Bitcoin price spared from Intel and Nvidia stocks meltdown

Bitcoin price held steady above $64,000 on Friday, even as technology stocks like Intel and Nvidia slumped.

Bitcoin (BTC) was trading at $64,700, up by 4% above its lowest point this week and 8% below its highest level on Monday despite a very red day on Wall Street on Thursday.

Semiconductor companies were among the worst performers. Intel stock dropped by over 22%, reaching its lowest point since 2015. It has dropped by over 65% from its highest point since April 2022. The sell-off happened after the company published weak quarterly results and announced that it would slash 18,000 jobs.

Nvidia, which has become a significant player in the artificial intelligence industry, has moved into a deep bear market after falling by over 25% from its highest point this year. Notably, Nvidia has underperformed MicroStrategy, the biggest Bitcoin holder, in the past 12 months, as it jumped by over 250%.

The ongoing tech sell-off has impacted global stocks. In the US, the Dow Jones and Nasdaq 100 index futures fell by over 500 points, while in Asia, the Hang Seng and Nikkei 225 indices fell by over 2% and 5%, respectively.

Bitcoin price faces risks and opportunities

Bitcoin faces several risks and opportunities going forward. First, Bitcoin could still join stocks in their sell-off if the risk-off sentiment continues. In some cases, BTC tends to move in the same direction as stocks.

Second, investors have started bracing for a Kamala Harris win in November. Data by PredictIt shows that Kamala has higher odds than Trump. Kamala has also narrowed Trump’s lead in a Polymarket poll.

Crypto investors believe that Trump would be a better president for the industry. In a statement last week, he hinted that he will convert the government’s Bitcoin holdings into reserves.

Still, history shows that Bitcoin does well regardless of who the president is. It performed well under former President Obama, during Trump’s first term, and now under President Biden. Also, there are signs that Bitcoin ETFs are still seeing inflows despite the volatile stock market, with $50.1 million added on Thursday.

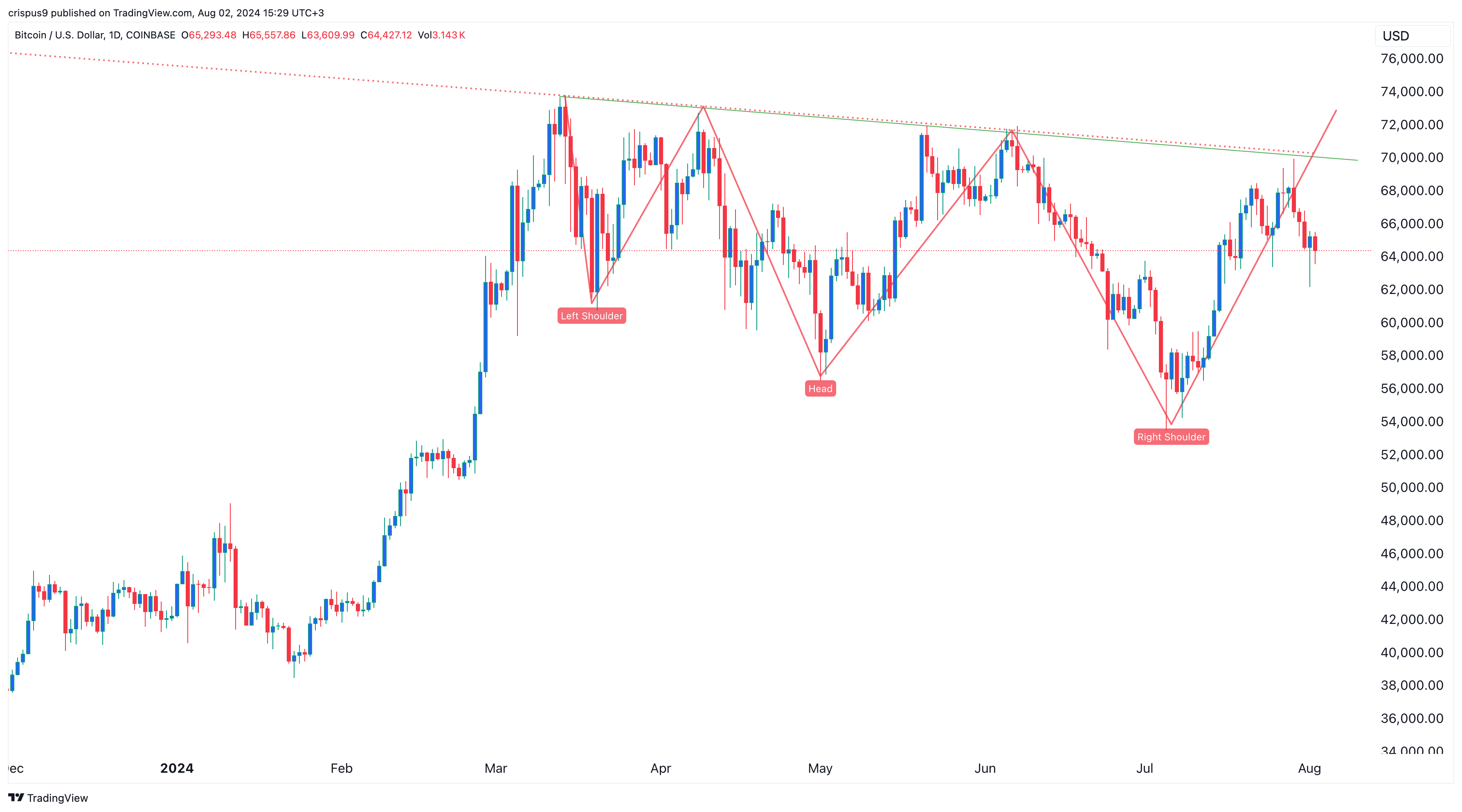

Additionally, Bitcoin is facing a technical challenge as it has constantly struggled to break the $70,000 and $72,000 resistance points.

On the positive side, the coin seems to be forming an inverse head and shoulders pattern, which often results in a strong bullish breakout. Such a move will only be confirmed if the price rises above the resistance levels at $70,000, $72,000, and $73,800 (the year-to-date high).