Bitcoin might be on the verge of bull run, data suggests

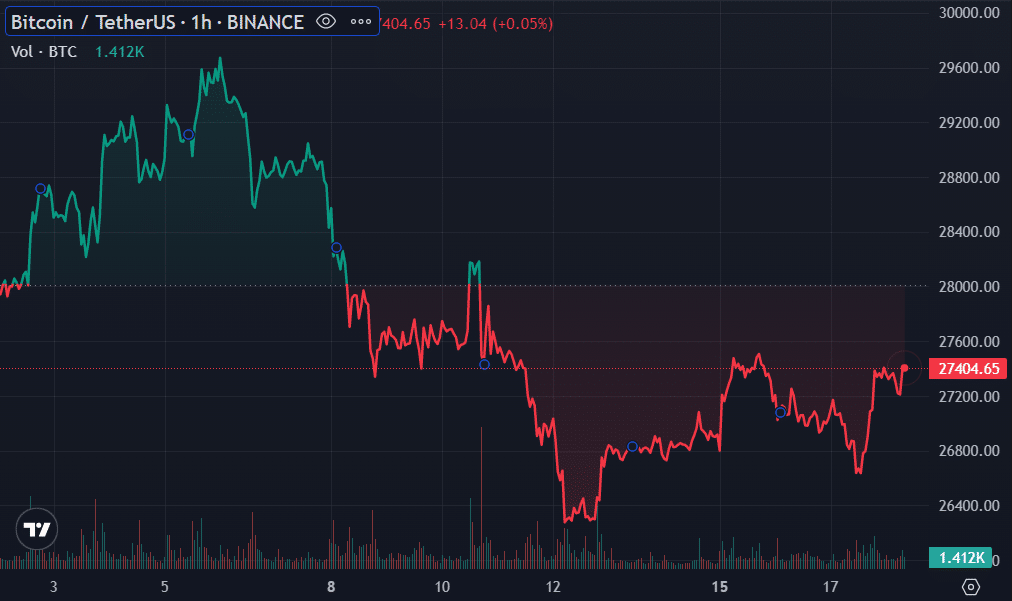

Bitcoin (BTC) is currently stuck in a bearish storm that started at the beginning of this month. Following four months of consistent gains this year, bitcoin began May on a bearish note. However, key historical data suggests the asset might be on the verge of a bull run in the long term.

Philip Swift, the founder of BTC data resource LookIntoBitcoin, and behavior analytics platform Santiment, recently highlighted this looming bull run. Both entities cited historical data from critical indicators, including but not limited to the BTC RHODL Ratio Indicator and the supply of BTC on exchanges.

The BTC RHODL Ratio

Swift created the RHODL Ratio to analyze bitcoin’s price based on investor behavior. The indicator looks at recently moved coins and compares them to coins that haven’t been moved for a while (between one and two years). This helps market watchers determine if investors are into BTC for quick profits or holding onto it for the long term.

The RHODL Ratio is heading to the upside, which means more market participants are using BTC for short-term profits. The indicator began its upswing in late 2022 amid the FTX-induced downtrend. Swift noted then that the upswing signaled a looming price increase. Notably, BTC has been up 65% since then.

In a recent tweet, Swift disclosed that the indicator suggests the potential emergence of a new bull run. According to him, historical data indicates that the metric is repeating a similar pattern to what was observed in 2020 when he created the indicator. This led to the bull run that resulted in bitcoin’s all-time high.

A continuation of the rally

Moreover, in a separate analysis, Santiment highlighted metrics that signal an impending price upswing for the BTC market. The analysis cited bitcoin’s on-chain transaction volume, supply on exchanges, whale accumulation, and short-term traders’ profitability.

Santiment pointed out that BTC investors are increasingly capitulating their holdings. The asset is experiencing a slew of negative spikes in its on-chain transaction volume, indicating fear and panic selling among investors. The analysis noted that this is bullish for long-term holders, who would scoop up the coins pumped into the market.

In addition, bitcoin’s supply on exchanges was observed to have dropped to a multi-year low, currently at 5.73%. The last time the ratio of BTC supply on exchanges went underneath 6% was in 2017. A significant transaction involving $3.35 billion worth of BTC contributed mainly to this drop after the tokens were moved from Binance to a new address on May 5.

Santiment also disclosed that whales (holding between 1,000 and 10,000 BTC) are on an accumulation spree. Moreover, short-term traders are experiencing negative returns, while long-term traders remain profitable. The analysis revealed that these metrics signal a continuation of the run that began earlier this year.

Meanwhile, BTC is changing hands at $27,418 at the reporting time. A bullish start to the day saw the asset surge to $27,485 before facing mild opposition. BTC is still 2% up in the past 24 hours, as it looks to recoup the previous week’s losses.