Bitcoin goes bullish as supply on exchanges plunges

Bitcoin’s (BTC) price has been struggling around the $26,000 mark over the past week, but with the recent incline, more investors have shifted to self-custody.

The flagship cryptocurrency finally gained bullish traction with a 1.5% rise in the past 24 hours — the upward momentum came while the BTC price dropped below the $26,000 mark six times over the past week.

Moreover, Bitcoin is trading at $26,460 with a $515 billion market cap at the time of writing. The asset’s 24-hour trading volume also rose by 5.4%, reaching $16.4 billion.

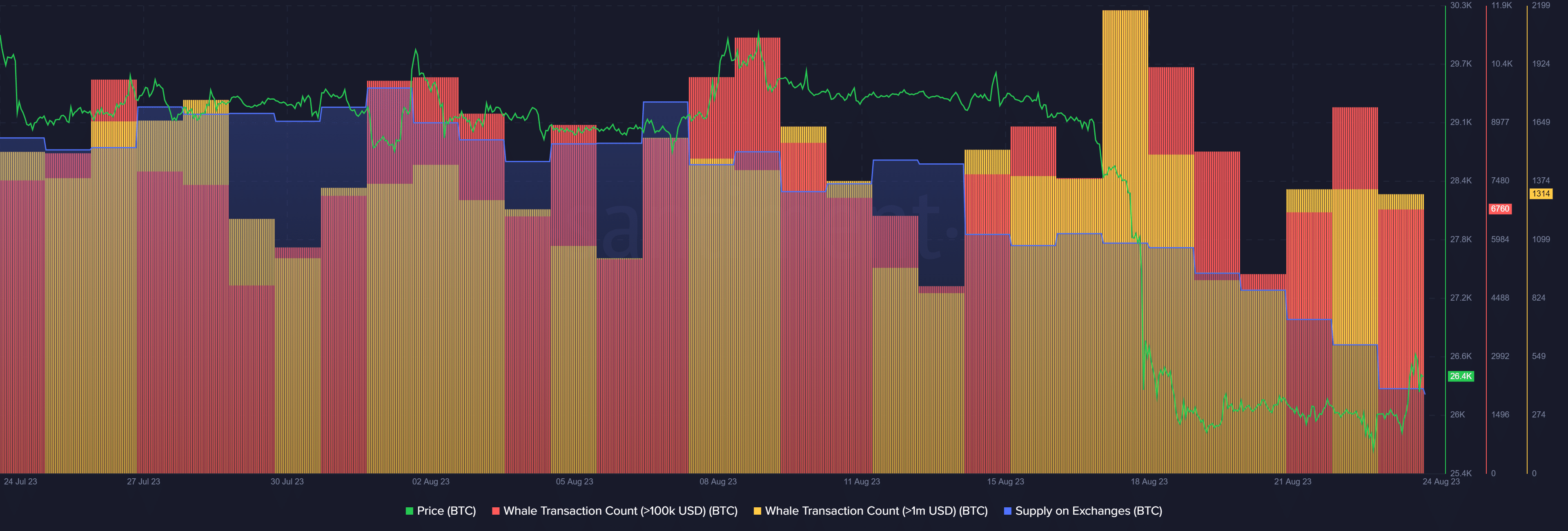

According to market intelligence platform Santiment, the Bitcoin whale activity has slightly declined. The number of whale transactions consisting of at least $100,000 and $1 million worth of BTC dropped from 9,372 and 1,337 to 6,760 and 1,314, respectively.

This suggests that small investors rather than whales could have driven the recent upsurge.

Moreover, Bitcoin supply on exchanges plunged to a 58-month low of 1.14 million coins. This was last seen in November 2018, per Santiment. The indicator suggests that investors are moving more Bitcoins to self-custodial wallets.

According to data provided by Glassnode, Bitcoin’s reserve risk has also dropped to 0.000024, marking a five-month low. When reserve risk goes down, long-term investors rise and accumulate.

Per Santiment, the number of addresses holding more than 0.1 BTC reached an all-time high of 4.44 million.