Bitcoin, Ethereum, XRP, and altcoin prices boosted as U.S. inflation dives

US inflation dropped in March, raising optimism that the Federal Reserve will adopt a more dovish tone in upcoming meetings—boosting crypto prices.

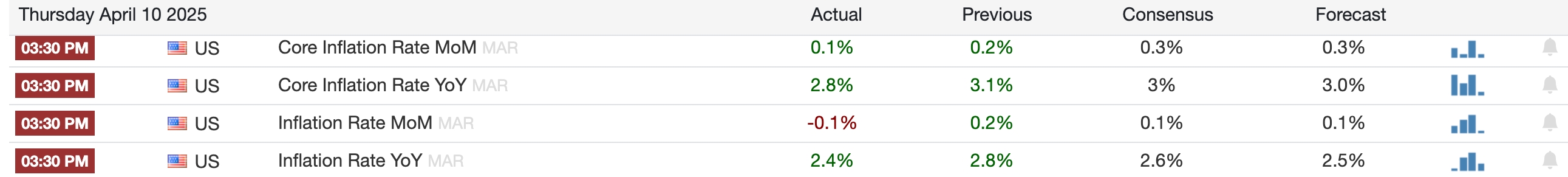

Data from the Bureau of Labor Statistics showed that the headline Consumer Price Index fell from 0.2% in February to -0.1% in March. On an annual basis, inflation declined from 2.8% to 2.4%, putting it on track to reach the Fed’s target of 2.0%.

The closely watched core CPI, which excludes volatile food and energy prices, also dropped from 0.2% to 0.1% month-over-month, pushing the annual core figure down to 2.8%. This marked the first time in years that core CPI fell below 3%.

The decline in inflation came despite the implementation of new U.S. tariffs on imported goods. President Donald Trump raised tariffs on Canadian and Mexican imports to 25%, disrupting the USMCA deal he negotiated during his first term. He also increased tariffs on Chinese goods by 20%.

Additionally, the U.S. implemented new tariffs on imported steel and aluminum used in construction and manufacturing.

As a result, the latest inflation data is likely to increase pressure on the Federal Reserve to resume interest rate cuts. The downward trend in inflation may continue, especially after Trump paused the Liberation Day tariffs on most countries.

Impact on Bitcoin, Ethereum, XRP, and altcoin prices

The US inflation data came as Bitcoin (BTC) and most altcoins like Ethereum (ETH) and Ripple (XRP) bounced back from their weekly lows. Bitcoin rose and stalled at $82,000, while Ethereum and XRP rose to $1,600 and $2, respectively.

U.S. stocks also rallied following Trump’s decision to pause some tariffs and instruct trade representatives to begin negotiations with over 70 countries. However, he raised tariffs on Chinese imports to 125%, putting over $500 billion worth of goods at risk.

This decision led to a sharp decrease in recession odds. Goldman Sachs, which boosted its recession odds earlier this week, was the first Wall Street bank to scale it down. A Polymarket poll with over $2.2 million showed that there was a 50% chance of a recession, down from this week’s high of 66%.

Falling inflation, especially as economic growth slows, could push the Fed toward cutting interest rate, an outcome that would serve as a bullish catalyst for Bitcoin and other altcoins. For instance, the crypto bull run that began in early 2023 was fueled in part by expectations that the Fed would ease monetary policy as inflation declined.