Bitcoin, Ether, Major Altcoins – Weekly Market Update April 5, 2021

The total crypto market cap added $129 billion to its value for the last seven-days and now stands at $1,948 billion. The top 10 coins were mostly in green for the same time period with Polkadot (DOT) and Binance Coin (BNB) adding 36 and 32.5 percent to their respective values. Bitcoin (BTC) is currently trading at $57,600, ether (ETH) is at $2,040.

BTC/USD

Bitcoin was on its way up ever since it hit $50,372 on March 25. This was the lowest point of the 18 percent correction that started 12 days earlier.

The biggest cryptocurrency reached the 100-day EMA on the 4-hour chart on Sunday and after two consecutive days in green, closed flat for the day. This resulted in a total loss of 3 percent on a weekly basis.

On Monday, March 29, the BTC/USD pair made another leg up, using the short-term EMAs on the daily timeframe as support. It touched $58,400 during intraday before closing at the previous weekly open and significant horizontal resistance zone near $57,400.

The move was followed by another solid green candle on Tuesday and bitcoin climbed up to the last major resistance zone below the all-time high – $58,800.

The mid-week session was again a positive one for buyers as the leading digital asset peaked was trading in the wide range between $56,760 and $59,850 before closing flat for the day.

The coin restored the mid-term uptrend thanks to the good news coming from VISA and PayPal as the two companies announced crypto-friendly services. The technical indicators and chart formations on the other hand were starting to show weaknesses with a potential double top formation on the 4-hour chart, combined with a bearish divergence on the lower 1-hour timeframe.

Bitcoin ended the month of March with a 29 percent of price increase.

On Thursday, the BTC/USD pair again remained flat near the $58,800 weekly resistance level even though it was trading above it for a certain period of time during intraday.

The exact same thing happened on Friday as bulls were starting to run out of gas to support the uptrend.

The weekend of April 3-4 started with a drop to the 26-day EMA on the daily timeframe on Saturday. The move resulted in a 3.2 percent pullback to the $57,000 mark.

On Sunday, BTC managed to bounce up from that level, but was unable to compensate for the loses ending the week at $58,200.

The bear pressure is increasing in the early hours of trading on Monday, April 5 as the fears of correction grow.

ETH/USD

The Ethereum project token ETH was rejected at the 21-day EMA near $1,715 on Sunday, March 28 and closed with a short red candle to $1,691. It was 5.2 percent down for the seven-day period as a direct result of the price pullback registered during the first three days of the week.

On Monday, the leading altcoin started trading by skyrocketing all the way up to $1,819. It surpassed the previous weekly open level and the psychological level of $1,800 to end the session 7.7 percent higher.

On Tuesday, March 30, the ETH/USD pair drew a second straight green candle on the daily chart and extended its gains up to $1,844. Here the ether bulls were about to face a really solid horizontal and diagonal resistances coming from the previous high registered on March 13.

The third day of the workweek came with a break above that zone. Buyers managed to consolidate around the $1,780 in the early hours of trading then pushed the price up to $1,920 at close.

The ETH token was 34 percent up on a monthly basis.

On Thursday, April 1 the coin registered its highest close ever on the daily chart hitting $1,967, above the weekly resistance.

The Friday session was no different and the ether successfully avoided the double-top formation by continuing to move upwards in the lower timeframe corridor. It jumped up to a new all-time high at $2,134, which corresponded to an 8.4 percent increase.

The first day of the weekend came with a 6 percent correction to $2,006 as the profit-taking activities started to kick in.

Then on Sunday the price partially recovered by climbing up to $2,075 at the end of the week.

Bears are once again in control on Monday morning. The ether is trading close to its previous all-time high registered in February – $2,045.

Top 10 Movers

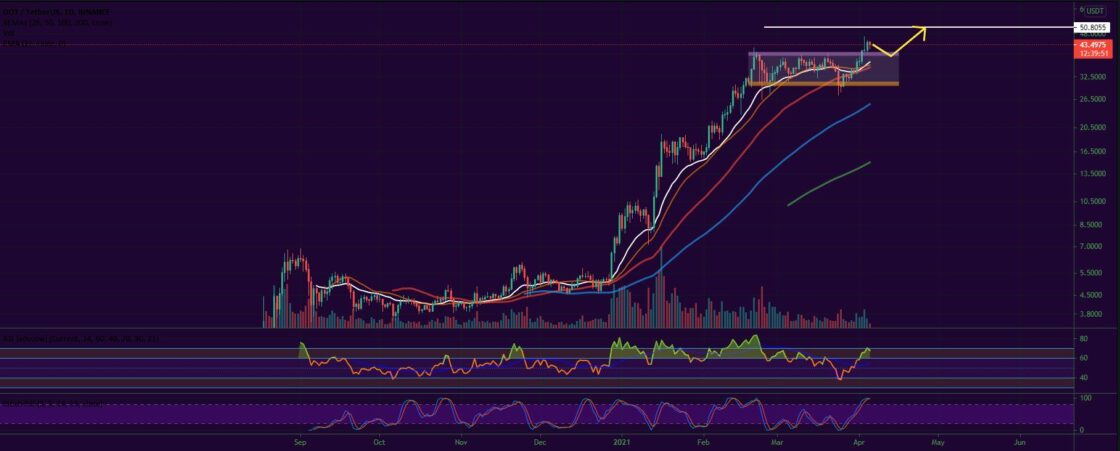

- Polkadot (DOT)

Ethereum’s main competitor added 37.5 percent to its valuation for the last seven days and moved up to #4 on CoinGecko’s Top 100 list with a market cap of $42.8 billion.

The coin moved above the short-term EMAs on the daily chart in the three-day period between 29-31 March then surpassed the previous range high at $38.2 on April 2, which allowed it to climb even higher. On April 3, DOT peaked at $46.7registering a new all-time high.

It was of critical importance for Polkadot to keep up with Ethereum’s pace to ensure it stays competitive during the initial parachain auctions phase.

DOT/USDT bulls have to make sure their prefferible pair stays above the $40 level to avoid going back into the previous trading range.

A proper consolidation in this zone will serve as a starting point for the next leg up to the area above the psychological level of $50.

Altcoin of the Week

Our Altcoin of the week is WINk (WIN). The gaming platform that runs on the TRC-20 standard on the TRON blockchain added the stunning 526 percent for the last seven days and moved up to #67 with a total market cap of $1.75 billion.

The WIN/USDT pair is 3,397 percent up since the beginning of 2021 thanks to the various applications of the platform’s native token WIN including staking and in-game social interactions.

As of the time of writing, WIN is trading at $0.00229 against USDT on Binance.