Bitcoin mining stocks brace for technical risk

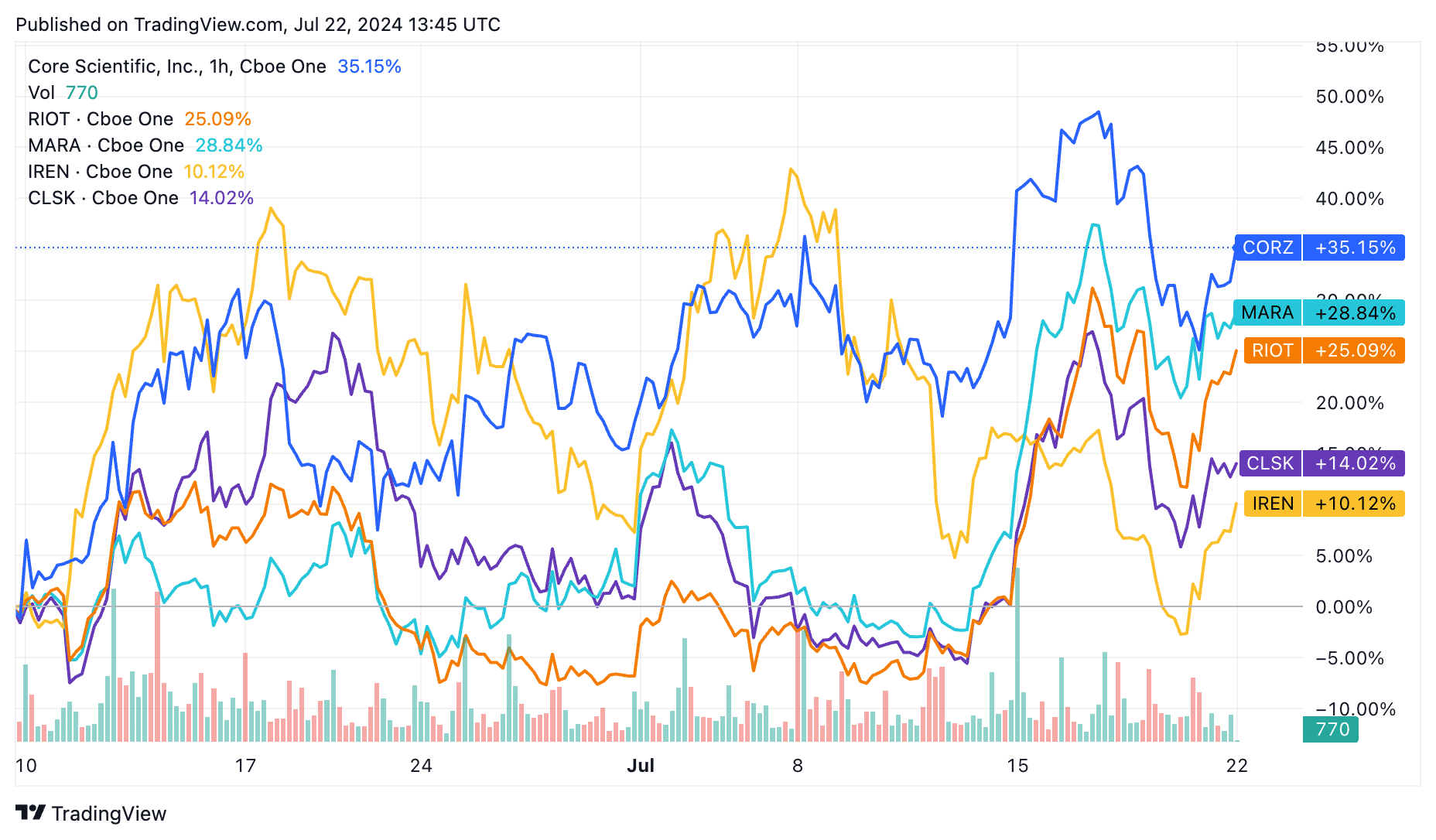

Bitcoin mining stocks continued their recovery as Bitcoin continued rising during the weekend.

Bitcoin mining stocks are rising

Bitcoin has risen by over 26% from its lowest point this month as bulls anticipate an eventual move to $70,000.

Core Scientific (CORZ) stock rose by 2.3% on Monday, while Riot Platforms (RIOT), Marathon Digital (MARA), Iris Energy (IREN), Cipher Mining (CIFR), and CleanSpark (CLSK) jumped by over 2%.

The companies have risen as investors remained optimistic that Bitcoin will continue its recovery this year. Polymarket saw 67% of users expect Bitcoin to jump to $70,000 this month, a big increase from the current $67,000.

A likely catalyst for this rally is polls indicating that Donald Trump will beat Kamala Harris in the next election.

Bitcoin will likely rise ahead of the upcoming Bitcoin event in Nashville, where Donald Trump will address the attendees. He will also attend a campaign fundraiser, for which tickets are selling for over $800,000.

Bitcoin mining stocks do well when BTC is in an uptrend, which leads to more revenues and profits. This price action is important because many miners produced fewer coins after the halving event in April.

The companies have also risen as signs of industry consolidation emerge. Riot Platforms made a bid for Bitfarms earlier this year while Core Scientific rejected a buyout by CoreWeave. Just last week, Bloomberg reported that Cipher Mining was considering a sale after receiving bids.

More Bitcoin mining companies could attract acquisition offers from firms seeking to grow their artificial intelligence (AI) footprint.

Bitcoin technicals are sending mixed signals

Still, these companies face technical risks as chart patterns send mixed signals about Bitcoin prices. In a note on Saturday, Peter Brandt, a veteran prop trader, noted that the current formation was not a bullish flag. Instead, he believes that Bitcoin is in a downtrend.

However, Bitcoin looks to be forming a falling broadening wedge pattern, a popular bullish sign. In line with this, Bitcoin has moved into the third phase of the three-dives pattern, pointing to more upside.

Additionally, Bitcoin has remained above the 200-day moving average, pointing to more upside. Therefore, as Michael Novogratz noted in June, more Bitcoin upside will only be confirmed if it rises above the YTD high of $73,400.