Bitcoin price doesn’t move much as Fed keeps interest rate steady

The current Bitcoin price is stabilizing near $89,000 as the U.S. Federal Reserve kept interest rates steady at a range of 3.5% to 3.75%

- Bitcoin is holding channel low and value area low support.

- Reclaiming the point of control signals improving short-term structure.

- Rising open interest supports the probability of a relief rally.

Bitcoin (BTC) price is showing early signs of stabilization after a corrective phase, with price action responding positively from a key technical support zone.

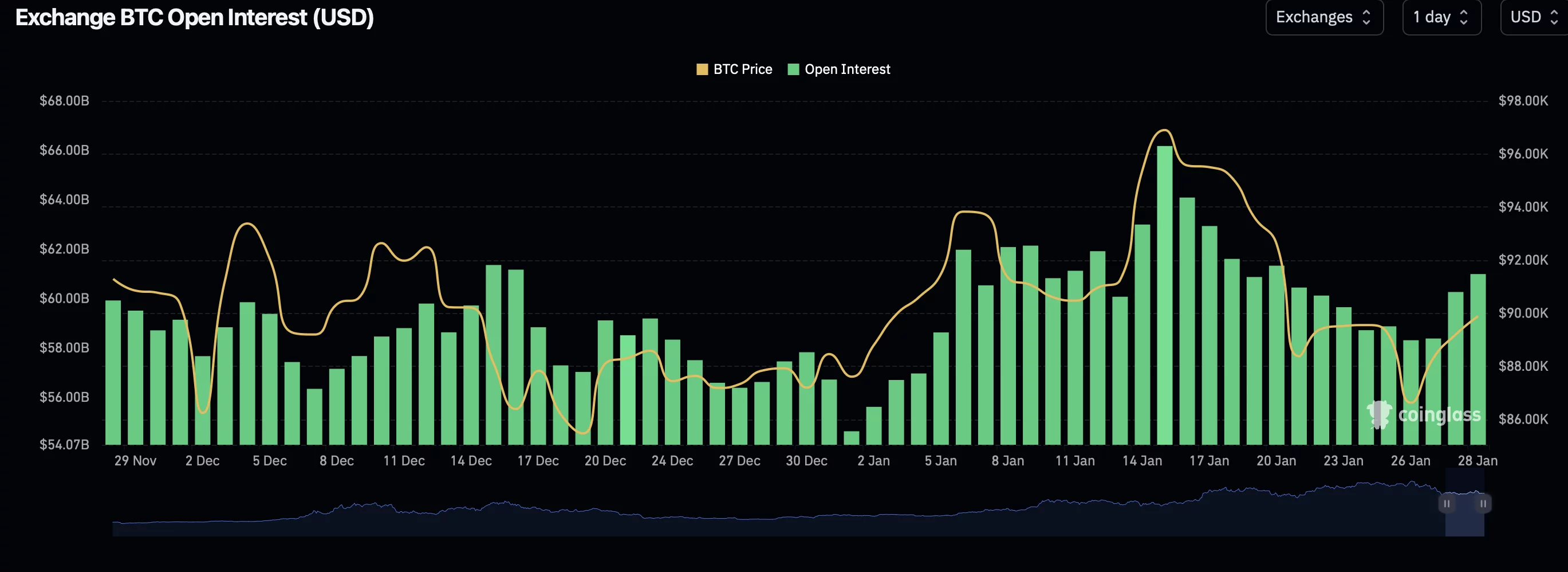

As Bitcoin trades near the channel low, market behavior suggests that selling pressure may be easing. This shift is being reinforced by a notable increase in open interest, indicating growing participation in the derivatives market.

While confirmation is still required, the combination of technical support and rising positioning points to the possibility of a short-term relief rally if current conditions hold.

Fed Rate

When the Federal Reserve keeps interest rates steady, it signals stable borrowing costs and can make cash and bonds less attractive, sometimes weakening the U.S. dollar.

Bitcoin often moves inversely to the dollar, so a softer or stagnant dollar can boost demand for crypto as an alternative store of value.

Steady rates also suggest the Fed isn’t aggressively tightening to fight inflation, encouraging investors to take on more risk, which benefits higher-risk assets like Bitcoin.

Bitcoin price key technical points

- Channel low and value area low holding as support

- Point of control reclaimed, signaling improving structure

- Rising open interest supports the bullish relief thesis

Bitcoin’s recent bounce originated from the channel low, which aligns closely with the value area low, making it a technically dense region.

This confluence often attracts buyers looking for discounted entries within a broader range. The initial reaction from this zone has been constructive, suggesting that demand is beginning to absorb sell-side pressure.

Importantly, this bounce was not immediately rejected. Instead, price followed through just enough to reclaim a key level that often defines the range’s control.

Reclaim of the point of control signals strength

One of the more encouraging developments is Bitcoin’s reclaim of the point of control (POC). The POC represents the price level where the highest volume has traded recently and often acts as a dividing line between bullish and bearish control.

Holding above the POC shifts short-term bias in favor of buyers. As long as Bitcoin maintains acceptance above this level, the probability increases that the recent move is more than a simple dead-cat bounce and instead a developing rotation higher within the channel.

Alongside improving price structure, open interest has been increasing, adding an important layer of confirmation to the setup. Rising open interest during consolidation near support suggests that traders are actively opening new positions rather than merely closing old ones.

This behavior typically indicates conviction, particularly when it occurs at technically important levels. In this context, the increase in open interest implies that derivatives traders are positioning for a continuation of higher rather than an immediate breakdown.

However, open interest alone is not inherently bullish or bearish. Its significance depends on whether the price holds support. If Bitcoin were to lose the reclaimed levels, rising open interest could instead amplify downside. For now, though, positioning aligns with the relief rally narrative.

Value area high becomes the next test

If Bitcoin continues to hold above the POC, attention shifts to the value area high, which now acts as immediate resistance. Acceptance above this level would confirm that the price is transitioning back into higher value territory, strengthening the case for a move toward the channel high resistance.

This step-by-step reclaim process is critical. Relief rallies often fail when the price cannot move beyond the upper boundary of value, resulting in renewed consolidation or rejection. A clean reclaim, backed by sustained open interest and volume, would materially improve upside probabilities.

Market structure is still cautious but improving

From a broader market structure perspective, Bitcoin is still recovering from a bearish phase. While the immediate downside momentum has slowed, a full trend reversal has not yet been confirmed. Instead, the current setup favors a relief rally within a larger range rather than an outright bullish breakout.

That said, the improvement in structure, from holding channel support to reclaiming the POC, marks a meaningful shift compared to recent weakness.

Bitcoin price action: What to expect

Bitcoin is at a pivotal short-term inflection point. As long as the price remains above the point of control and channel low support, the probability favors a continued relief rally toward the value area high and potentially the channel high resistance. Rising open interest supports this scenario by signaling active positioning at support.

However, failure to hold these reclaimed levels would weaken the bullish case and reopen downside risk. In the immediate term, price acceptance above value will determine whether this relief move develops into a sustained rotation higher.