Bitcoin price base case for 2025 is $180,000, VanEck’s Sigel predicts

Bitcoin’s price continued its strong bullish trend this week, with many analysts believing that the rally has more room to run.

Bitcoin (BTC) was trading at $91,200 on Thursday, Nov. 14, bringing its year-to-date gains to 115%. It has outperformed popular assets like the Dow Jones, Nasdaq 100, and S&P 500 indices.

In a CNBC interview, Matthew Sigel, the head of digital assets at VanEck, said that the Bitcoin price rally had more room to run.

He expects that the coin will make repeated all-time highs in the next few quarters now that the US election has ended. Donald Trump, who is the first pro-crypto president, has already appointed several similar officials, including Matt Gaetz, JD Vance, Vivek Ramaswany, Elon Musk, and Tulsi Gabbard.

Moreover, some newly elected officials in the House of Representatives have made pro-crypto statements. Sigel also noted that several top indicators his firm tracks were still flashing green. He predicts Bitcoin’s price could rise to $180,000, almost double its current trading value.

Polymarket is also highly bullish on Bitcoin. A poll with over 724,000 in assets indicates that BTC has a 56% chance of hitting $100,000 this month.

Still, not everyone is bullish on Bitcoin. In an X post, Ali, who has over 81,000 followers, predicts that the coin could see a short-term pullback. He attributed this to the TD Sequential indicator, which has a sell signal on the daily chart.

Similarly, Ki Young Ju, the founder of CryptoQuant, warned that the perpetual market was overleveraged, which could lead to a sharp retracement.

Bitcoin price rally has room to go on

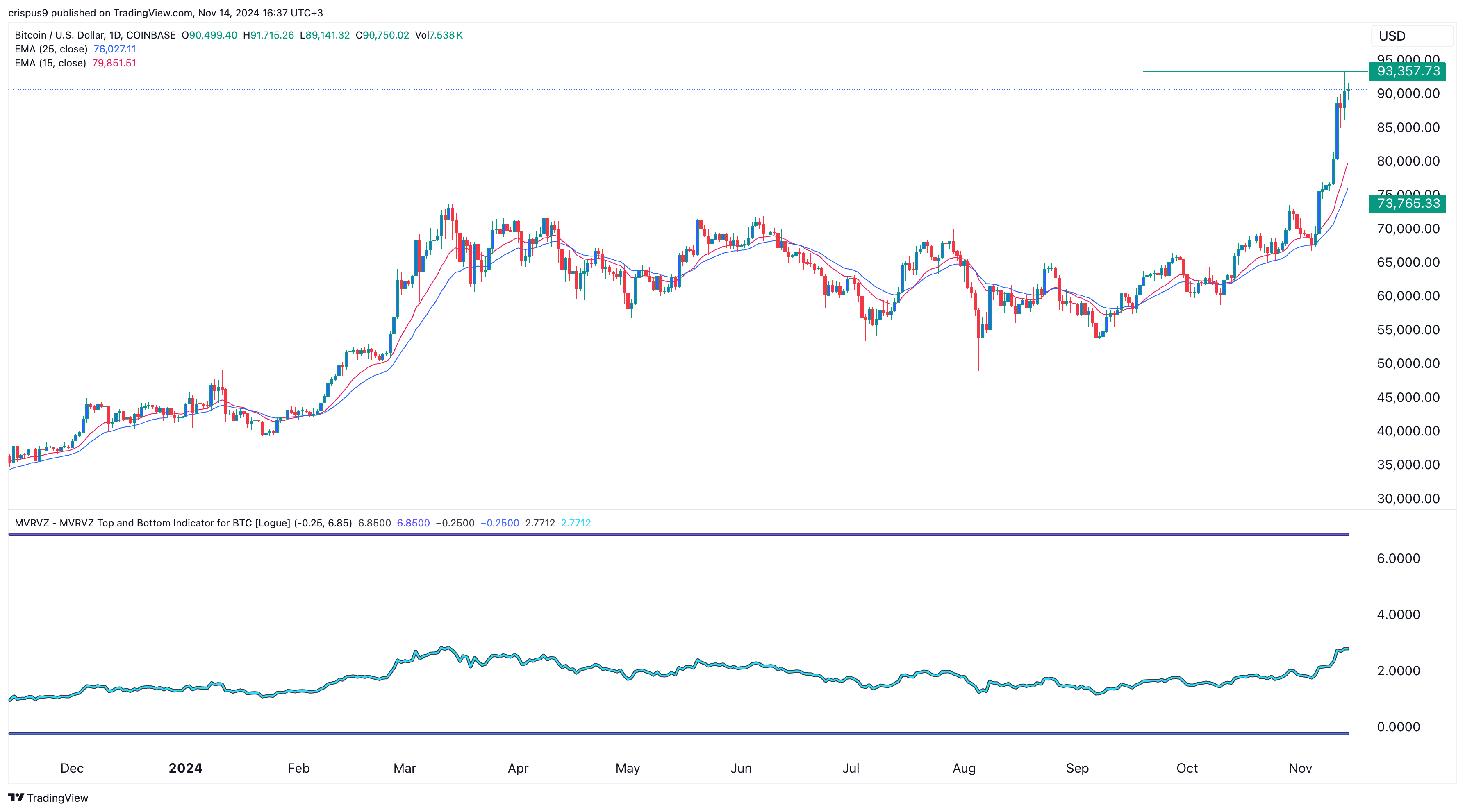

The daily chart suggests more Bitcoin upside in the near term. It has already crossed the important resistance level at $73,777, the previous all-time high, and the neckline of the inverse head and shoulders pattern.

Bitcoin has formed a golden cross pattern, which often leads to substantial gains. Most notably, the MVRV indicator has risen to 2.7. Sell signals are usually triggered when the MVRV indicator jumps to 3.5.

Therefore, the path of least resistance for Bitcoin’s price is higher, with the next target being $100,000. This outlook will become invalid if the price falls below the support at $85,000.