Bitcoin open interest marks 4-month low as volatility persists

Crypto market volatility discouraged digital asset speculation, flushing out Bitcoin leveraged positions despite the March 4 recovery bounce.

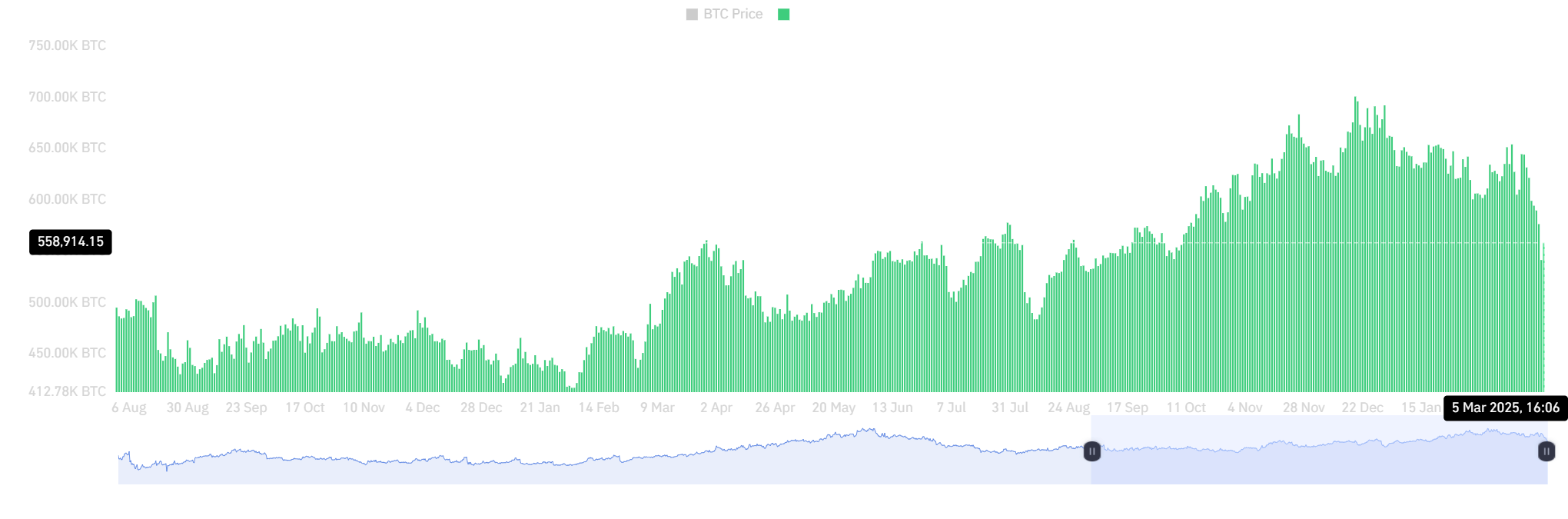

Bitcoin (BTC) open interest backpedaled to $49 billion, or 558,914 BTC across exchanges, reaching a four-month low and revisiting levels last seen in October 2024, per CoinGlass data. Open interest measures the sum of outstanding futures or options contracts. In this case, BTC OI calculates the total money allocated to Bitcoin leveraged positions.

Data showed BTC OI in a downtrend since December, falling to current levels from around 700,000 BTC worth over $62 billion. Binance, crypto’s second most traded venue for BTC OI, noted a 12-month low on March 5.

The steady OI decline in Bitcoin’s market suggests spot buying outpaced leverage-driven activity during BTC’s blitz to a new all-time high. It could also indicate that investors have changed gears on BTC speculation, likely trimming positions due to volatility or realizing losses amid billions in liquidations over the past week.

BTC declined as far as $78,300 in late February, retracing some 25% from its January peak price of $108,786 as macro uncertainty and cyclical bottoming patterns depressed crypto markets.

President Donald Trump’s teaser of a multi-asset crypto reserve, which would include BTC, briefly buoyed the digital asset sector last week before another selloff ensued. However, BTC and the broader crypto market had regained some ground at press time. The total digital asset market capitalization settled above $3 trillion while BTC tapped $90,000.

Analysts foresee more price swings while volatility persists this month and tariff-fueled trade wars continue. The assertion is backed by seasonal patterns from the Bitcoin Volmex Implied Volatility 30 Day Index. Per the chart, volatility may increase in March and decrease by April, possibly buffering BTC prices and relieving sell pressure.