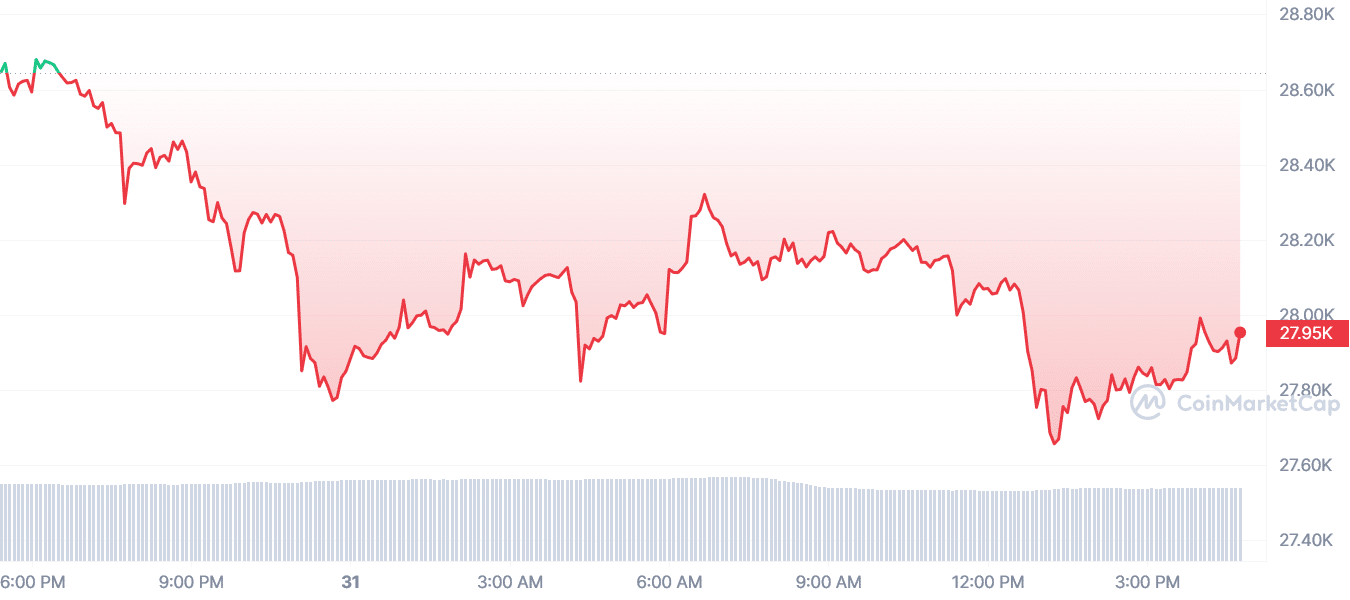

Bitcoin plunges below $28k amid market’s recent dip

Bitcoin (BTC), the world’s largest cryptocurrency, has suddenly dropped in value, slipping below $28,000 to trade at $27,953 on March 31.

This decline represents a 4.1% decrease from its 90-day high of $29,159 reached just the day before on Mar. 30.

The market capitalization has also taken a hit, shrinking to $1.17 trillion, a nearly 2% drop within 24 hours.

As we analyze this recent downturn, let’s explore possible reasons for the decline and potential future movements.

Key trading range and support levels

Crypto Tony, a prominent analyst, has highlighted the importance of the $27,700 equilibrium (EQ) level as key support that the bulls should preserve.

On the other hand, Filbfilb, a market analyst, expects Bitcoin’s 200-week moving average (WMA) near $25,500 to be the “front run” next, translating to two-week lows.

Market structure shift and the monthly close

On a more optimistic note, analytics account Tedtalksmacro highlights that bitcoin has “truly shifted” its market structure on longer timeframes, breaking away from the bear market since its latest all-time highs in November 2021.

With the first higher highs since November 2021 and the first higher low since January 2022, he believes the market structure has shifted, providing traders with clear invalidation.

Profit-taking, portfolio reshuffling, and macro catalysts

As the first quarter of 2023 draws to a close, we can also point to profit-taking and portfolio reshuffling as potential reasons for the recent dip in bitcoin’s value.

Meanwhile, macro catalysts, such as the Federal Reserve’s preferred measure of inflation, could also impact the crypto market.

Should the March data show a cooling in inflation, it could increase bets on the Fed holding off on interest rate hikes after its next policy decision in May, potentially fueling further gains for bitcoin.

Amid the current market fluctuations, a cryptocurrency trader known as “Moustache” has shared his perspective on the state of bitcoin.

Drawing parallels to the long accumulation phases in 2015 and 2019, he points out that a crossover in the double RSI previously indicated the beginning of a bitcoin bull run. This signal has recently emerged again.

The road ahead

With bitcoin dipping below $28,000, you should closely monitor key support levels, high-timeframe resistance, and macro catalysts that could affect the market.

While some analysts predict further downside, others believe that bitcoin’s market structure has shifted, offering hope for a more bullish future. In any case, traders and investors should keep a keen eye on the unfolding situation.