Bitcoin mining difficulty drops by 6%, lowest since December 2022

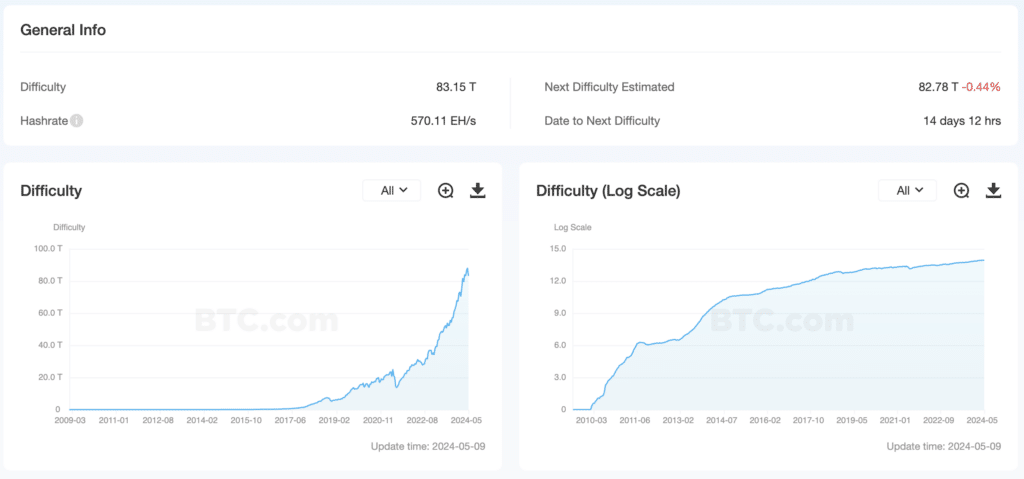

Bitcoin mining difficulty has dropped to its lowest level since December 2022.

According to BTC.com, on May 9, the difficulty of mining Bitcoin (BTC) fell by 5.63% to 83.15 T. The same value was during the 2022 bear market phase due to a series of bankruptcies, including the collapse of Terra and FTX.

Since the previous change in value, the average hashrate over an approximately two-week period was 595 EH/s versus 630 EH/s, indicating the possible shutdown of equipment by miners, the operation of which became unprofitable after the most recent Bitcoin halving.

The indicator’s next change will occur on May 23. The predicted value is a drawdown of 0.19%.

On April 20, the block reward was changed from 6.25 BTC to 3.125 BTC. Immediately after the halving, mining difficulty increased sharply due to the high commissions on the Bitcoin network, but miners’ income was largely unaffected by the halving of the reward.

At the beginning of May, Bitcoin miners’ daily revenue dropped to the values of October 2023. Blockchain.com data shows that total miner income fell to $26.38 million on May 3.

Ki Young Ju, founder and CEO of the analytical company CryptoQuant, found no signs of capitulation by the miners. He assumed that the profit-providing quotes of BTC after halving the block reward should be $80,000.