Bitcoin futures OI falls to one-month low amid sustained decline

Bitcoin (BTC) might be witnessing a drop in investor interest. Its open interest (OI) in perpetual futures across significant exchanges registers considerable declines since May 1. Consequently, OI recently plummeted to a one-month low.

Per data from Glassnode, bitcoin’s OI on leading exchange Bitfinex has dropped to a 1-month low of $133.6 million. A chart shared by the blockchain data intelligence provider indicates that this decline began in May, following a noticeable peak observed in April.

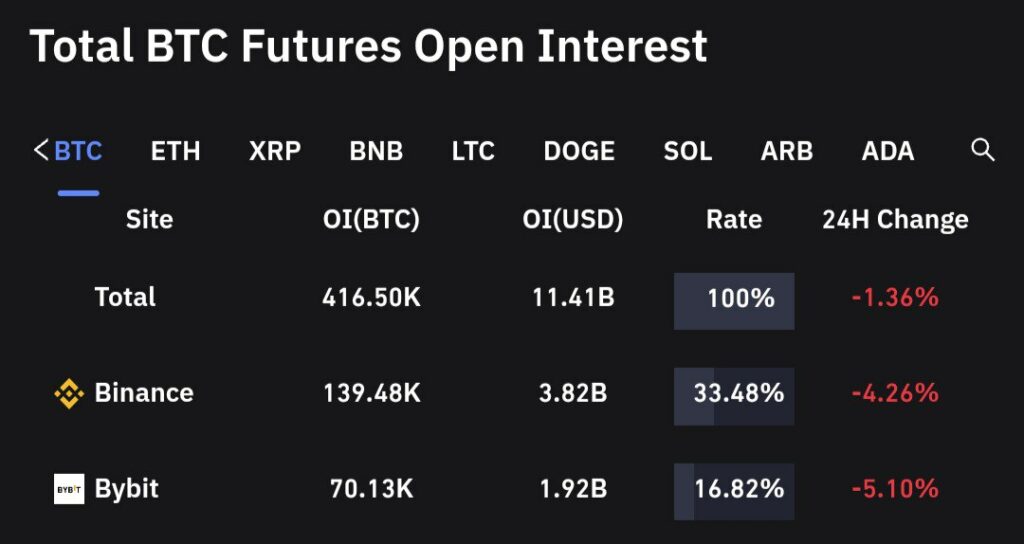

Data from futures trading and information resource Coinglass shows a gradual decline in the bitcoin futures Open Interest across all major exchanges, including Binance, Bybit, CME, and OKX.

Coinglass data shows that the combined BTC open interest across these exchanges stood at $11.663 billion at the end of April. This value has decreased since the start of May, dropping to $11.1 billion earlier today. Moreover, data suggests that OI is currently $11.41 billion, having fallen by 1.36% in the past 24 hours on all exchanges, and 4.26% on Binance.

Despite the persistent declines, bitcoin’s current OI is considerably higher than the values observed late last year amid the prevalent bearish condition. Open Interest remained below $10.5 billion from mid-November to the end of the year due to the contagion from the FTX implosion.

What this means for investors

Futures open interest refers to the total number of outstanding contracts for the bitcoin futures market. Each contract represents an agreement to buy or sell a certain amount of BTC at a specified price and date in the future.

The decrease in bitcoin futures open interest suggests that fewer market participants are willing to trade BTC futures, either by closing their existing positions or not opening new ones. This could be interpreted in several ways, such as reduced demand for bitcoin futures, a shift in market sentiment, or a lack of confidence in bitcoin’s future price movements.

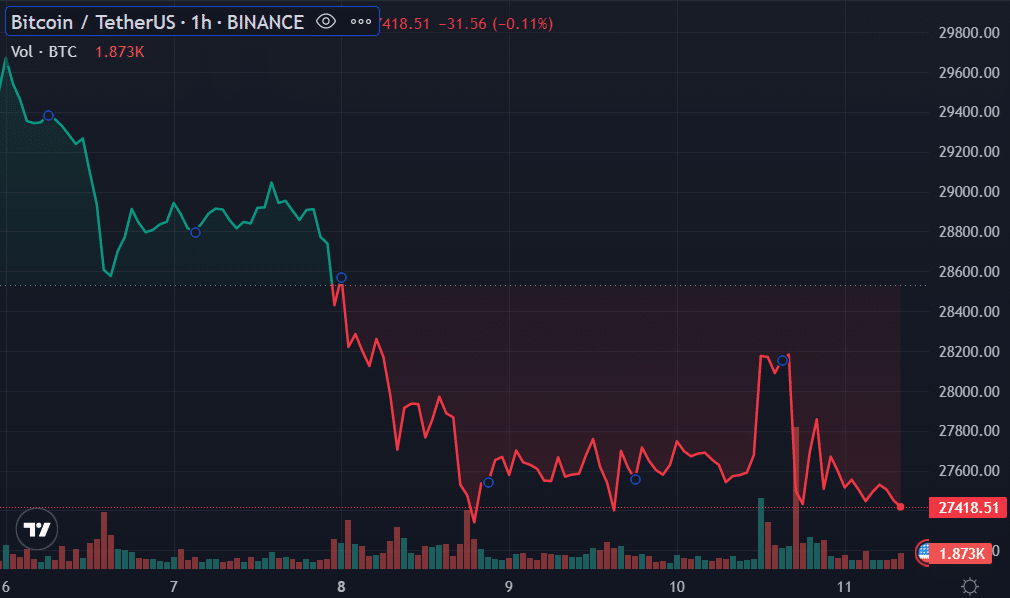

This lack of confidence can be attributed to the bearish events observed with the asset’s recent price actions. BTC recently dropped to a 7-week low of $26,777. Despite staging a comeback, the asset is still down 5.85% in the past week. BTC is trading for $27,404, down 0.62% in the past 24 hours.