Bitcoin, Ether, Major Altcoins – Weekly Market Update September 6, 2021

The total crypto market cap added $291 billion to its value for the last seven days and now stands at $2,358 billion. The top 10 coins were all in green for the same time period with Solana (SOL) and Polkadot (DOT) leading the pack with 52.3 and 35.4 percent of gains respectively. Bitcoin (BTC) is currently trading at $51,916 while ether (ETH) is at $3,952.

BTC/USD

Bitcoin closed the trading day on Sunday, August 29 at $48,780 after suffering yet another rejection in the area above $49,000. The $49,750 mark started acting as a resistance ever since it was first reached on August 21, but in general, BTC was slowly forming a bull flag on the daily chart – a pattern indicating a potential reversal to the upside if respected.

Bulls successfully avoided a break below the $46,500 mark and established it as a support on the higher timeframe.

On Monday, the BTC/USDT pair corrected its price down to $46,965 erasing 3.5 percent of its total valuation but found stability at the 21-day EMA and the lower boundary of the mentioned bull flag formation.

The Tuesday session on August 31 found the biggest cryptocurrency struggling to break above the $48,000 area, so it only managed to form a short green candle to $47,165. BTC was 12.6 percent up for the month of August.

The mid-week trading on Wednesday started with a drop to $46,500 in the early morning hours, but bulls were quick to react and defended the support line. BTC rallied 3.7 percent and closed the day at $48,850.

On Thursday, September 2 it confirmed the break out of the bull flag by closing the trading day at $49,230. Buyers were even able to push the price up to $50,500 during intraday.

The Friday trading was no different and the biggest cryptocurrency continued to move in the upward direction. It closed above the $49,500 mark for the first time since May 14.

The weekend of September 4-5 started with a consolidation around the psychological level of $50,000 on Saturday. Then on Sunday, BTC surged in price hitting $51,800 and adding 3.5 percent to its value.

Bitcoin is trading flat midday on Monday.

ETH/USD

The Ethereum Project token ETH was trading in the $3,320 – $3,000 zone for more than 22 days, which according to the majority of the cryptocurrency market analysts represents a consolidation phase after the rapid increase before and after the last major network upgrade.

On Sunday, August 29, the ether closed at $3,218 on its second consecutive day in red.

The Monday session was when bulls tried to push the price of ETH above the $3,320 mark, but once again it resulted in a failure. The coin closed flat.

On Tuesday, August 31, the ETH/USDT pair bounced back up from the 21-day EMA on the daily timeframe and broke out of the range, eventually closing at $3,420 or 5.8 percent higher. It was 35.4 percent up on a 30-day basis.

The mid-week session on Wednesday came with a second consecutive day in green and a new mid-term record – $3,841.

On Thursday, September 2 the ETH/USDT pair pulled back down to $3,783 as some traders were already booking profits.

The last day of the workweek was basically a continuation of the uptrend and a daily candle close at $3,936. The coin was just one leg away from setting a new all-time high record.

The trading session on Saturday was marked by a small correction in the price of ETH down to $3,880. However, it was short-lived and the coin formed the exact same candle but in the opposite direction on Sunday, which allowed it to set the ground for further increases.

The ether is trading at $3,950 on Monday, September 6.

Leading Majors

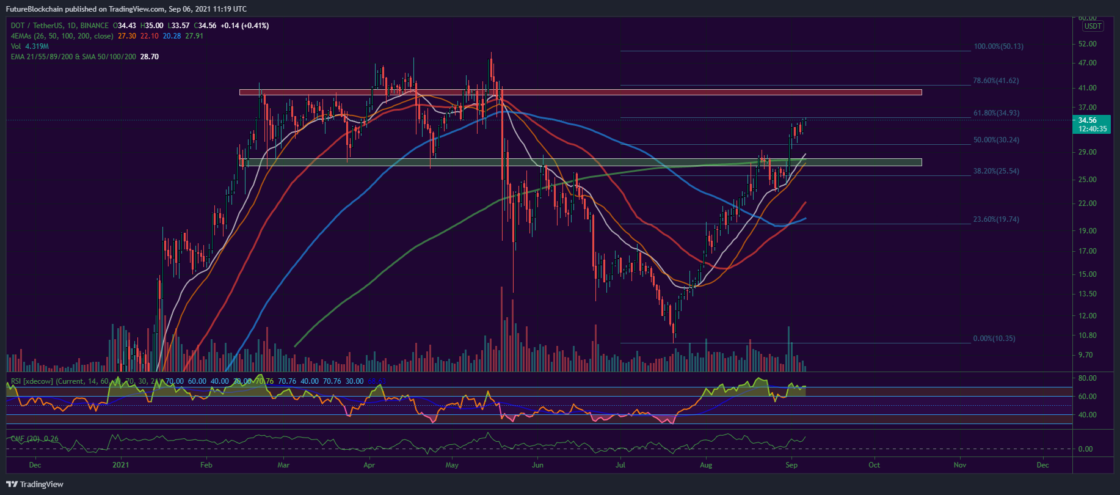

- Polkadot (DOT)

The Layer 1 coins are currently on the rise and Polkadot is no exception. What is more, the Polkadot platform and infrastructure should actually closer to a Layer 0 protocol aiming to be interoperable and to be able to communicate and collaborate with all the other blockchains instead of competing with them.

The DOT/USDT pair added 33 percent to its value for the last seven days. The majority of the analysts were pointing out the fact Polkadot is severely underrated compared to the rest of the coins in the Top 10 or Top 20 given the upcoming parachain auctions and the success of the Kusama auctions.

For instance, Kusama (KSM), which is the native token of the Polkadot test chain is performing significantly better.

The coin is expected to revisit the area near its previous all-time high in the short to mid-term. The next logical resistance level is situated somewhere near the February peak around $40. We’ll be looking for support around the $27 mark.

Altcoin of the week

Our Altcoin of the week is Fantom (FTM). The popular layer-1 platform that was built on an aBFT consensus protocol added the stunning 105 percent to its value for the last seven days. The coin is 735 percent up since it bottomed at $0.1518 on July 20.

The recent surge in the price of the FTM/USD pair resulted in a new all-time high reached on September 6 – $1.356 and a move up to the 55th position on CoinGecko’s Top 100 list. Fantom now has a total market capitalization of approximately $3.226 billion.

The main reason behind the sudden interest in the Fantom project is the fact all major layer 1 projects are experiencing a renewed interest in their platforms – Solana, Fantom, Avalanche, and others are all seeing triple-digit increases for the last month.

Additionally, on August 30, the team behind FTM announced a 370m FTM incentive program for both new and existing protocols on Fantom to further boost the ecosystem development.

As of the time of writing, FTM is trading at $1.28.