Bitcoin mining stocks continue to slump ahead of halving

Bitcoin mining companies are facing a notable decrease in stock value in anticipation of the upcoming halving.

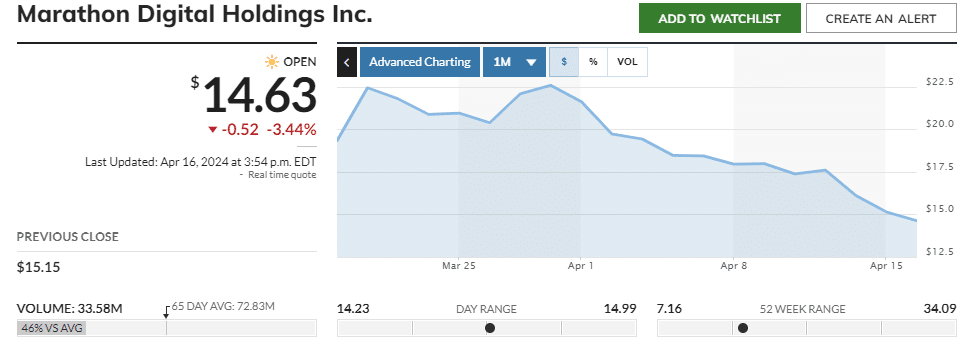

Shares of Marathon Digital Holdings, Riot Platforms, and CleanSpark have declined for three consecutive days. Marathon Digital Holdings, the largest public Bitcoin miner, lost nearly 25% of its stock value in the past month, while Riot Platforms lost almost 30%. Additionally, the Valkyrie Bitcoin Miners exchange-traded fund has seen a reduction of about 28% in its value this month.

The decline in stock prices continues against a backdrop of increasing short interest in cryptocurrency mining stocks and geopolitical tensions following recent conflicts between Iran and Israel, leading investors toward safer assets.

Despite these challenges, the CEOs of these mining companies remain optimistic, according to Bloomberg. The mining companies’ cost-efficient operations, advanced mining technology, and increased demand for cryptocurrencies are potential compensatory factors for the anticipated $10 billion annual revenue loss due to the upcoming Bitcoin halving.

Furthermore, the companies are hopeful that the surge in demand driven by new spot ETFs will bolster Bitcoin’s price sufficiently to offset the adverse effects of the update. Since their introduction by traditional asset management firms in January, these ETFs have attracted a total cumulative net inflow of $12.4 billion.

The recent approvals of Bitcoin ETFs in Hong Kong also draw significant optimism from crypto leaders. In a comment shared with crypto.news, Sumit Gupta, co-founder of CoinDCX, one of the largest exchanges in India, shared enthusiasm about the first major ETF approval in Asia.

“Institutional involvement has historically served as a driving force behind the increased attention and traction observed in various asset classes. The fact that this development has occurred in Asia for the first time brings it closer to our home, underscoring the global nature of this evolving narrative. The trajectory of the crypto industry is moving in a direction that fosters adoption, albeit gradually, signaling promising prospects for its future growth and mainstream acceptance.”

– Sumit Gupta, co-founder of CoinDCX