Bitcoin is still undervalued despite surge to $66k

Bitcoin (BTC) gained bullish momentum a day after falling to a one-month low of $61,500 due to the heightened conflict between Iran and Israel.

BTC is up by 3.2% in the past 24 hours and is trading at around $66,450 at the time of writing. The asset’s market cap surpassed the $1.3 trillion mark while the daily Bitcoin trading volume plunged by 27%, currently hovering at $43.5 billion.

On April 14, the flagship digital currency fell to a one-month low of $61,514. One of the main reasons behind the bearish momentum was the start of Iran’s drone attack on Israel.

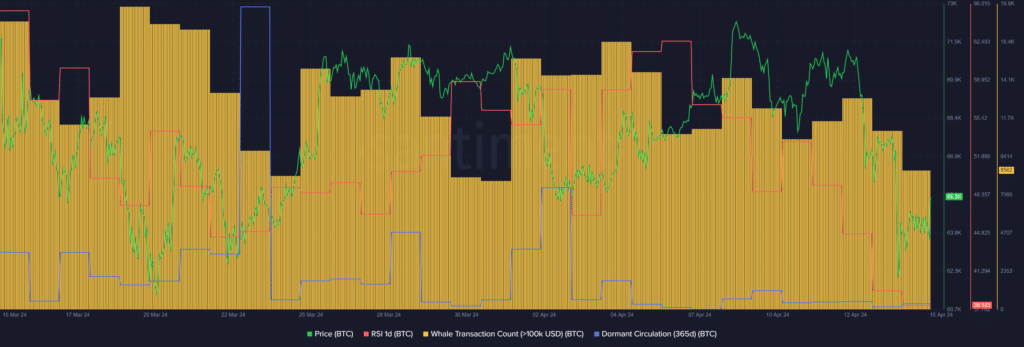

According to data provided by Santiment, the BTC Relative Strength Index (RSI) has been consistently declining since April 10 — currently hovering at 38. The indicator shows that Bitcoin is still undervalued despite the recent bullish momentum.

Bitcoin’s RSI would need to stay below the 50 mark to remain bullish.

Moreover, data from Santiment shows that whale transactions consisting of at least $100,000 worth of BTC recorded a 34% fall over the past three days — decreasing from 13,004 transactions on April 12 to 8,562 unique transactions over the past 24 hours.

Decreasing trading volume and whale activity usually means lower price volatility for an asset.

On the other hand, BTC’s one-year dormant circulation rose from 3,975.15 to 4,954.98 coins per day, according to Santiment. This shows some long-term Bitcoin holders might be looking to sell their assets for profit.