Bitcoin price dumps as Ceffu sells again and fear returns

Bitcoin price retreated for four consecutive days as the crypto fear and greed index moved back to the fear zone and as geopolitical risks rose.

Bitcoin (BTC) fell to $60,200, its lowest level since Sep. 18, and 8% below its highest level last week.

The current weakness is taking place as investors embraced a risk-off sentiment amid growing geopolitical tensions after Israel pledged to retaliate for Tuesday’s attacks.

Risky assets like the Dow Jones, S&P 500, and Nasdaq 100 indices continued their recent sell-off, while bond yields rose. The US dollar index also rose to $101.50, its highest level since Sep. 13.

Bitcoin also retreated as some whales continued selling their holdings. One of the top sellers was Ceffu, which withdrew 3,372 coins worth $211.3 million. The account has been selling Bitcoin, Ethereum (ETH), Solana (SOL), and Avalanche (AVAX). According to Arkham, the entity has assets worth over $2 billion

Another investor sold 265 Bitcoins for $17.5 million last week. He acquired those coins for $6.2 million two years ago, making $11.5 million profit.

According to Santiment, the current reversal is happening because of the increased sentiment on the coin in social media. In most cases, Bitcoin tends to drop when there is so much enthusiasm among social media users.

Meanwhile, the crypto fear and greed index has dropped to the fear zone of 39, down from last week’s high of 60.

On the positive side, October is often a strong month for Bitcoin, with average returns of 20.6%. It is then followed by November, where the average returns are over 46%.

The key catalysts that may push it higher are more Federal Reserve rate cuts and the end of the American election period.

Bitcoin price hit a key resistance

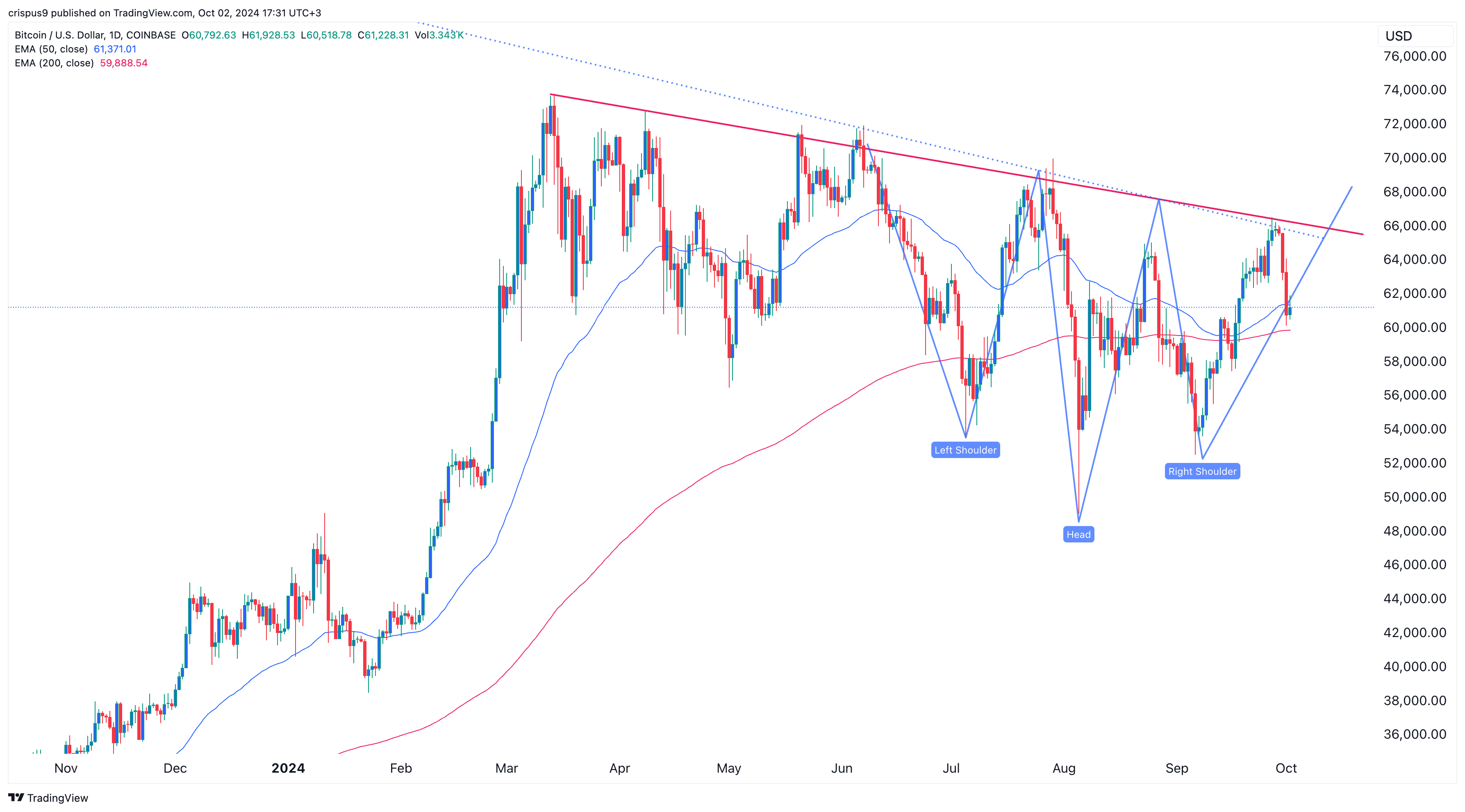

Technically, the coin also pulled back after hitting key resistance at $66,000. This is a notable price as it connects the highest swings since March this year. In a note, Peter Brandt, a well-known trader, mentioned that a clear breakout will be confirmed if it flips that resistance and then rises above the all-time high.

On the positive side, it has remained above the 50-day and 200-day moving averages and formed an inverse head and shoulders pattern. Therefore, there is a likelihood that it will bounce back in the coming days.