Bitcoin price outlook as CLARITY Act approval odds hit 90%

Bitcoin traded near $67,000 on Thursday, steadying after a session that coincided with sharp swings in prediction market odds for the CLARITY Act.

- Bitcoin traded near $67,000 as Polymarket odds for the CLARITY Act swung from 90% to 55%, highlighting regulatory uncertainty.

- The CLARITY Act aims to define oversight between the SEC and CFTC, potentially reducing ambiguity and boosting institutional confidence in crypto markets.

- Technically, BTC is consolidating between $65,000 and $70,000, with weakening bearish momentum but key resistance overhead at $70,000–$75,000.

On Polymarket, approval odds for the CLARITY Act briefly surged to 90% earlier in the day before sharply retracing to around 55% at press time, reflecting uncertainty around the bill’s path forward.

The CLARITY Act is a proposed U.S. crypto market structure bill designed to define regulatory oversight between the SEC and CFTC. The legislation aims to provide clearer rules for digital assets, token classification, and exchange compliance.

If passed, it could reduce regulatory ambiguity, encourage institutional participation, and improve long-term capital inflows into the crypto sector.

Bitcoin price outlook: Momentum stabilizing after sharp drop

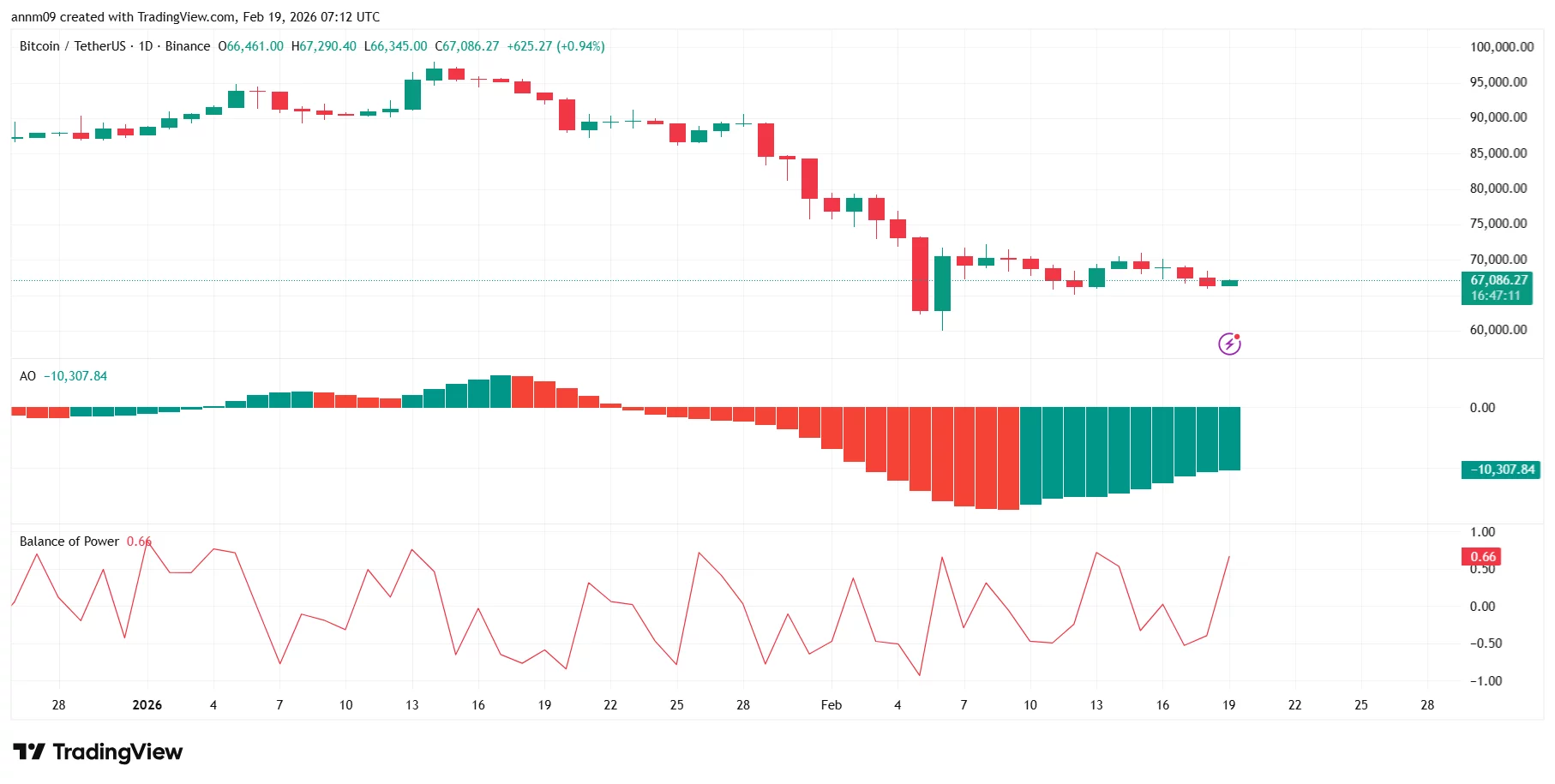

On the daily chart, Bitcoin remains in a broader short-term downtrend following its sharp selloff from the mid-$90,000 region earlier this year. Price action shows a series of lower highs and lower lows before stabilizing around the mid-$60,000 range.

The recent large red candle near $72,000 marked a capitulation-style move, with price briefly dipping toward the low-$60,000s before rebounding. Since then, BTC has been consolidating between roughly $65,000 and $70,000.

The Awesome Oscillator (AO) remains in negative territory but is printing rising green bars, suggesting bearish momentum is weakening. Meanwhile, the Balance of Power (0.66) has turned positive, indicating buyers are attempting to regain short-term control.

Immediate resistance sits near $70,000, followed by a stronger ceiling around $75,000, where prior breakdown occurred. On the downside, key support lies at $65,000, with a deeper level near $60,000 if selling resumes.

For now, Bitcoin appears to be consolidating. A decisive break above $70,000 could open the door for recovery, while failure to hold $65,000 may invite renewed downside pressure.