Bitcoin, Ether, Major Altcoins – Weekly Market Update March 8, 2021

The total crypto market cap added $88 billion to its value for the last seven-days and now stands at $1,554 billion. The top 10 coins were mostly in green for the same time period with Uniswap (UNI) and Chainlink (LINK) adding 55 adding 16.6 percent to their values respectively. By the time of writing bitcoin (BTC) is trading at $50,278, ether (ETH) is at $1,718.

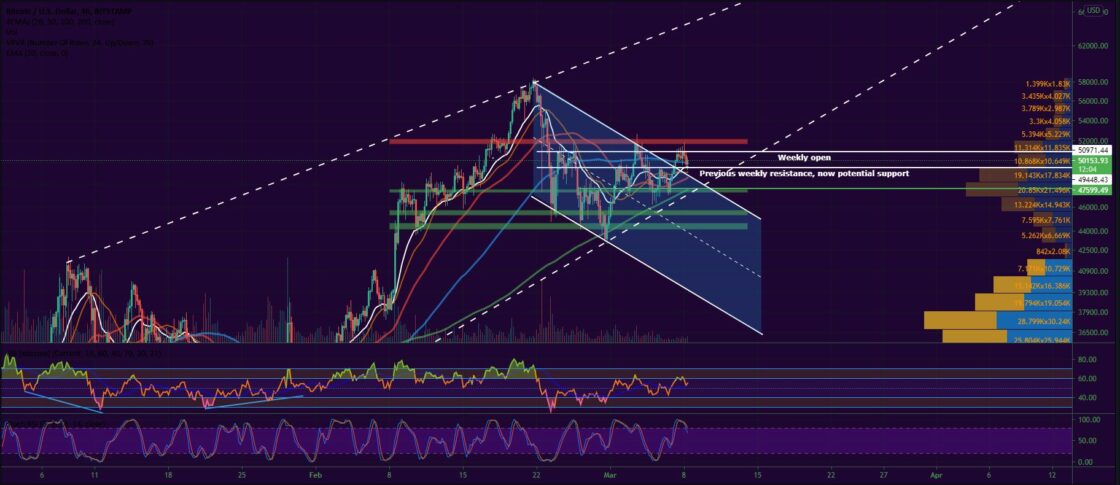

BTC/USD

Bitcoin closed the month of February at $45,160 after jumping up from a daily low of $43,000 on Sunday. This resulted in another 37 percent added to the coin’s market cap on a monthly basis.

On Monday, the BTC/USD pair started trading on positive territory and eventually managed to break the 4 days long losing streak by forming a huge green candle to $49,674. By doing this it moved above the short-term EMAs (20 and 26 days) and avoided further decline.

The second day of the workweek came with a pullback to $48,500, but not before testing the newly established support in the $47,000-47,500 area. The 24-hour trading volumes were still relatively low compared to the previous few weeks as many traders continued to remain cautious about the potential upside reversal.

The mid-week session on Wednesday was again a good one for bulls. The leading cryptocurrency formed one leg up and climbed above $50,000 for the first time since February 25. It peaked at $52,640 during intraday, also breaking into the next supply zone. The trading activity, however, was not backed by enough volume, and BTC started losing momentum in the evening part of the session eventually closing at $50,423. It still registered huge gains compared to the previous session.

On Thursday, March 4 the BTC/USD pair made one more attempt to break into the resistance zone but was once again rejected, which drove the price down to $48,395 or 4 percent lower. The coin was still caught in a short-term downtrend channel.

The last trading day of the workweek came with a drop to $46,283 during intraday. Bulls, however, reacted immediately and pushed the price to $48,756 in the second half of the session.

The weekend of March 6-7 started with a short-lived pullback to the support zone near $47,500 early on Saturday. The coin closed flat, but still above the 20-day EMA.

Then on Sunday, it climbed up to $51,461 before closing the week at $5,012.

Bitcoin is trading slightly lower on Monday but still managed to hit the resistance zone near $51,700 in the morning.

4-hour chart:

ETH/USD

The Ethereum Project token ETH hit a weekly low at $1,285 on February 28 and was already trading 37 percent lower compared to its $2,045 peak registered on February 20. It managed to recover to $1,422 by the end of the session, which corresponded to an 8.3 percent increase for the second month of the year.

On Monday, the ether followed the example of Bitcoin and rapidly started moving upwards. It closed the day at $1,573 adding 10.6 percent.

The coin erased half of if its gains the very next day by correcting its price down to $1,486, right below the 26-day EMA. The $1,590 – $1,610 area was the next major obstacle in front of bulls. It first acted as resistance back in early February, then again was a trouble area for sellers during ETH’s freefall last week.

On Wednesday, March 3 made a sharp turn North reaching the 200-day EMA on the 4-hour chart at $1,660, also above the already-mentioned resistance area. However, the momentum was not strong enough and bulls easily gave up on their gains ending the trading day at $1,570.

The ETH/USD pair was rejected for a second consecutive day near the mentioned resistance zone on Thursday. The area was now the crossing point of the 20-day EMA and the horizontal and diagonal lines.

On Friday, the coin decreased further to $1,526 but not before hit a daily low of $1,441.

The first day of the weekend came with a big green candle on the daily chart. The ether moved up to $1,647 breaking above the $1,620 zone to close the day with an 8 percent increase.

Then on Sunday, it continued to move upwards by reaching $1,735 during intraday. The coin closed the week at $1,728 and is trading around $1,722 by the time of writing this market update on Thursday.

Top 10 Movers

- Uniswap (UNI)

The leading decentralized finance platform that runs on the Ethereum blockchain stormed into the Top 10 list last week after gaining 55 percent for the period. The surge in price was a direct result of the news that the Ethereum Improvement Proposal (EIP) 1559 finally received a green light for implementation and will go live in July. It is expected to significantly improve the user experience in an attempt to put control over the increasing transaction gas fees.

The UNI/USDT pair broke out of the consolidation pattern on the lower timeframes and peaked at $34.9, surpassing its previous all-time high of $32.97 on Sunday evening. The coin is now ranked at #8 with a market cap of $17.3 billion.

What is next for UNI is to stabilize above the short-term EMA’s and consolidate in order to open the door for $50, which according to some altcoin traders is the next big target in front of bulls.

The next support zone will be looking at downwards is the significant weekly/daily S/R around $28.7-$29.2.

Altcoin of the Week

Out Altcoin of the week is Chiliz (CHZ). The sports & entertainment-focused blockchain platform benefited from the non-fungible token (NFT) craze and rallied to an all-time high of $0.155 on Thursday, March 4.

The CHZ token added 156 percent to its value on a weekly basis and reached a total market capitalization of approximately $834 million also entering CoinGecko’s Top 100 list at #90. It registered a stunning 533 percent of increase for the last 30 days.

Since NFT is on the rise, it is possible that the upward trend is extended in the coming days/weeks.

As of the time of writing this, the CHZ/USDT pair is trading at $0.161 on Binance: