Bitcoin outperformed Amazon, Netflix over last decade

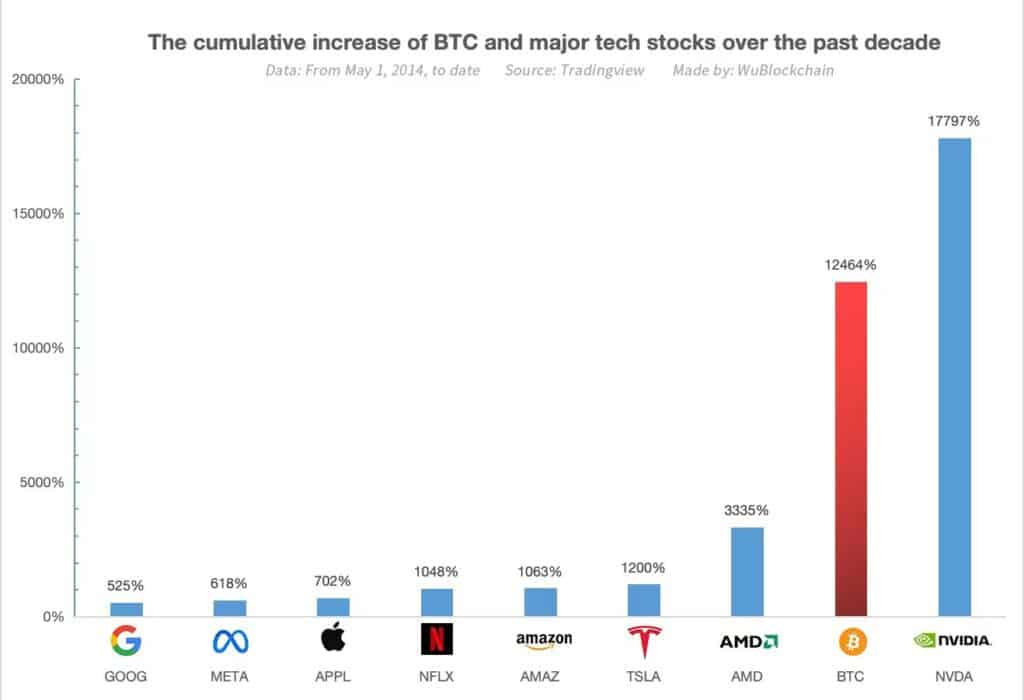

Bitcoin, crypto’s top token, outperformed equities from tech giants like Amazon, Google, and Netflix over the previous 10 years.

Despite only debuting 15 years ago, Bitcoin (BTC) has successfully competed with the biggest names in the technology industry.

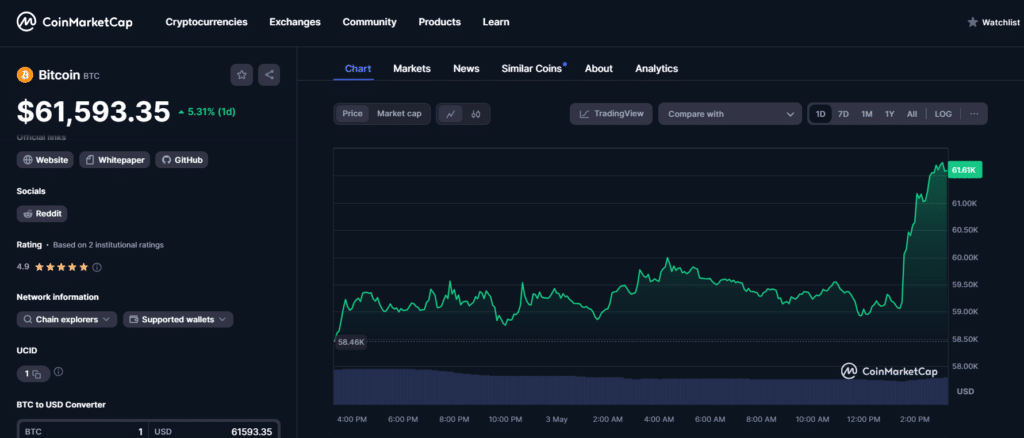

At the close of 2014, a BTC cost about $378. Recently, digital assets have been largely in a downturn, and BTC changed hands 16% below its all-time high set in March, at $61,500 per token price at press time, per CoinMarketCap.

Bitcoin ranked second among tech investments

TradingView data showed that GPU maker Nvidia was the only tech heavyweight to outclass BTC over the past 10 years. Nvidia’s stock NVDA has returned a cumulative 17,797%, against Bitcoin’s 12,464%.

Semiconductor producer Advanced Micro Devices (AMD) followed in third with a 3,335% price increase. A 1,200% increase in the stock price of Elon Musk’s Tesla (TSLA) placed the company fourth, and Jeff Bezos’ Amazon completed the top five with a 1,063% gain. Other Silicon Valley players observed included Netflix (NFLX), Apple (APPL), Meta (META), and Google (GOOG).

What’s next for BTC?

Last month, a hardcoded on-chain shift designed by BTC creator Satoshi Nakamoto went live, slashing block mining rewards by 50% and straining miner revenues. The Bitcoin halving maintains scarcity by curtailing token inflation, introducing a fresh supply dynamic to the market.

Historically, a market lull follows the halving and prices stagnate for some time before rising higher. Speculators surmised that the trend might change in the short-term during this cycle, but an expert told crypto.news that the long-term impact outweighs immediate price movement.

DCL.Link Partnerships Lead Peter M. Moricz said BTC miners must adopt a more energy-efficient approach and hedge operations to cover expenses. One miner, Stronghold Digital Mining, is assessing its options to stay afloat, including selling its business to maximum shareholder value.

Moricz argued that a major concern is mining centralization, rather than revenue. As more entities consolidate businesses and possible mergers occur, the risk of government influence increases, and “this is the main concern for the BTC ecosystem going forward,” Moricz explained.

Regarding price action, the financial markets veteran remarked that higher BTC prices are inevitable despite skepticism from some Wall Street stalwarts.

“The BTC ETF has pulled all the price movement forward rather than after the halving. Even then, the historical pattern showed that each price action was lower than 4 years prior. BTC rallied for the past 7 months, ever since the BlackRock BTC ETF application was rumored, and with IBIT pulling in a record amount of money for any ETF, the steam had run out for now.

A correction, with some sideway trading, will give a healthy market for the next leg up. BTC scarcity is real – there are only 21 million BTC out there no matter what Jamie Dimon says.”

Peter M. Moricz, DCL.Link Partnerships Lead