Bitcoin, Ether, and XRP Weekly Market Update November 18, 2019

The total crypto market cap lost $5.7 billion of its value during the last seven days which now at time of writing stands at $234.5 billion. The top 10 currencies are all in the red for the same time frame with Bitcoin Cash (BCH) and Stellar (XLM) being the worst performers, each losing 10 and 9.8 percent respectively. At the time of writing bitcoin (BTC) is trading at $8,468 while ether (ETH) stands around $183. Ripple’s XRP is trading at $0.259.

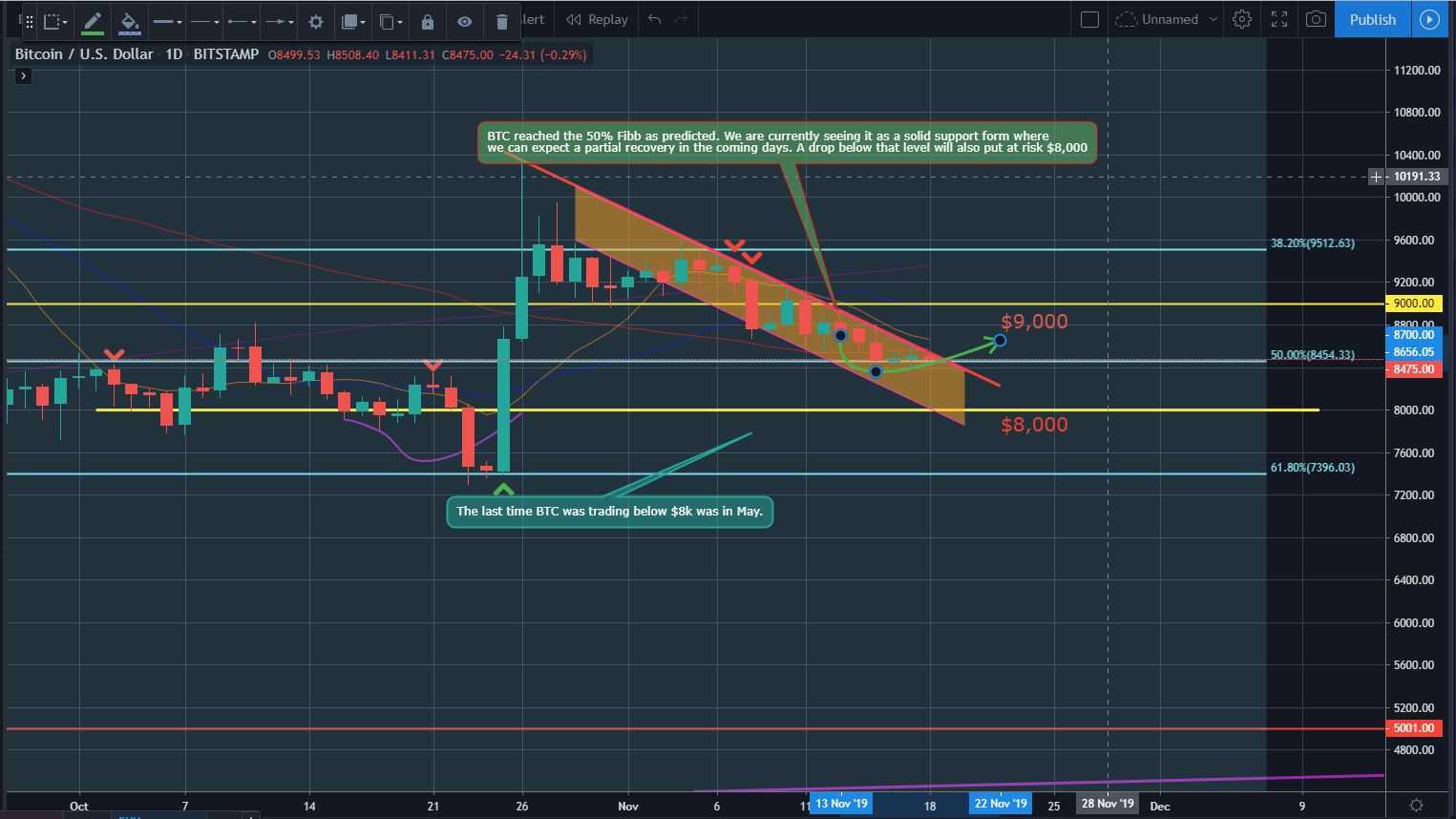

BTC/USD

Bitcoin climbed above the $9,000 mark on Sunday, November 10, and ended the session at $9,029 with a 2.5 percent increase for the day. Still, it was 1.9 percent down on a weekly basis.

The most popular cryptocurrency opened trading on the following Monday with a huge red candle on the daily chart after bulls were once again rejected around the above-mentioned critical level. The BTC/USD pair erased 3.5 percent of its value and stopped at $8,718.

It entered a downtrend earlier this month and a week later we were already looking at the 50% Fibonacci ($8,465) as the next support zone. On Tuesday, November 12, the coin was seen as low as $8,555 during intraday but managed to close with a slight increase to $8,809.

Bulls returned to losing ways on the mid-week session on November 13 when BTC dropped further to $8,749.

The coin remained in its downward channel on Thursday, erasing another 1.4 percent of its value closing at $8,631.

The BTC/USD pair continued to slide on Friday and ended the day with a loss to $8,454, perfectly hitting the Fibonacci 50% as previously predicted.

The first day of the weekend brought back some positive vibes to the charts as buyers rebounded and added $30 to the price of bitcoin.

On Sunday, November BTC coin was trading in the $8,636-$8,376 are and closed with a small increase to $8,504. It was 6 percent down for the week.

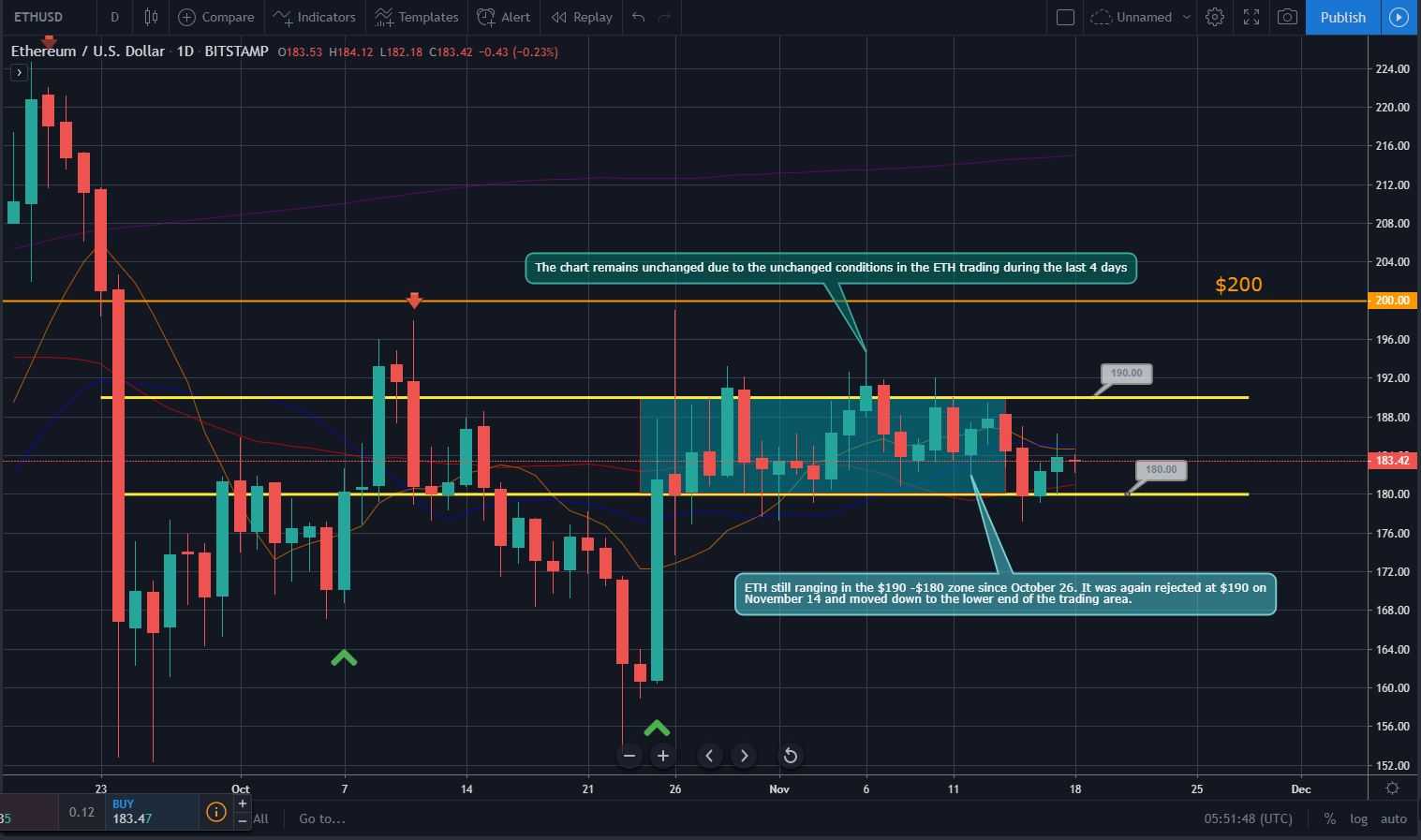

ETH/USD

The Ethereum Project token ETH followed the general crypto market trend on Sunday, November 10, and drew a big green candle to $189 adding 2.4 percent to its value, and then ending the week with an additional 4.4 percent of increase.

The ETH/USD pair started the new trading period on Monday by forming the exact same candle on the daily chart, but in the opposite direction. It fell back down to $184 and erased 2.6 percent. Bulls were rejected around the same old $190 resistance, which once again proved to be a tough one to break, especially in the current conditions of a weak ETH.

On Tuesday the major altcoin moved up to $186.5; this was followed by a second consecutive green candle on Wednesday, November 13 when the ETH made another step up, this time to $187.9.

We were not expecting big moves in the green zone for the coin unless a proper consolidation was in place to trigger an escape from the $180-$190 area.

This was even more obvious on Thursday, November 14, as ETH continued to slide and retreat to $184. We witnessed another sharp drop in price on the last day of the workweek with the coin closing at $179,7 with a 2.7 percent decrease or one step below the support zone.

On Saturday, November 16, the ETH/USD pair initiated a recovery and jumped to $182. It continued to rise on Sunday, November 17, closing at $183.9 with 2.9 percent of a weekly loss.

XRP/USD

The Ripple was again rejected around $0.285 on Sunday, November 10, and fell down to $0.279. It closed 4 percent lower compared to the previous 7-day period.

The XRP/USD pair was in a downtrend since November 7 when it last peaked at $0.31 and failed to surpass the September high of $0.313.

It opened the new period with a drop to $0.273 on Monday, November 11. The coin was trading as low as $0.268 during intraday, right below the important support at $0.27.

The token formed its third consecutive red candle on the daily chart on Tuesday, November 12, and continued to lose more and more of its ground. This time it stopped at $0.271.

Bulls tried to reverse the trend during the mid-week trading on November 13 and were keeping the price successfully around $0.275 in the early hours, just to close with a short loss to $0.271 in the evening.

The already mentioned support line was finally broken on Thursday when the XRP token fell to $0.267. The move was followed by another losing session on the last day of the workweek as the popular cryptocurrency lost 2.6 percent of its value and stopped at $0.26. Even though bears managed to push the price all the way down to $0.251, they were later rejected as the long-standing support line at $0.26 was defended successfully.

The weekend of November 16-17 started with a small increase to $0.261 on Saturday. The coin moved up to $0.263 on Sunday and closed the seven-day period with 6.8 percent of losses.

Altcoin of the Week

Our Altcoin of the week is the Singapore-based VeChain (VET). This blockchain project is supporting the supply-chain industry and is aiming to build a “trust-free and distributed business ecosystem to enable transparent information flow, efficient collaboration, and high-speed value transfer.”

VET is 32.8 percent up for the last seven days and 77.2 for the two-week period. It peaked at $0.00771 on Saturday, November 16 and currently stands at #25 on the CoinGecko Top 100 coins ranked by market capitalization. The VeChain project is estimated to be worth $475 million.

One of the main reasons for the current surge is the recently announced tea traceability platform based on the VeChain blockchain. On November 13, the government of Shuangjiang County in China officially approved the partnership between VeChain and the top tea producers Mengku Rongshi, Yunlian, and Linova.

The purpose of the newly launched Pu’er Tea Traceability Platform is to tackle known problems with counterfeit goods as well as to provide better tracking solutions for both tea producers and customers.

Additionally, one of the biggest newspapers in China, People’s Daily mentioned VeChain and its role in the food industry safety program “From French Farms to Chinese Plates”. The initiative represents a blockchain ecosystem developed by ASI Group, DNV GL, and VeChain that aims to provides Chinese consumers with easier access to quality French products.

At time of writing, VET is trading at $0.0074 against USD on Bitfinex.