Bitcoin longs lead $247m in liquidations as markets lull

Volatility rocked crypto markets less than two days before Bitcoin’s halving, with the asset bouncing between $61,000 and $64,000.

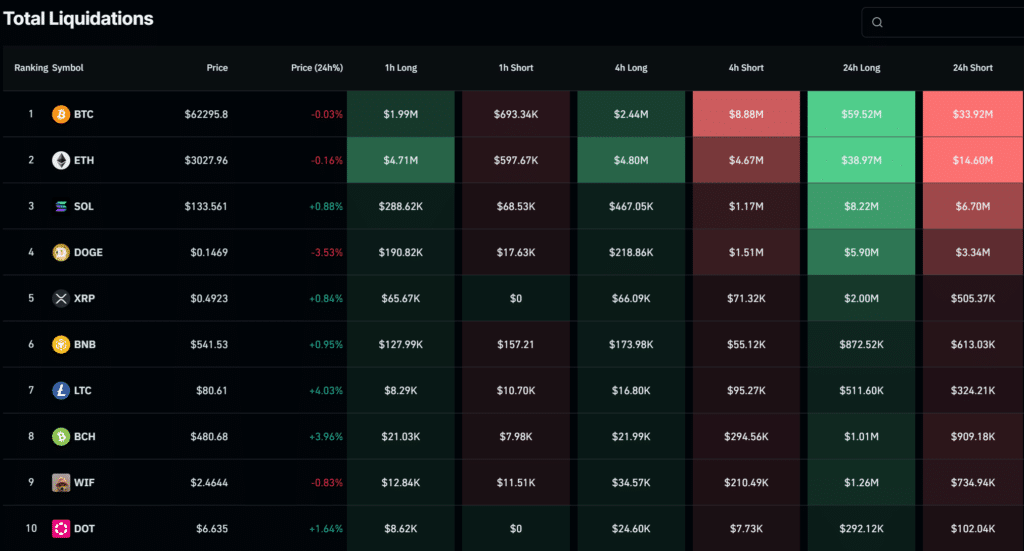

According to CoinGlass, this market fluctuation triggered more liquidations in Bitcoin (BTC) positions and across the broader digital asset ecosystem. Long BTC positions suffered the biggest hit on April 18 due to the token’s brief drop under $62,000.

Traders betting on higher Bitcoin prices logged over $57 million in liquidations across several trading venues. Short positions, investors predicting price declines, lost north of $36 million in 24 hours.

Data also ranked a $5.3 million BTC/USDT pair trader on crypto exchange OKX as the single-larget liquidation order at press time, as more than 74,571 traders saw positions wiped out from the market.

Ethereum (ETH), the second-largest cryptocurrency, trailed BTC with over $53 million in liquidations comprised of long and short traders. Major altcoin Solana (SOL) boasted considerably less at $14 million, followed by veteran meme token Dogecoin (DOGE) with around $9 million.

Bitcoin pre-halving swings

Bitcoin’s corrections and subsequent price swings seem to have initiated a market cooldown after racing to a new all-time high last month and buoying the entire crypto market near its 2021 peak.

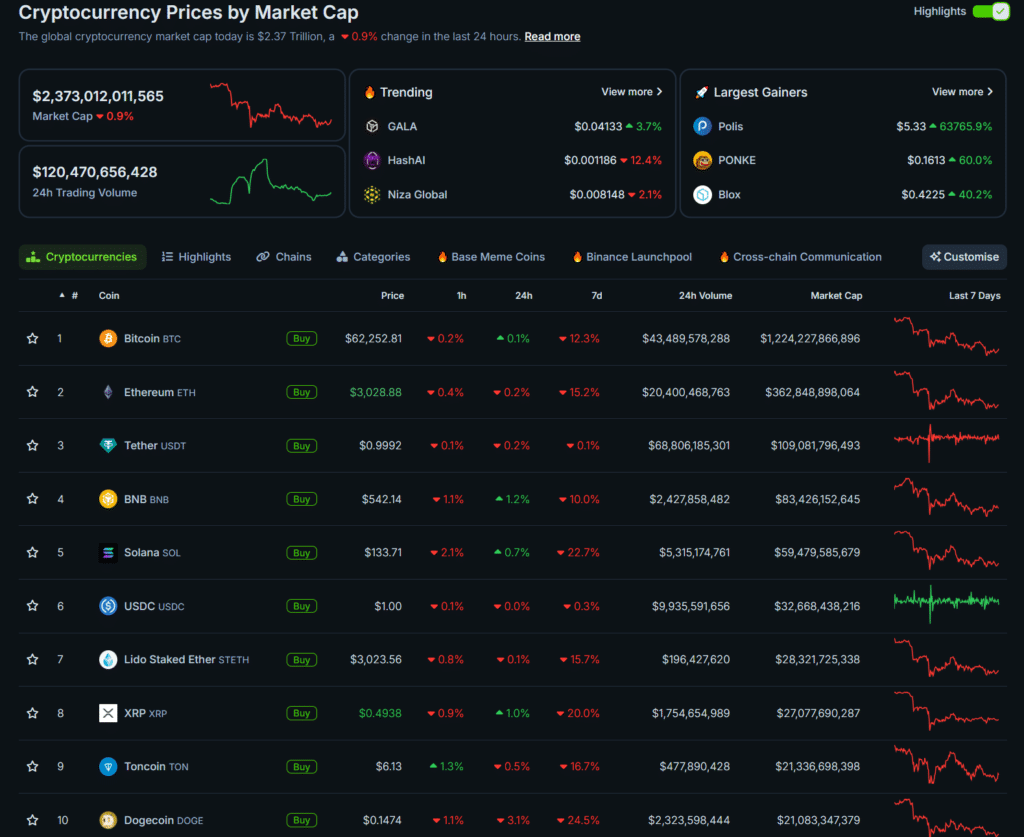

As of writing, the total crypto market traded flat, down 0.9% at a $2.3 trillion valuation per CoinGecko. The sector surpassed $3 trillion during the previous bull run and came close to this height following BTC’s boom earlier this year.

However, pre-halving volatility is not a novel pattern in crypto, and markets historically retrace up to 50% before BTC automatically deploys its code change. As the name suggests, the halving will cut block reward by half, potentially stifling mining companies’ revenue.

As a cautionary measure, miners reportedly turned on more machines before the halving to extract as much value as possible from the blockchain and stockpile cash reserves to cushion operational costs.