Bitcoin finds support as the Coinbase premium index recovers

Bitcoin continued rising in price over the weekend, reaching a high of $98,300 after finding crucial support at $91,405.

The largest crypto by market cap has risen for six consecutive days, coinciding with ongoing demand and supply dynamics.

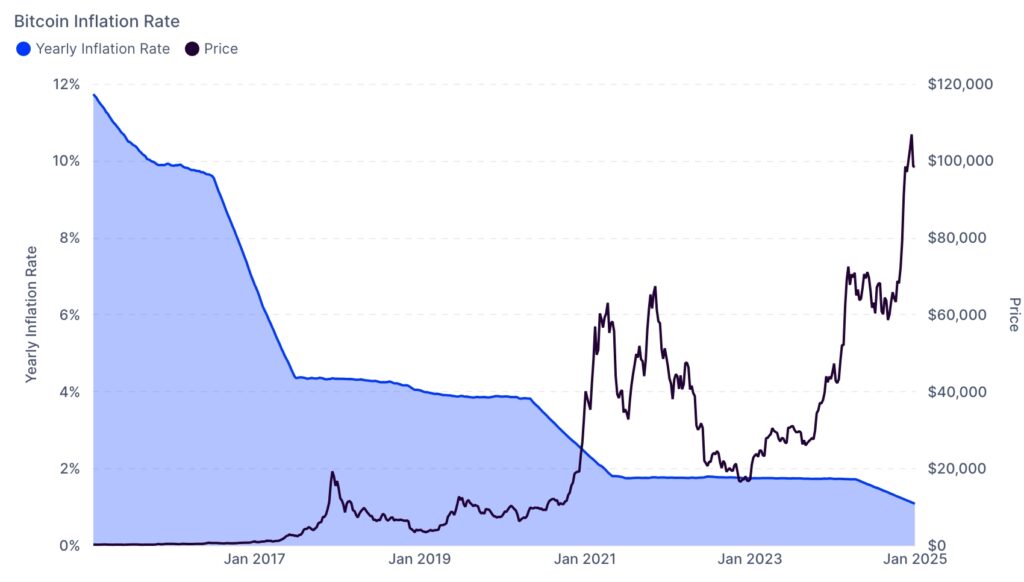

On the supply side, the mining difficulty and hash rate metrics have jumped to their record highs since the last halving event in April. This trend has pushed the coin’s inflation rate to 1.11%, much lower than the US consumer price index figure of 2.7%.

It is also lower than 12%, compared to 2016, while the amount of Bitcoin (BTC) in exchanges has continued falling.

On the other hand, demand is rising as ETF inflows continue. These funds have accumulated over $128 billion in assets, with BlackRock’s IBIT having over $54 billion.

MicroStrategy has also continued its buying spree and now holds over 450 coins. Polymarket users expect that the company will have over 500,000 coins by March.

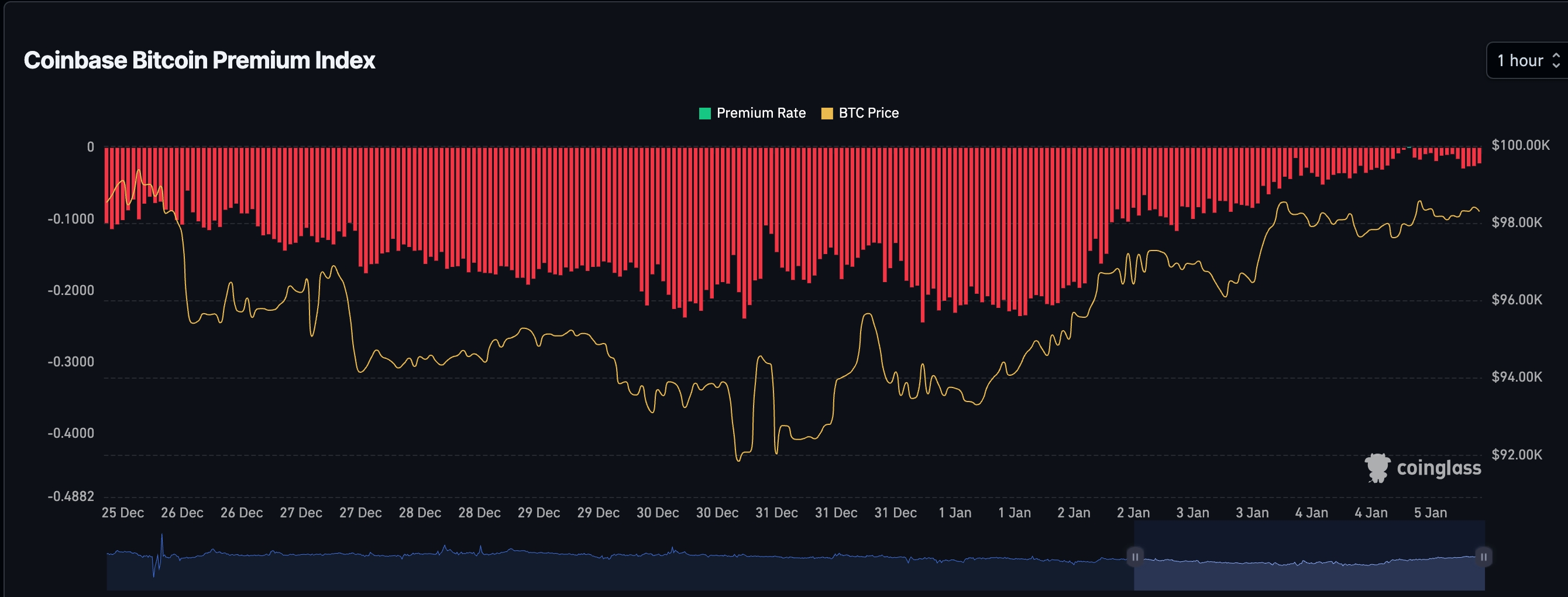

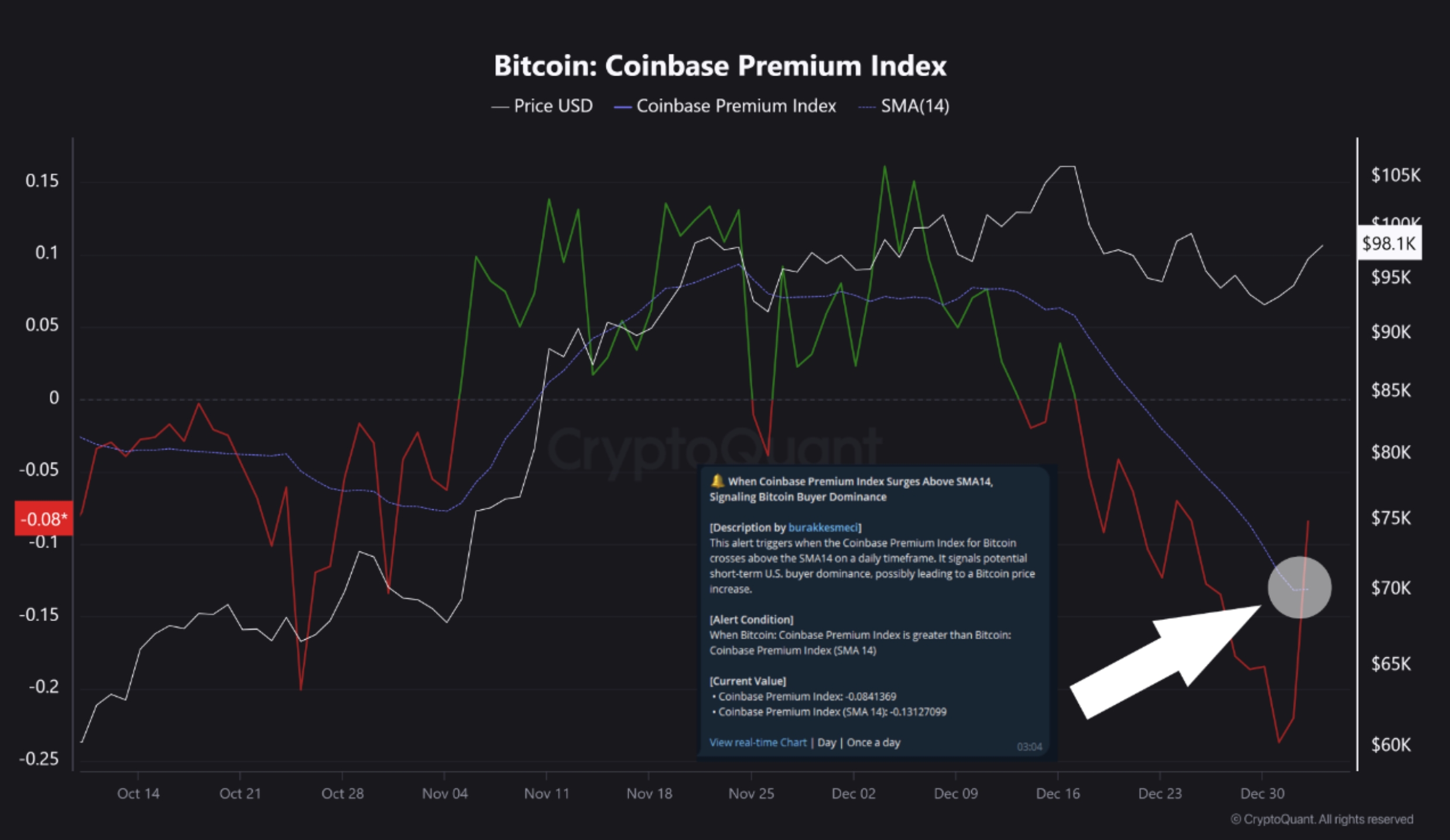

There are signs that American investors are buying more Bitcoins. In addition to their ETF purchases, data shows that the Coinbase Premium Index has recovered after falling sharply in December.

According to CoinGlass, it has moved to minus 0.021, up from minus 0.24 in December.

Another data by CryptoQuant shows that the index has broken above the 14-day Simple Moving Average after 26 days — a positive sign for prices.

The Coinbase Premium Index is an important figure that examines purchases by American investors, including institutions. Coinbase is the most widely used exchange in the United States, so when it rises, it indicates that the biggest pool of capital is possibly accumulating.

Additionally, Bitcoin faces other fundamental catalysts ahead, including President-elect Donald Trump’s inauguration and the upcoming FTX $16 billion distributions.

There are chances that some of the recipients of these funds will invest in Bitcoin and other coins. Also, as crypto.news reported last week, Bitcoin’s MVRV ratio is still low — a sign that it is undervalued.

Bitcoin price analysis

The daily chart shows that BTC has rebounded in the past few days. It has risen in the past six straight days and constantly remained above the 50-day moving average.

Bitcoin has also found substantial support at the key support at $91,400, where it failed to move below several times since December.

Therefore, there are chances that it will continue rising as bulls target the all-time high of $108,000. A move above that level will point to more gains, potentially to the 38.2% Fibonacci Retracement point at $114,000.

However, forming a head and shoulders pattern is risky. This may lead to a bearish breakdown below $91,400.

Analyst’s bearish take

Analyst Jacob King of WhaleWire recently issued a stark warning about Bitcoin and the broader crypto market, citing signs of a potential bear market.

In a post on social media, King highlighted several developments, including MicroStrategy reducing its Bitcoin purchases, El Salvador seemingly shifting away from crypto-focused policies, and BlackRock selling significant BTC holdings.

King criticized MicroStrategy’s strategy as a “giant scam” and unsustainable. He also pointed to Tether (USDT) pausing new minting for over 20 days, coinciding with the coin’s recent price stagnation.

Labeling the situation as “the calm before the storm,” King warned that a crypto downturn might align with a broader stock market crash, urging investors to reassess their risks.

At last check Sunday, BTC was trading at $98,035.