Bitcoin Price Could Climb After Chinese Foreign Exchange Suspensions

The People’s Bank of China (PBOC) has suspended at least three foreign banks from conducting foreign exchange transactions until the end of March. Other banks have yet to comment on their situation. Liquidation of spot positions and other services related to cross-border, onshore and offshore businesses have been restricted. This measure follows a series of steps taken to stabilize the Yuan since its devaluation in August and was enacted in response to the divergence between offshore– and onshore-Yuan exchange rates in an attempt to stem capital outflows.

A similar event occurred back in September when China tightened capital controls. BTC-USD responded by pushing up from around $230 to $300 by the end of October. Then at the end of November, the Yuan was upgraded to reserve status by the IMF which gave China permission to devalue. Consequently, citizens are becoming increasingly concerned with the loss of purchasing power. Therefore, they are turning to alternative currencies, one of the most popular being Bitcoin.

The total deposits held in China amount to over $21.5 trillion, while the market capitalization of Bitcoin is relatively smaller at $6.3 billion. Even if a small fraction of this money is channelled into Bitcoin, this would create a substantial appreciation in primarily BTC-CNY, but also in BTC-USD as well. While the PBOC has not yet commented on the reason for the latest intervention, it could be a temporary attempt to reduce demand for the US Dollar.

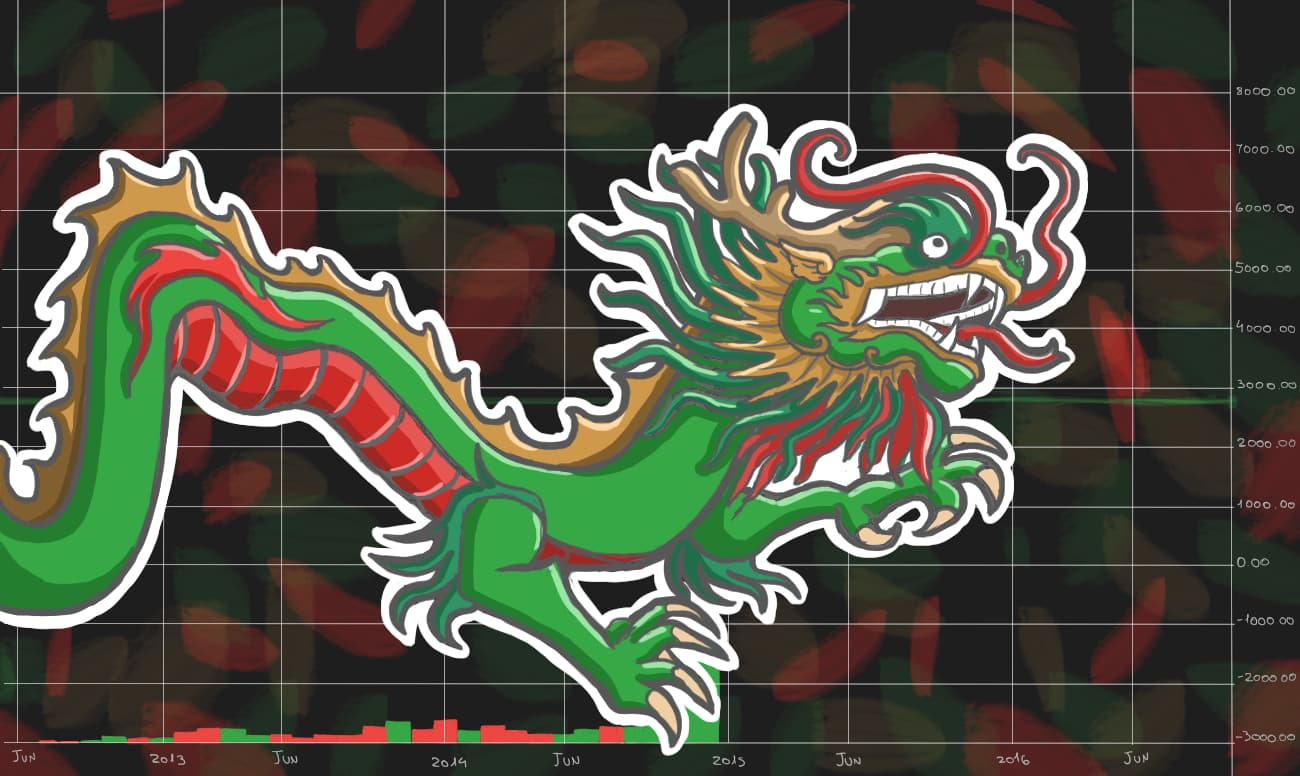

The price of Bitcoin futures contracts have hardly changed on the week’s open, suggesting indecision amongst traders at the moment. But this latest move will no doubt embolden buyers in China, where volumes traded have increased to fresh highs across most exchanges in China. Both Huobi and OKCoin exchanges have seen their highest ever monthly volumes, with 42.68 million net bullish contracts so far this month versus 19.61 million in November on OKCoin and a similar increase for Huobi.

The chart below shows the increasing volumes traded on the OKCoin exchange over the past three months as capital controls have helped to drive people towards using and buying Bitcoin. Increasing volumes provides strong support for the price to continue higher going forward. From the chart below, the high around 8000 Yuan (approximately $1200) is easily reachable again on this higher volume; if 8000 was reached with such low volume, this means that a similar high could be repeated. Sentiment is also strong; many analysts are predicting record highs for Bitcoin in 2016. More interventions of this nature will strengthen their case.