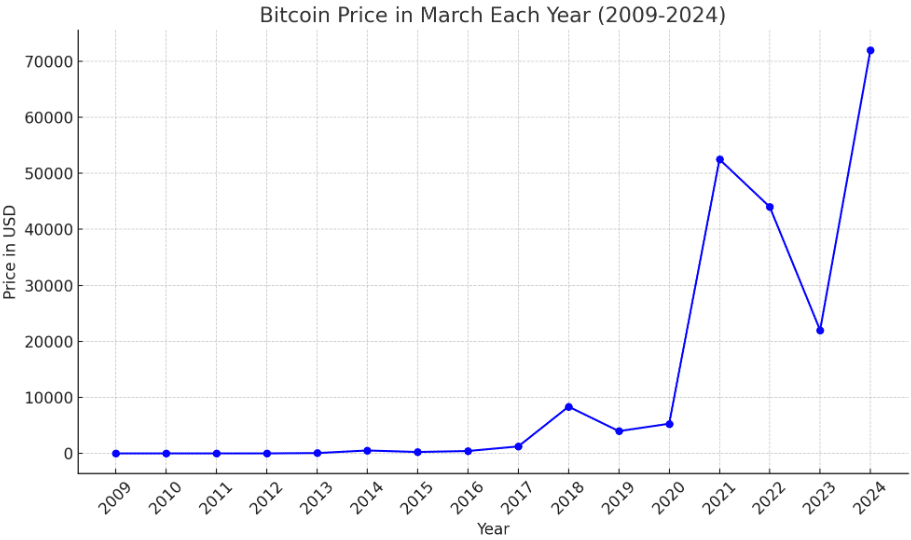

Bitcoin has outpaced USD nearly every year since its inception

Since its inception, Bitcoin has experienced annual price declines in only four of 14 years.

Despite its inherent volatility, this shows the overall trend of growth and long-term utility of Bitcoin (BTC) as an asset class. With BTC hitting its all-time high of $72,000 today, the leading cryptocurrency is up by over 260% annually. But this isn’t the only time BTC has recorded significant yearly gains.

Since the token started first trading in March 2010, BTC has experienced an annual decline only in 2015, 2019, 2022, and 2023.

“Every investor who has ever entered the Bitcoin market is currently enjoying profitable returns, as the current price far surpasses any historical point. However, it’s imperative to remember that past performance does not guarantee future results. With the halving event looming just 41 days away, we anticipate a forthcoming supply shock amid escalating demand. This delicate balance between reduced supply and heightened interest sets the stage for unprecedented momentum.”

– Sumit Gupta, Co-founder of CoinDCX

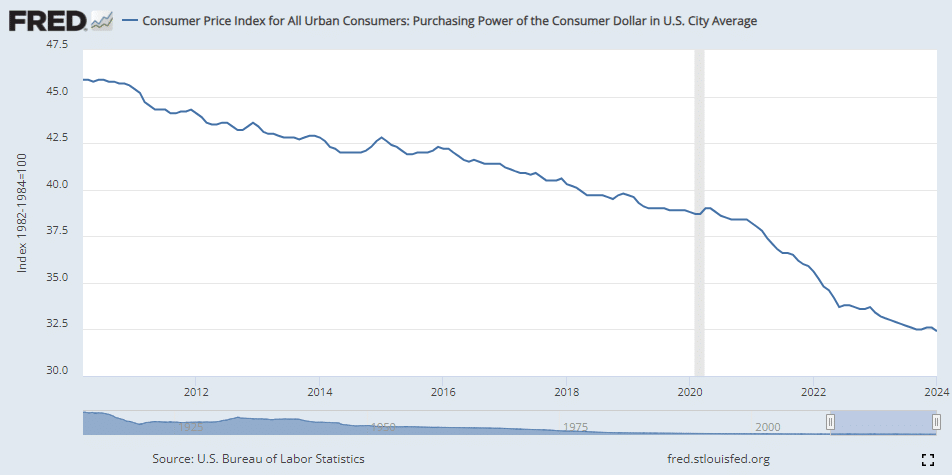

Conversely, the USD has experienced a consistent annual inflation rate, leading to a gradual decrease in purchasing power over time. The inflation rate has varied, with periods of higher inflation, especially noted in the early 2020s, reflecting economic challenges, including the impacts of the COVID-19 pandemic and subsequent recovery efforts. Inflation reduces the value of money over time, meaning that a dollar in 2009 has less purchasing power in 2024.

Since Bitcoin’s debut through Satoshi Nakamoto’s novel whitepaper, there have been no reported years of deflation that would indicate an increase in purchasing power. So, the USD’s purchasing power, widely considered the most traded fiat currency, decreased every year for 14 years.

The stark contrast between Bitcoin’s exponential growth and the USD’s decreasing purchasing power due to inflation underlines the fundamental differences between a decentralized cryptocurrency and a fiat currency. Bitcoin’s rise reflects its growing acceptance and the speculative interest it attracts, alongside debates about its role as an inflation hedge.

Meanwhile, the inflation rate affecting the USD highlights the impact of centralized economic policies, supply chain dynamics, and global events on traditional currencies.