by extreme volatility. The biggest cryptocurrency was trading in the wide range between $18,500 (hitting a new high) and $17,000 before closing with a short green candle to $17,774.

On Thursday, November 19, the BTC/USD pair was once again making ups and downs, hovering around the daily resistance line at $17,700, but remained flat at the end of the day.

The uptrend was resumed on Friday and bitcoin climbed to $18,700 in an attempt to fill the gap to the next weekly resistance at $18,900. It added another 5 percent.

The weekend of November 21-22 found bulls trying to break above the mentioned horizontal line in the early hours of trading on Saturday just to close with a negligible short green candle to $18,720 in the evening.

Then on Sunday sellers pushed the price below the daily resistance line at $17,700, but there was not enough momentum to ensure a close below that line and BTC recovered to $18,450.

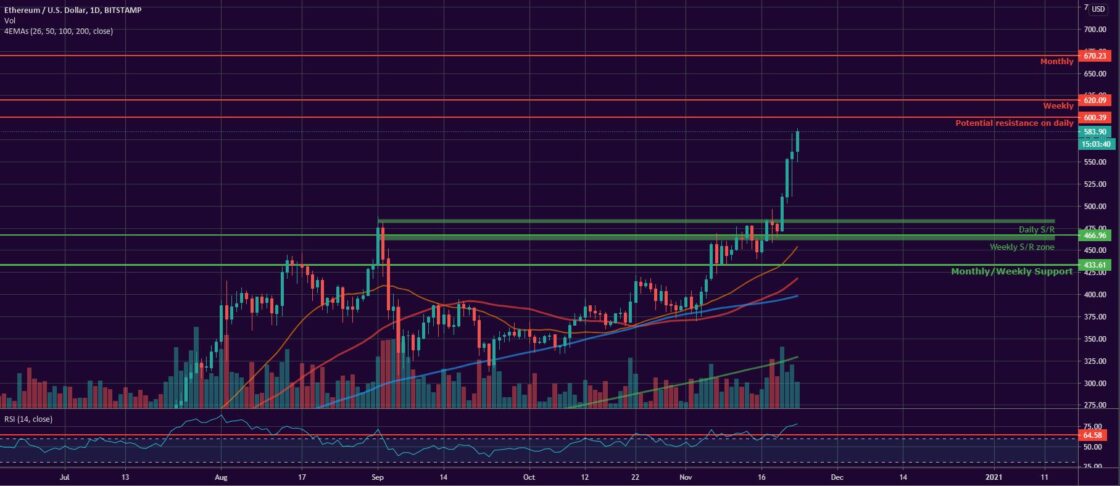

ETH/USD

The Ethereum Project token ETH was lagging behind Bitcoin in the recent rally but was still posting some serious returns for its buyers. It closed the Sunday session at $447 after failing to break above the next resistance zone around $465 but kept its price floating above the weekly/month horizontal support.

The ether remained flat for the seven-day period.

On Monday, November 16, it followed the example of Bitcoin and started to move upwards, once again reaching the already-mentioned area thus ending the day at $460.

The ETH/USD pair continued to surge on Tuesday and broke above the resistance line up to $482, also climbing above the September 2020 high. The last two sessions of trading corresponded to a 7.8 percent price increase.

On Wednesday, November 18, the ether was again highly volatile, hitting a new local high at $497 in the early hours of trading, but also dropping as low as $458 at some point before closing at $478 at the end of the day.

The daily resistance line proofed to be a tough one for bulls and ETH corrected its price to $471 on Thursday.

Nevertheless, the bull flag formation on the lower timeframes triggered a reversal to the upside and ETH climbed up to $510 on Friday. This was followed by another great session for the leading altcoin on Saturday. It closed at $553 for the first time since January 2018 and registered a consolidated gain of 17.4 percent for the two-day period.

On Sunday, November 22 bears tried to put an end to the uptrend but they were rejected at $512, so ETH closed the day in green.

XRP/USD

The Ripple company token XRP ended the previous seven-day period with a 6.3 percent price increase. The coin stayed flat around $0.269 on Sunday, November 15, still above all major EMAs and its monthly horizontal resistance line.

The XRP/USD pair climbed all the way up to $0.288 on the first day of the new workweek and added another 7 percent to its value.

The huge green candle on the daily timeframe was followed by another one as XRP continued to surge on Tuesday, November 17. Bulls successfully surpassed the next resistance cluster and closed above $0.30 for the first time since August 19.

The “ripple” was quite volatile on Wednesday. We saw it trading in the wide range between $0.308 and $0.281 before pulling back to $0.294 at the end of the session.

On Thursday, November 19, however, it continued its march up by hitting the weekly resistance at $0.305.

The last day of the traditional trading week came with a bang. The XRP/USD pair skyrocketed up to $0.33 and added yet another 8 percent.

Surprisingly, this move was dwarfed by what happened on Saturday, November 21. The “ripple” reached its highest point in a year and a half time by touching $0.463. It gained 40 percent of value in just one day and became the main driving force of the altcoin market’s revival.

On Sunday, XRP peaked at $0.496 but then fell back down to $0.446 closing the day with a loss.

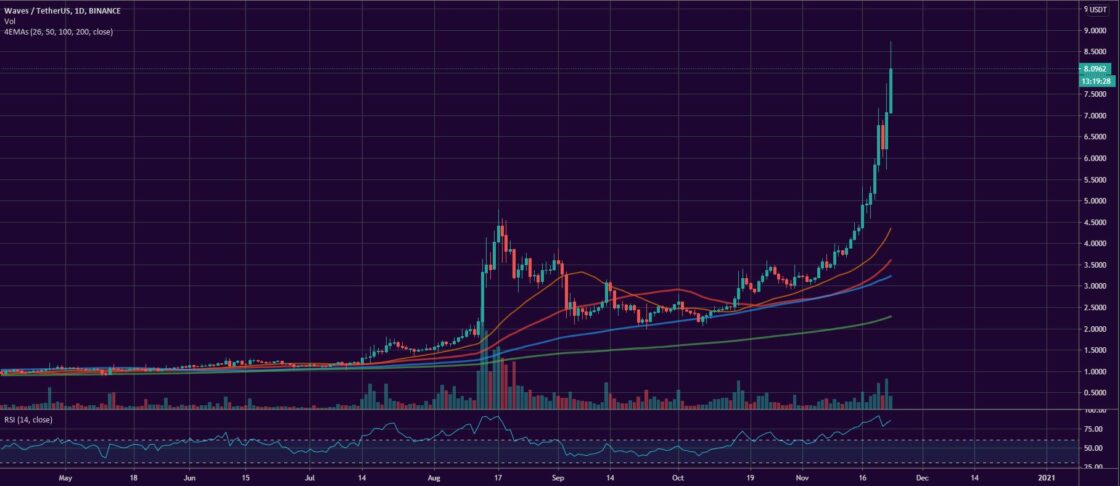

Altcoin of the Week

Our Altcoin of the week is WAVES (WAVES). The open network protocol which helps designers develop and run their own Web 3.0 dApps on the blockchain, was 70 percent up for the last seven days.

It was also registered a 113 percent increase for the two-week period and reached #38 on CoinGecko’s Top 100 list with a total market capitalization of $685 million.

WAVES peaked at $7.56 on Sunday, November 22 and as of the time of writing is trading at $8.09 on Binance.