Bitcoin may find $54k support during bearish September: QCP

After Bitcoin’s red August, QCP Capital analysts predict a bearish September for the crypto, but a Federal Reserve pivot could provide relief.

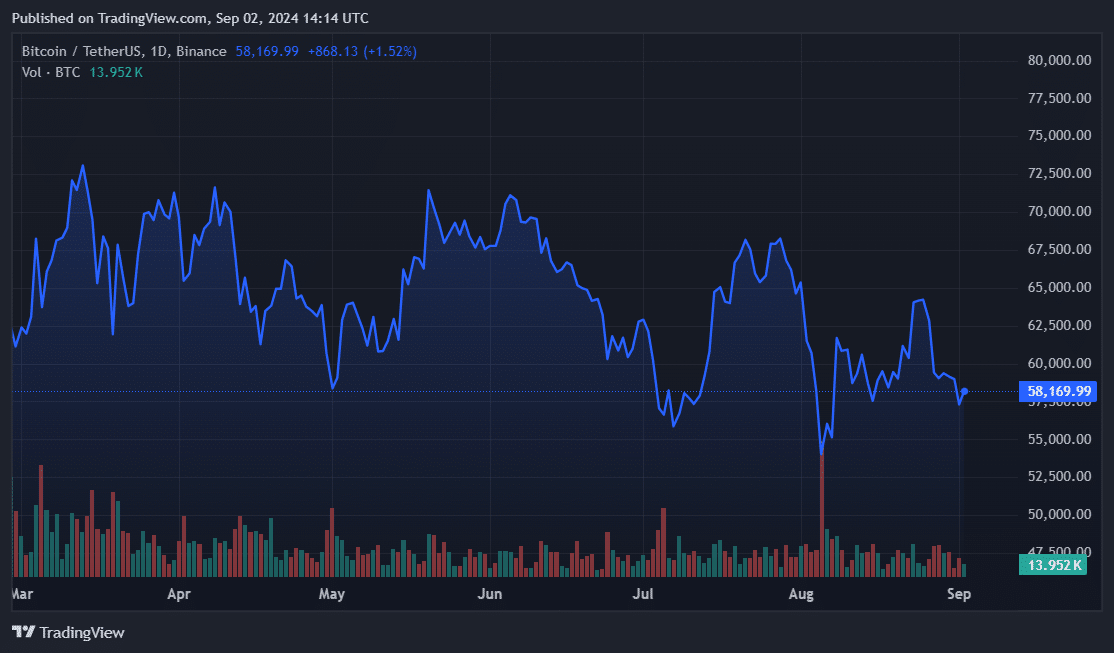

According to the digital asset trading desk, Bitcoin’s (BTC) historical trend looked likely to repeat itself, and the cryptocurrency may dip another 5% this month following August’s downswing.

Bitcoin has traded in the red during six of the last seven September months, averaging losses of up to 4.5% in those years. QCP Capital said this decline could work in BTC’s favor and support a potential upward move.

The firm expects BTC to gather strength around $54,000, the same level Bitcoin bounced from before racing to $70,000 in July. At press time, the crypto changed hands for $58,000 and was up nearly 2% on a modest broad market climb.

Experts: Fed rate cuts could negate historical Bitcoin trend

While this month typically represents a bearish overhang for BTC, an expected monetary policy pivot from the U.S. Federal Reserve may catalyze a rally, Li.Fi CEO Philipp Zentner told crypto.news over email on Sept. 2.

During the Jackson Hole speech last month, Fed chair Jerome Powell said it was time for a shift in interest rates. Investors widely anticipate rate cuts between 25 and 50 basis points later this September.

Zentner pointed to rising BTC dominance, dwindling crypto exchange balances, and an influx of BTC miner supply in the open market as bullish indicators.

Indeed, BTC dominance rose to 58% as investors backed the leading cryptocurrency over altcoins like Ethereum (ETH), which have underperformed compared to Bitcoin.

CoinGlass data showed billions in BTC leaving crypto exchanges like Binance and Coinbase in the last 30 days. In June, BTC and ETH exchange balances fell to a four-year low. The trend could signal a bullish investor outlook, although sentiment remained mixed ahead of expected rate cuts.

Overall, the market is setting up for a potentially significant rally, driven by a combination of strong Bitcoin fundamentals, a well-capitalized stablecoin market, and the anticipation of a more favorable monetary policy environment. This confluence of factors positions Bitcoin and the broader market for a bullish phase as we move further into the year.

Philipp Zentner, Li.Fi CEO