Bitcoin holders experience $500b wealth surge in 2023

Bitcoin’s market capitalization has experienced substantial growth in 2023, rising from $320 billion to $827 billion, an increase of $500 billion for BTC holders, Matrixport says.

In a recent report by Matrixport, the Singapore-headquartered crypto investment firm argues that significant attention should be given to the pivotal role of U.S. inflation as a critical variable in the accumulation of Bitcoin wealth.

Over the last year, official inflation in the US has decreased from 8% to 3.1%, with analysts expecting a further decline to 2% in 2024.

Despite the Federal Reserve indicating a reduction in interest rates in 2024, analysts project that the gap between Fed Funds rates and the Consumer Price Index (CPI) will likely remain constant, leading to the accumulation of further Bitcoin wealth.

“While the Fed has guided the market in cutting interest rates by 75 basis points in 2024, the gap between Fed Funds rates and CPI is significantly wider, notably 220 basis points, and will remain, at least, constant, even if the Fed cuts, as inflation is expected to fall, according to our model.”

Matrixport

The report emphasizes that macroeconomic factors are poised to support higher Bitcoin prices in 2024, as miners “tend to restrict the supply of new Bitcoins around the halving cycles.”

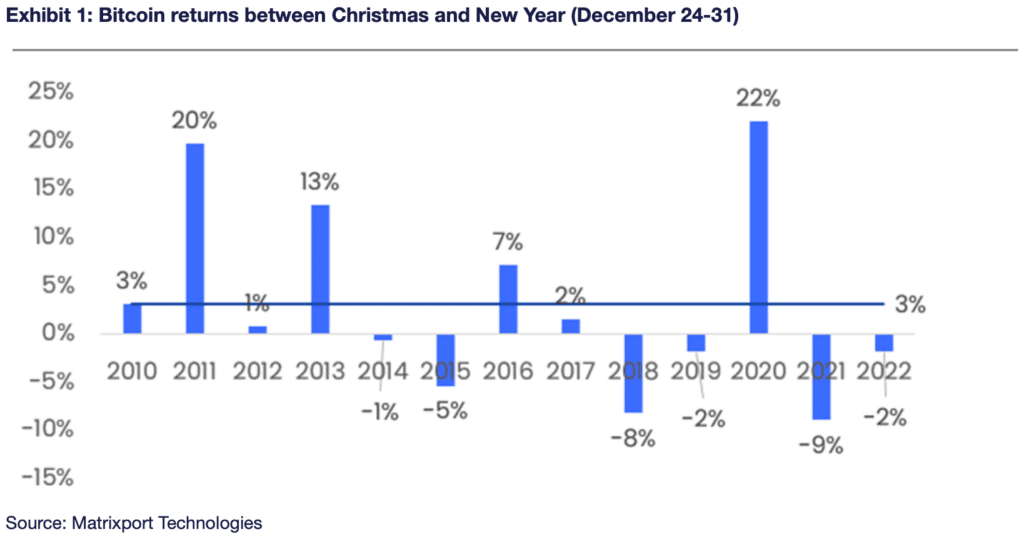

However, analysts also suggest that crypto investors should not expect another rally in 2023, as historically Bitcoin has only rallied only a few percent points between Dec. 24 until Dec. 31.

“This means that we might have seen the highs for the year, and prices could continue to consolidate into year-end. Bitcoin’s market cap rose from $320 billion to $827 billion, roughly a $500 billion wealth increase for Bitcoin holders.”

Matrixport

With reduced market activity expected during the Christmas holidays, Matrixport also foresees a decline in the funding rate. Nevertheless, elevated volatility may persist as traders hedge their positions in anticipation of the potential approval of a Bitcoin spot exchange-traded fund (ETF).

As reported earlier by crypto.news, analysts at K33 Research anticipate that the U.S. Securities and Exchange Commission is likely to approve spot Bitcoin ETFs “in the next three weeks” amid a flurry of updated S-1 filings from issuers like BlackRock.