Bitcoin miners’ revenue drops amid declining transaction fees

The Bitcoin (BTC) miners’ revenue has been consistently declining after the halving event. The downtrend comes as the average transaction fee on the network plunges.

According to data provided by YCharts, the average transaction fee on the Bitcoin network declined by 28% in the past 24 hours, hovering around $24.99 at the time of writing.

Data shows that the average Bitcoin transaction fee surged from $19.76 to $128.45 between April 19 and 20. It’s important to note the transaction fee was sitting at $5 a month ago and dropped to as low as $2.8 on April 6.

Moreover, the daily Bitcoin miners’ revenue has also been declining after the network’s block reward was cut in half. Per data from YCharts, the miners’ earnings fell by 5.1% on April 22, reaching $48.17 million per day.

Despite the downturn, the daily BTC miners’ revenue is still up by 87% over the past 365 days — on April 23, 2023, the amount of miners’ earnings was sitting at $25.7 million.

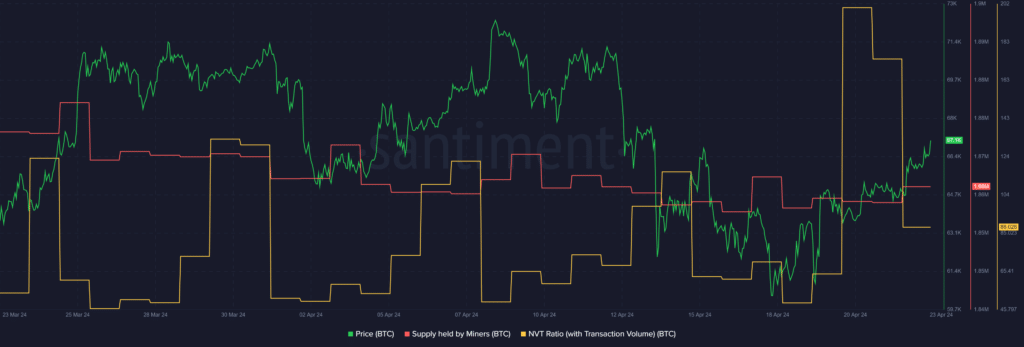

According to data provided by Santiment, the total Bitcoin supply held by miners is $1.86 million BTC.

Notably, the lower BTC production has also decreased the asset’s price volatility.

Bitcoin is up by 0.15% in the past 24 hours and is trading at $66,175 at the time of writing. The asset’s market cap is roaming around the $1.3 trillion mark with a daily trading volume of $24.7 billion.

Data from the market intelligence platform shows that the Bitcoin network value to transaction (NVT) ratio declined from 174 to 88 over the past 24 hours.

The indicator shows that Bitcoin is slightly undervalued at this price point. An NVT ratio higher than 100 would suggest the asset is overvalued.