Bitcoin price could jump by 210%: mining executive predicts

A senior Bitcoin mining executive expects prices to continue rising in the ongoing bull market cycle.

In an interview with Bernstein, a major Wall Street firm, CleanSpark’s CEO predicted that Bitcoin (BTC) would rise to $200,000 in the next 18 months. If his view is correct, he expects the coin to rise by 210% from its current levels.

CleanSpark’s CEO is bullish on Bitcoin

Zachary Bradford cited several potential catalysts for Bitcoin, including Federal Reserve interest rate cuts, the conclusion of the U.S. general election, and the dynamics of the post-halving cycle, according to The Block.

He also expects that well-run, low-cost, pure-play mining companies will outperform firms like Core Scientific and TeraWulf, which are diversifying into artificial intelligence.

Bradford’s statement is notable because he runs CleanSpark, the third-largest mining company in the industry in terms of market cap, after Marathon Digital and Core Scientific.

The most recent results showed that CleanSpark’s revenue rose to $289 million in the nine months to June, while its adjusted EBITDA rose to over $238 million.

CleanSpark is also one of the largest Bitcoin holders in corporate America, with 7,558 coins worth $482 million on its balance sheet.

Bradford joins other high-profile analysts who have delivered bullish statements on Bitcoin. In a recent CNBC interview, MicroStrategy’s founder, Michael Saylor, predicted that the coin would reach $13 million by 2045. MicroStrategy owns over 252,000 Bitcoins, which would be worth over $3.2 trillion if it reaches his target level.

BlackRock, the largest asset manager with over $10.4 trillion in assets, has also delivered a positive Bitcoin prediction. In a white paper, three senior executives argued that Bitcoin was an ideal asset for portfolio diversification.

Ki Young Ju, the founder and CEO of CryptoQuant, also believes that Bitcoin is in the middle of a bull cycle that could push it higher.

Odds of Bitcoin rising to a new all-time high have also jumped on Polymarket, the fast-growing prediction platform.

Bitcoin needs to flip key resistance level

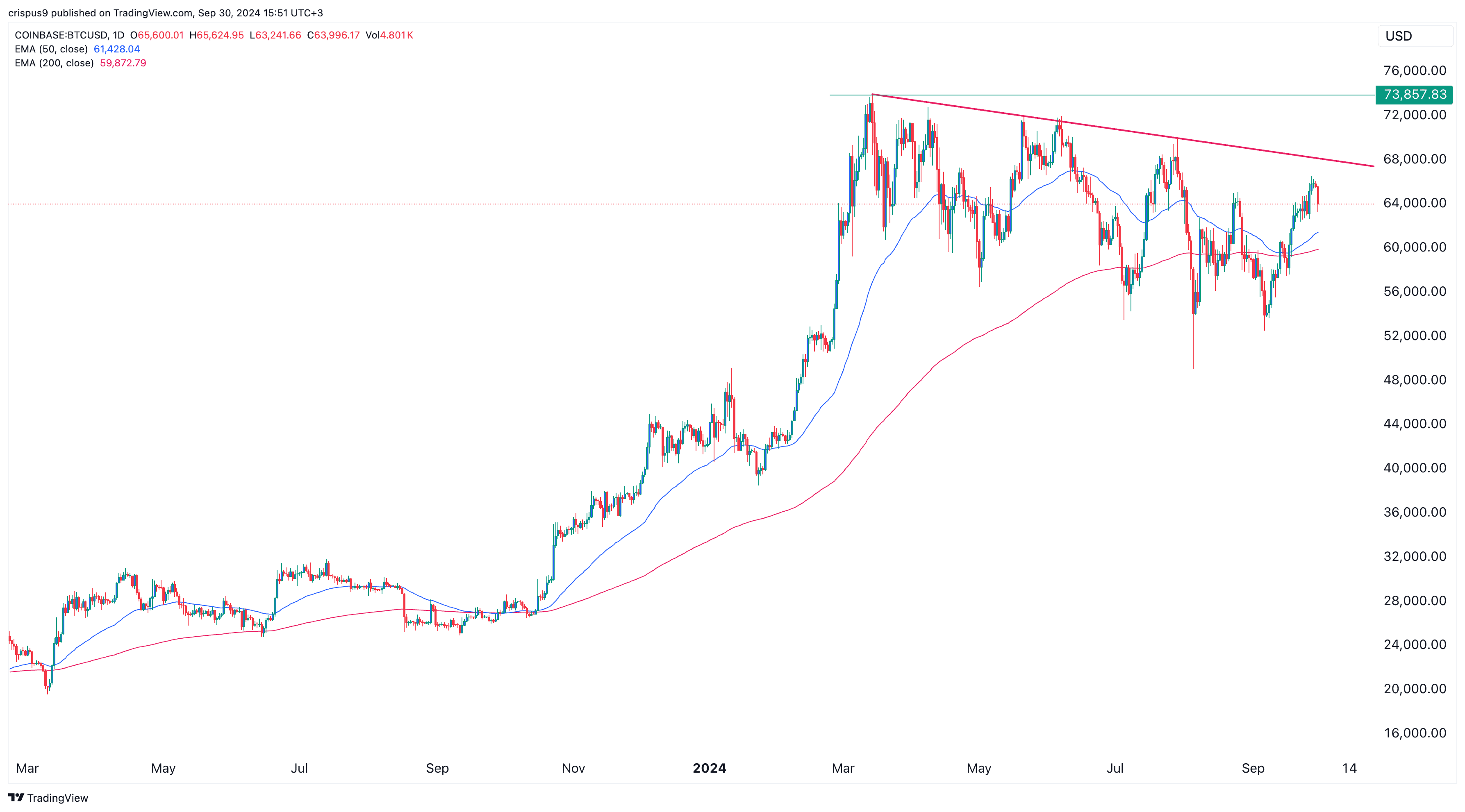

Bitcoin has formed some positive technical patterns. On the daily chart, it has formed an inverse head-and-shoulders pattern and remained above the 50-day and 200-day Exponential Moving Averages. It has also been forming a falling broadening wedge pattern since March.

However, the main challenge is that it has found a strong resistance point around the $68,000 level. It has failed to move above this trendline five times since March.

Therefore, a break above that trendline will point to further upside, with the initial target being $73,777, its highest point this year.