Bitcoin hits all-time high against Argentine peso

The persistent inflation in Argentina has resulted in a record high price of bitcoin against the Argentine Peso (ARS) on April 25.

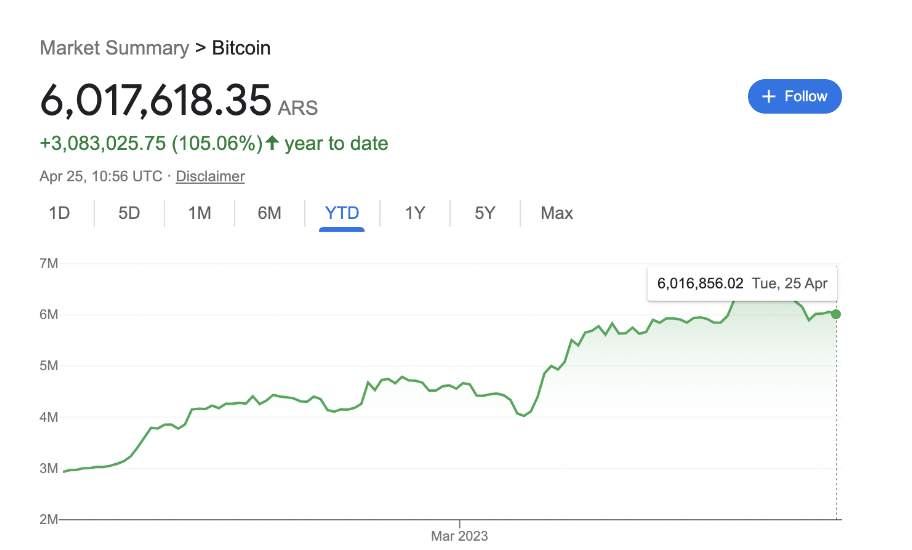

The exchange rate of BTC to ARS crossed over 6.59 million ARS on April 18, according to aggregated price data tracked by Google Finance.

Despite a 9% correction, the BTC/ARS exchange rate currently stands at approximately 6 million ARS, representing a significant increase of more than 100% year-to-date (YTD).

A potential safe haven

Argentina has been struggling with economic challenges for several years, including high inflation rates and a growing debt burden.

As Argentina’s economic crisis deepens, locals are continuing to seek refuge in bitcoin as the black market rate for the U.S. dollar reached 460 ARS on April 24, more than double the official rate of 220 ARS.

The country’s central bank responded to the crisis by raising its policy rate by 300 basis points to 81% on April 20, and restricting access to dollars for certain business payments.

The Central Bank of Argentina now requires permission for firms to pay interest on intra-company debts with dollars, while most service-sector businesses applying for dollars will have to wait 60 calendar days to receive them.

With the central bank’s reserves estimated to have dropped by half to $1.3 billion since 2019, many Argentinians fear further devaluation and are turning to bitcoin as a potential safe haven.

In 2023, Argentines are showing a greater level of enthusiasm towards cryptocurrencies, particularly stablecoins which have emerged as the top choice for 50% of the population, as per a recent report.

Bitcoin’s popularity in the country is also growing, as evidenced by the approval of a bitcoin-based futures index by the National Commission of Value (CNV). This derivative will enable accredited investors to access the bitcoin markets and will be settled in pesos.

Continuous bitcoin adoption

With more usage of cryptocurrency in Argentina, the country has also been grappling with the regulation of cryptocurrencies, which have become increasingly popular as a means of circumventing traditional financial systems.

Among other recent announcements were the mandate of proof-of-solvency procedures for exchanges and custodians, following the collapse of FTX and The National Securities Commission working on requirements and rules for crypto companies.

Furthermore, a recent bill proposed by the Ministry of Economy incentivized citizens to declare their crypto holdings by offering tax benefits. Finally, an Argentine province announced its intention to issue a dollar-backed stablecoin in December 2022.