Bitcoin, Ether, Major Altcoins – Weekly Market Update March 29, 2021

The total crypto market cap added $29 billion to its value for the last seven-days and now stands at $1,814 billion. The top 10 coins are all in green for the same time period with Theta Network (THETA) leading the pack with a 42 percent of price increase. Bitcoin (BTC) is currently trading at $57,950, ether (ETH) is at $1,762.

BTC/USD

Bitcoin continued to be unstable, hovering around the $57,500 horizontal S/R line during the intraday trading on Sunday, March 21. It briefly touched the 21-day EMA at $55,400 then moved up to $57,300 in the evening part of the session, but still closed in red. This resulted in an accumulated loss of 2.7 percent for the seven-day period.

On Monday, the biggest cryptocurrency fell further to $54,000 in its biggest single-day loss since February 23. It moved below the mentioned short-term exponential average and erased 5.7 percent of its value.

The Tuesday session was not that volatile in terms of a trading range and the BTC/USD pair was moving in the zone between $55,800 and $53,000 before closing with a short green candle to $54,286 in an obvious effort to consolidate and avoid further decline.

On Wednesday, March 24, however, it nosedived to $51,600 but managed to compensate for some of the losses later in the day eventually closing at the support zone near $52,200.

It is good to mention that in the first part of the trading day, bitcoin made a breakout attempt by hitting the weekly open at $57,500. The rapid surge in its price was caused by the news that Elon Musk’s Tesla started accepting BTC as a payment method for their products. Not only that, but the founder of the company himself confirmed that all bitcoins received will not be sold but accumulated instead. The rally was short-lived and all buy orders were quickly absorbed by bears.

On Thursday, March 25, the BTC/USD pair fell below the 50-day EMA on the daily chart and touched its lowest point for the current correction – $50,175.

The last day of the workweek was when the market finally started to bounce on the options expiry event. BTC formed a huge bullish engulfment candle and closed at $55,000 or 8 percent higher.

The weekend of March 27-28 started with another trend reversal confirmation session on Saturday as bitcoin progressed to $55,900. Then on Sunday it approached the $57,000 level, but could not extend its winning streak and closed flat.

What we are seeing in the early hours of trading on Monday morning is a break above the $57,400 resistance (last week’s open).

ETH/USD

The ETH/USD pair dropped down to $1,747 on Sunday, March 21 in a short-lived pullback during the Asia session then went back up to its preferred zone around $1,790. The coin, however, was spending too much time in the weekly resistance range between $1,890 and $1,780 without being able to surpass it, which was putting it at a risk of trend reversal given the fact the relative strength index exhaustion. It ended the seven-day period with a 3.5 percent loss

On Monday, the price of ether finally broke below the horizontal support and the triangle pattern and corrected its price down to $1,683 – a level last visited on March 7. Additionally, it lost all major short-term EMAs on the daily timeframe at once.

The upcoming options expiry on Friday, March 26 was the most probable reason for the sudden market selloff with a total of $1.15 billion of put and call options expected to expire by the end of the workweek. This, according to the majority of the veteran traders might cause a general lack of consistency in the price behavior.

On Tuesday and Wednesday, the coin continued to register new lows in its 4th and 5th consecutive days in red. It hit $1,516 on March 24 marking the lowest point of its pullback.

On Thursday, the ETH/USD pair skyrocketed all the way up to $1,679 during intraday, completely erasing the losses from the previous session. Bears, however, once again were quick in absorbing the buy orders, pushing the price down to $1,585.

On Friday, we finally saw a breakout. The biggest altcoin started to move upwards and formed a solid candle to $1,700, which resulted in a 7.2 percent of increase.

The first day of the weekend served as confirmation of the reversal and the ether closed at $1,713, right at the 21-day EMA.

On Sunday, it was rejected at the above-mentioned area and closed at $1,691.

The coin is trading significantly higher on Monday morning reaching $1,760 by the time of writing this article.

Top 10 Movers

- XRP (XRP)

The Ripple company token XRP remains among the biggest cryptocurrency projects in terms of market capitalization. The coin was one of the very few in the Top 10 list to register price increase during last week’s pullback that impacted the entire market.

The XRP/USD pair added approximately 9 percent for the period and peaked at $0.6 on March 22. It is worth noting that the coin is more than 50 percent up since its February low of $0.36.

Next for bulls is to attempt a break out of the $0.57-$0.60 range and beat the year-to-date high of $0.74. Down, bears will try to push the price below $0.5, the next potential support level.

Altcoin of the Week

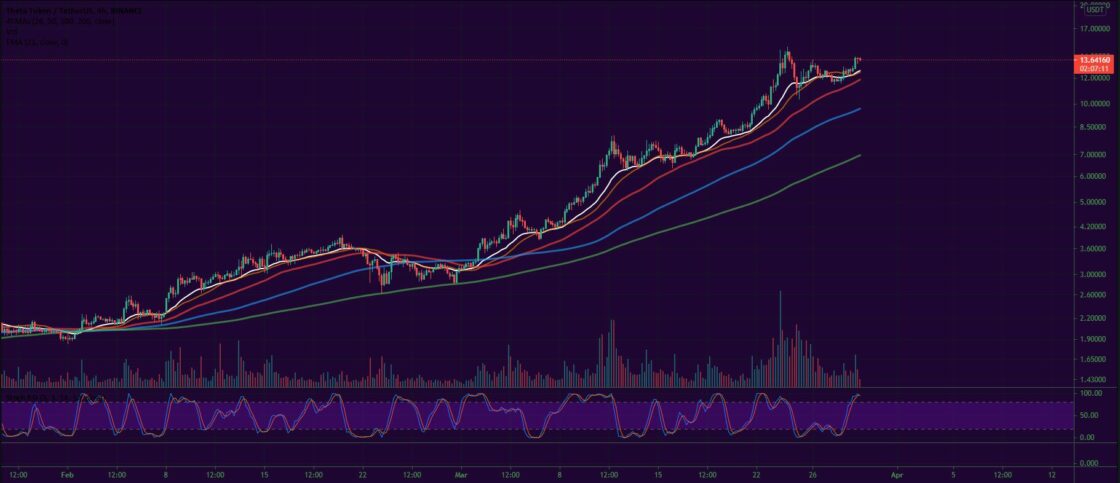

Our Altcoin of the week is Theta Network (THETA). The popular blockchain-based video streaming platform, which enables users to share bandwidth and computing resources in a decentralized manner, grew by 42 percent for the last seven-day period. It increased by 345 percent on a monthly basis and stormed into the Top 10 list on CoinGecko successfully replacing Chainlink (LINK).

The THETA/USDT pair peaked at $14.97 on March 24 and is now ranked #9 with a market capitalization of $13.6 billion.

The recent surge in price is most probably related to the news that Theta Labs has been granted a 2nd U.S. patent for decentralized blockchain-based video design and data delivery. The patent will help the company focus on the design of a new trusted payment system on blockchain technology.

THETA is currently trading at $13.6 against USDT on Binance: