Bitcoin price growth lagged crypto mining stocks following halving, data shows

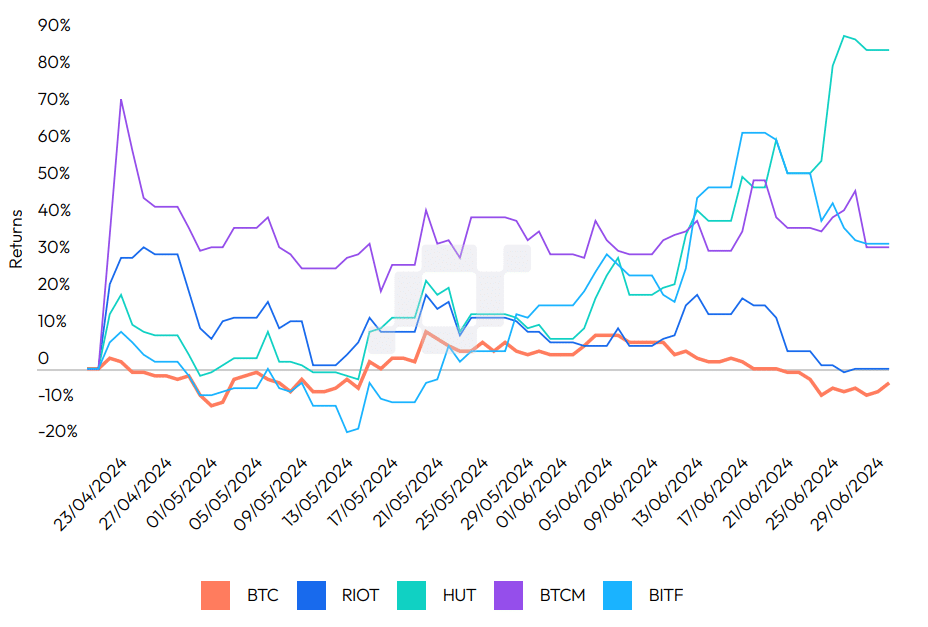

Despite Bitcoin’s strong start in early 2024, crypto mining stocks outperformed BTC after the halving, with Hut 8 and Bitfarms delivering the highest returns.

The fourth Bitcoin halving event has brought significant shifts in the crypto mining landscape, impacting smaller mining firms more severely, analysts at CCData wrote in a research report. This is due to “suboptimal infrastructure and the lack of economies of scale,”

As a result, private equity firms consolidated smaller firms and integrated their infrastructure, despite recent headwinds for Bitcoin (BTC) itself. This strategic interest has led to a noticeable performance in mining stocks, the analysts say, adding that shares of Hut 8 (HUT) and Bitfarms (BITF) achieved the highest returns of 86% and 34%. By contrast, Bitcoin is down 3.62% post-halving.

The analyst report also pointed out that Bitcoin’s price has remained range-bound between $59,000 and $72,000 in the three months following the halving. By contrast, major U.S. equity indices have reached new all-time highs. This, along with reduced trading activity on centralized exchanges, has led some to speculate that the market may have topped this cycle.

However, historical trends suggest that the halving event “always preceded a period of price expansion,” lasting from 366 days (in 2014) to 548 days (in 2021) before hitting a cycle top, CCData notes. The analysts claim that the data and previous trends are “strong enough” to suggest that any sideways price action “is temporary,” adding that the market is likely to “breach the previous all-time highs once again before the end of the year.”