Bitcoin, Ether, Major Altcoins – Weekly Market Update March 15, 2021

The total crypto market cap added $154 billion to its value for the last seven-days and now stands at $1,715 billion. The top 10 coins showed mixed results for the same time period with bitcoin (BTC) and Litecoin (LTC) adding 9.9 and 7.5 percent to their values respectively while Uniswap (UNI) erased 12.5 percent. Bitcoin is currently trading at $56,000, ether (ETH) fell to $1,763.

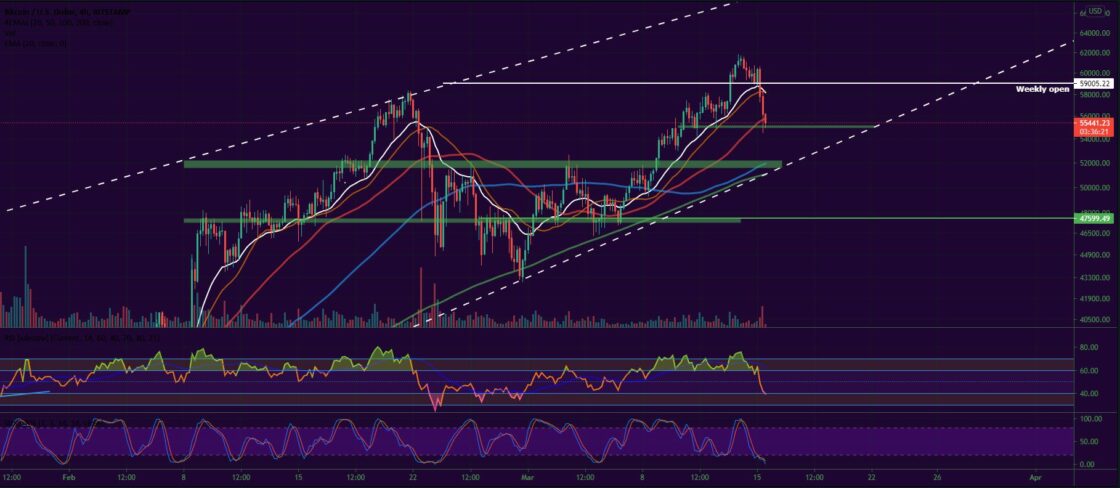

BTC/USD

Bitcoin closed the first trading week of March with a solid 12.7 percent of price increase. The leading cryptocurrency successfully climbed above the short-term 20 and 26-day EMAs on Sunday, March 7 reaching the $51,000 mark.

The next major obstacle in front of bulls naturally was the solid horizontal resistance formed around $52,000. The two unsuccessful attempts to break it on February 25 and March 3 resulted in 18 and 12 percent of price corrections respectively.

On Monday, the BTC/USD pair stormed past that zone and stopped at $52,400 in the evening part of the session or 2.7 percent higher. Analysts were already pointing out that a proper consolidation in this area would invalidate a potential bear case scenario in the short to mid-term.

The Tuesday session brought a fifth straight green candle on the daily chart for bitcoin. It moved further up to $54,950, just a step away from its all-time high registered 20 days ago.

On Wednesday, we saw no difference in the BTC/USDT pair behavior as it continued to surge in price. Buyers pushed it up to $57,450 but were unable to protect their gains, which resulted in a drop to $55,800 later in the day.

The coin made a short pullback to $54,250 during Asia hours on Thursday, but quickly reversed its direction and eventually closed at $57,800.

The last day of the workweek came with another big selloff early in the day. Bitcoin fell as low as $55,000 only to close with a short red candle to $57,300 some time later, keeping the mid to long-term uptrend intact.

The weekend of March 13-14 was when the new stimulus check agreement finally came into play. BTC continued to march North and registered a new all-time high reaching $61,866. The move resulted in another 7 percent being added to its valuation.

On Sunday, we noticed some profit-taking activities and the biggest digital asset dropped in price to finish the week at $59,038.

The correction is still ongoing as of the time of writing this article and the BTC/USD pair is nearing the $55,000 mark.

ETH/USD

The Ethereum Project token ETH was experiencing a huge upside reversal ever since it hit a low bottom of $1,290 on February 28. The coin was quick in initiating recovery and increased by 21.4 percent for the last seven-day period. It closed the trading day on Sunday, March 7 at $1,729 and moved above its short-term EMAs. Looks like bulls were on track to reach the next supply zone area near $1,759.

The start of the new week was solid for the ETH/USD pair as it easily jumped to $1,835, surpassing the mentioned resistance and adding yet another 6 percent to its value.

In the next 24 hours, we saw a continuation of the upward movement and a new monthly high, this time $1,872 on Tuesday evening.

On Wednesday, March 10, the leading altcoin started moving South. It corrected its price down to $1,790 after hitting a daily low of $1,753.

The ETH token moved below the closest support zone on the next day and touched $1,721 as the bear pressure was increasing. Buyers however stepped in just in time to avoid a trend structure break, which helped the coin formed a green candle to $1,829.

During the Friday session, however, the ETH/USD pair continued to disappoint and fell further to $1,765. On the other hand, the price movement was showing similarities to the candle formation from mid-February when ETH was having troubles surpassing the same price zone and needed a short consolidation before doing so.

Exactly the same happened on the first day of the weekend. The ether climbed up to $1,918 breaking above the resistance. Another 8.5 percent was added to the market cap.

On Sunday, the coin took a short break and corrected its price down to $1,846.

It continues to slide on Monday morning and is now dangerously close to the 20-day EMA on the daily chart (1,730).

Top 10 Movers

- Litecoin (LTC)

One of the oldest and most popular cryptocurrency projects, Litecoin is trading in an uptrend corridor ever since it hit a low of $42.8 in September 2020. Still, it was lagging behind the other majors in terms of growth percentage.

For the last seven days, the LTC/USDT pair increased by $12.1 percent and re-entered the Top 10 with a market cap of $14,4 billion.

We see the $225$-$230 zone as the next major horizontal resistance in front of bulls. It is a solid level from back in 2018 and also where the Fibonacci level 78.60 level is situated from the last correction. The second target is $250.

Altcoin of the Week

Our Altcoin of the week is Decentraland (MANA). This cryptocurrency project allows its users to join a virtual world hosted on the blockchain. Players are able to purchase and manage land and monetize the content. Essentially, the coin is riding the non-fungible token (NFT) wave thanks to which it skyrocketed to a new all-time high of $1,22 on Sunday, March 14.

MANA added the astonishing 152 percent to its value for the last seven days and moved up to #68 on CoinGecko’s Top 100 list with a total market cap of approximately $1,32 billion. It is 4824 percent up on a yearly basis, so $1,000 investment a year ago is worth $48,240 today.

The MANA/USDT pair is currently trading at $0.952 on Binance: