Bitcoin long-term investors have started selling, potentially derailing $75k price rally

Bitcoin’s price started the week positively, rising to a daily peak of $68,884. However, with BTC long-term holders booking profits ahead of the halving event, the rally could be short-lived.

On March 18, the Bitcoin price unsuccessfully attempted to reclaim the $70,000 territory. On-chain data trends provide insights into major bearish catalysts that could impact the price rally in the week ahead.

Holders have sold more BTC in March than last two months

Crypto investors are switching focus towards hotshot sectors, including mega-cap Layer 1 assets like Avalanche (AVAX) and Solana (SOL), while some strategic traders are aping into presale meme tokens. In effect, the industry big shots Bitcoin (BTC) and Ethereum (ETH) have struggled for momentum.

However, in addition to these factors, on-chain data trends show that Bitcoin long-term investors appear to be trading increasingly bullish as the Halving date draws nearer.

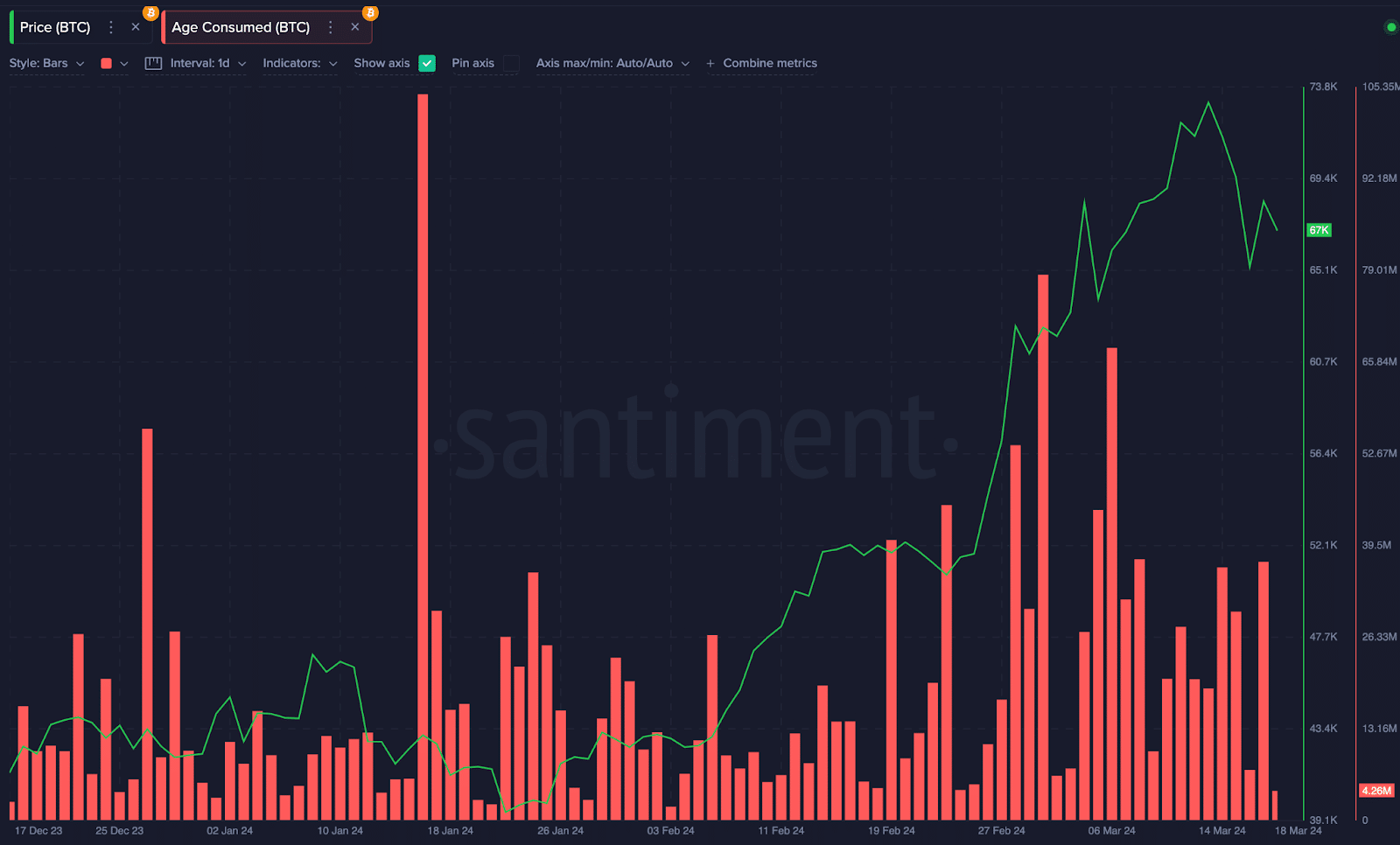

Santiment’s age-consumed metric is a proxy for tracking the trading activity among long-term investors. It multiples the total number of coins traded by the days since they were last moved.

The chart above shows that BTC recorded 37.6 million coin days consumed on March 17. Notably, this marks the seventh time in a month that the BTC age consumed has crossed the 30 million mark.

Essentially, spikes in age consumed appear when a larger number of long-held coins are on the move and vice versa.

For context, Bitcoin age consumed only crossed the 30 million mark five times in January and February 2024 combined.

When long-term investors begin to offload many coins, it could impact prices negatively for several reasons. Firstly, it signals that long-term investors may anticipate a major price dip in the weeks ahead. With the Bitcoin halving event now 32 days away, this could form a precursor to a larger sell-off as the event approaches.

More importantly, long-term holders control a significant portion of the total BTC circulating supply. Without a commensurate surge in demand, they could effectively dilute market supply and put a drag on BTC’s short-term prospects of reclaiming the $75,000 territory.

Bitcoin price forecast: $75,000 target now a tall order

Drawing insights from the long-term holders’ selling frenzy, Bitcoin price appears unlikely to hit a new all-time high above $75,000 in the coming week.

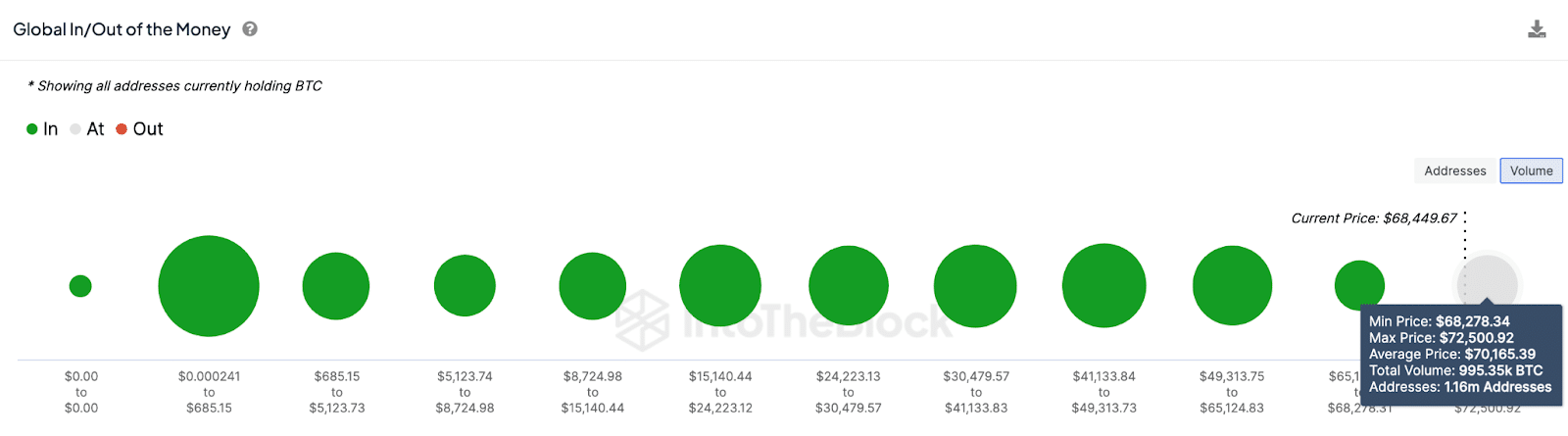

IntoTheBlock’s global in/out of the money data, which groups all existing Bitcoin holders according to their entry prices, also affirms this poignant stance. It shows that about 1.2 million addresses bought in on the rally last week, acquiring 995,350 BTC at an average price of $72,500.

Many holders could be spooked into selling once prices approach their break-even mark. With the halving date drawing closer, if long-term investors keep unloading on the market, a downswing below $65,000 could be on the cards.

Conversely, another week of record-breaking inflows from the Bitcoin ETFs could see BTC withstand the long-term investors’ selling pressure and advance toward $70,000.