Bitcoin launched today 14 years ago, let’s remember why

The bitcoin (BTC) blockchain mined its first block on Jan.3, 2009 — exactly 14 years ago — but why?

When wondering why bitcoin was created, one good hint is on the blockchain itself. More precisely, in the coinbase parameter — the name of a data entry of a transaction generating new BTC as a block reward that inspired the name of the Coinbase crypto exchange — of the so-called genesis block.

The genesis block is the first block in the bitcoin blockchain. It was mined by the creator of bitcoin, known under the pseudonym Satoshi Nakamoto, on January 3, 2009. The block contains a single transaction which is the first ever recorded on the bitcoin network and is known as the “coinbase” transaction — the one issuing the block reward.

The genesis block also contains a message from Satoshi Nakamoto in the coinbase parameter which reads “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This message is a reference to a headline in the British newspaper “The Times” and serves as a timestamp for the block.

This headline serves as proof that the data was not generated before Jan. 3, 2009 — but the choice of this particular headline is also a clear statement.

Bitcoin was created to oppose the modern financial system and fractional reserve banking and the included headline also serves as a commentary on the financial crisis of 2007-2008 and the perceived need for a decentralized and trustless alternative to traditional financial systems.

Bitcoin is meant to circumvent capital controls, economic manipulation — usually called monetary policy by the proponents of the conventional financial system — and fiat money.

Fiat currencies such as the US dollar can be printed by the central bank without any real limit, which causes hyperinflation in many places around the world. One particularly infamous case is Venezuela where people ended up weighing banknotes instead of counting them when buying groceries until new banknotes with added zeros were released.

While it is easy to dismiss such issues as problems that can only be found in the third world or developing economies — especially those struck by embargos like in Venezuela’s case — it would not be correct to think that it does not happen in developed economies, including the United States. According to US Inflation Calculator, in 2022 a dollar is worth 9% less than what it was worth back in 2021.

In other words, a dollar this year is equivalent to $0.91 in 2021.

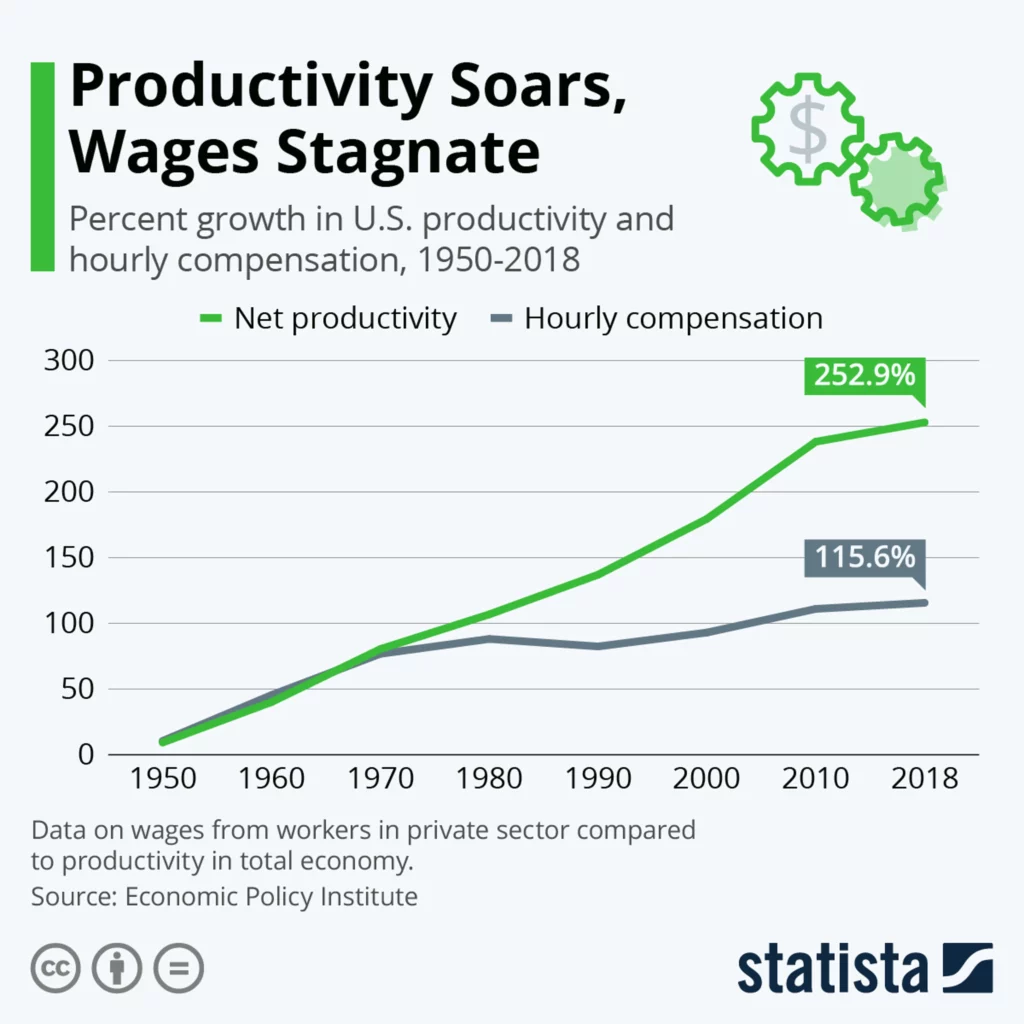

Things get even worse when we consider the turn that the world’s economy took after Nixon first broke the gold standard and rendered the United States dollar a fiat currency back in 1971. Data released by the economic policy institute clearly shows that since 1971, the net productivity growth in the United States stopped causing hourly wages to grow as well.

More data shows that the real gross domestic product, real wages, and trade policies in the United States were also nearly as strictly intertwined until Nixon decided to wreck the economy and allow dollars to be printed at will. Income concentration at the top also grew significantly after the abandonment of the dollar’s gold standard as well.

Fiat currency is accepted only because its acceptance is forced and because it is a social and economic norm to accept them. Still, fiat money is far from being the only problem of modern economics.

Famously, Henry Ford himself — who many believe to be the man most responsible for jumpstarting the industrial revolution — suggested that if the general populace were to understand how money works it would revolt. This comment is most likely dated back to the thirties when the dollar was still backed by gold but a law made it illegal to own physical gold in 1933.

The law required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. In some shape or form, these rules were active until 1975, when gold was not backing the dollar anymore.

Another aspect of traditional finance that is highly criticized by bitcoin proponents is fractional reserve banking. When customers deposit fiat currency in the bank, traditionally the bank could lend about 90% of the deposits and lend the rest. So effectively the bank created up to about nine extra dollars for each dollar deposited into an account out of thin air.

The Federal Reserve decided to change this back at the end of 2020, to contrast the economic instability caused by the COVID-19 pandemic.

Since then, the institution has set a new minimum bank reserve requirement of 0%, meaning that banks are now free to hold no reserves whatsoever. A document published in the federal register at the end of 2022 exempts from having to hold reserves banking institutions with up to $32.4 million worth of deposits, an increase from $21.2 million in 2021.

With inflation increasing worldwide and the financial system becoming ever more broken and unjust it is important to remember why Bitcoin was created and that it is more relevant now than it has ever been.