Bitcoin price tumbles following $140m in liquidations

Bitcoin price tumbled below $65,800 on April 2, as leveraged bull traders booked over $130 million in losses, BTC network fundamentals and vital macro indices suggest an imminent rebound.

On April 2, Bitcoin price tumbled to a 10-day low of $65,800, marking a 6% decline within a frenetic 12-hour period. Can BTC recover before the forthcoming Halving event.

Why is Bitcoin price down today?

Bitcoin price dropped from $71,317 to $65,800 in morning trading hours GMT on April 2. The BTC market downturn can be attributed to Bitcoin ETFs making a negative start to the week, with a total net outflow of $85.7 million on April 1. According to data from Farside Investors, Grayscale’s GBTC led the outflows, bleeding over $302 million.

While Grayscale ETF outflows tipped the scale, Bitcoin price decline was further accelerated by rapid liquidations in the derivatives markets.

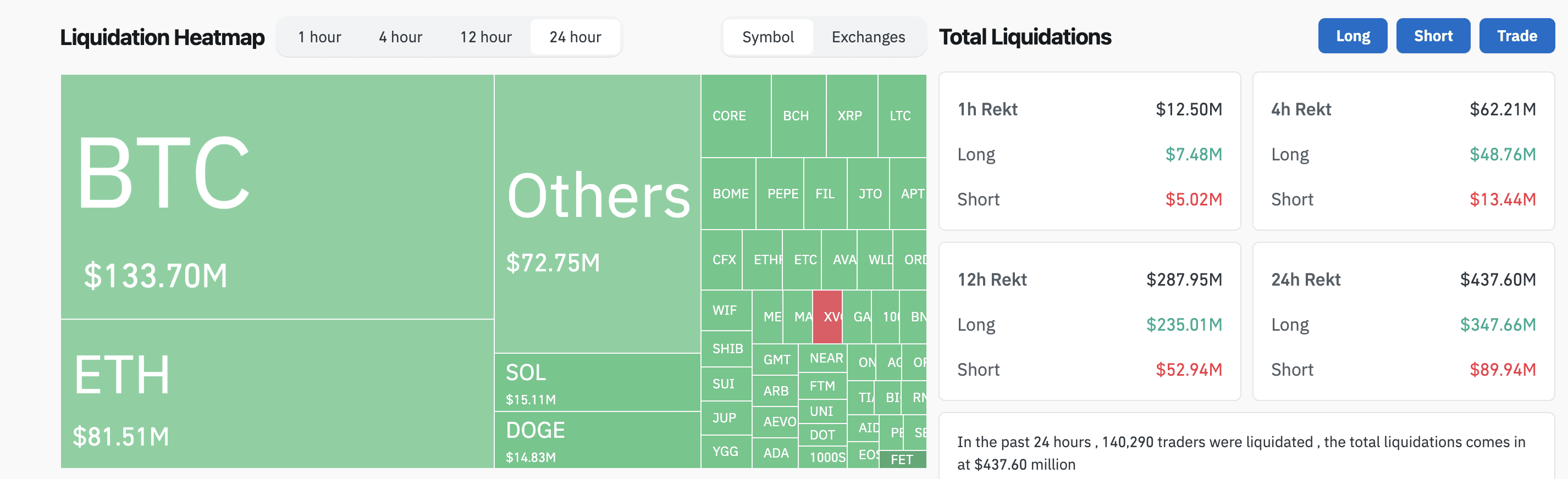

Coinglass’ liquidation heatmap chart below visualizes the volume and frequency of liquidations across different assets and within specific timeframes.

At the time of writing on April 2, over 140,290 traders have had $437.6 million leveraged position liquidated in the last 24 hours. Notably, BTC long traders took the biggest hit, losing over $133.7 million.

While the bearish impact of this widespread liquidation has culminated in a 6% price decline within the daily timeframe, the bulls are now incentivized to react in other to stem the losses.

During periods of cascading market liquidations, bull traders may make rapid covering purchases to mitigate further losses, while short traders begin to book profits, easing the bearish pressure. Without deterioration in Bitcoin network fundamentals, this scenario could trigger an instant BTC price recovery.

Whales anticipate recovery before Halving, as Fed Chair eases recession fears

Bitcoin price dipped 6% to hit $65,800 within the daily timeframe on April 2, wiping off over $80 billion from its market cap within the daily timeframe. However, BTC fundamentals including network usage remain steady, social sentiment remains largely positive, signaling that the recent market downturn has been pushed into overdrive by the cascading liquidations.

Recent statements from Fed chair Jerome Powell, cooled recession fears and hinting at imminent rate cuts, a move that could spark a quick BTC recovery before the April 20 Halving date.

On Friday March 29, Fed Chair Jerome Powell reiterated is “no reason” to think that the risks of a U.S. recession are elevated.

There is no reason to think the economy is in a recession or the edge of one (a recession). We are at a place where the economy is strong. The labor market is at a good place.

-US Fed Chairman, Jerome Powell, March 29, 2024.

In affirmation of the optimistic stance posed by Jerome Powell’s bullish comments, BTC whales have shown remarkable resilience amid the turbulent market fluctuations on April 2.

As seen above, this cohort of whales have invested over $6.8 billion to acquire 100,000 BTC in the last 30-days, increasing their balances from 11.7 million to 11.8 million BTC between March 1 and April 1.

Notably, as BTC price tumbled on April 2, it has now fallen below 30-day simple moving average (SMA) price of $68,171. But interestingly, despite slipping into a net-loss position, the chart above shows BTC whales continue to hold on to their fresh acquisitions, likely, in hopes of a quick rebound.

If the whales keep up the resilient disposition, strategic retail traders could soon take the cue to ease up the bearish pressure on BTC could ease up in the days ahead.

Moreso, a positive outlook on the next Non-Farm Payrolls (NFP) report slated for Friday April 5, could increase bullish activity in risk assets markets again. This scenario could spur bullish recovery phase before the Halving.

Bitcoin (BTC) price forecast: $75k rebound before Halving?

BTC whales holding on to their $6.8 billion fresh acquisitions and positive statements from Fed Chief all point towards an early Bitcoin price rebound above $70,000 before the Halving.

But to validate this bullish price prediction, BTC bulls first have to avert further downswing below the $65,000 territory.

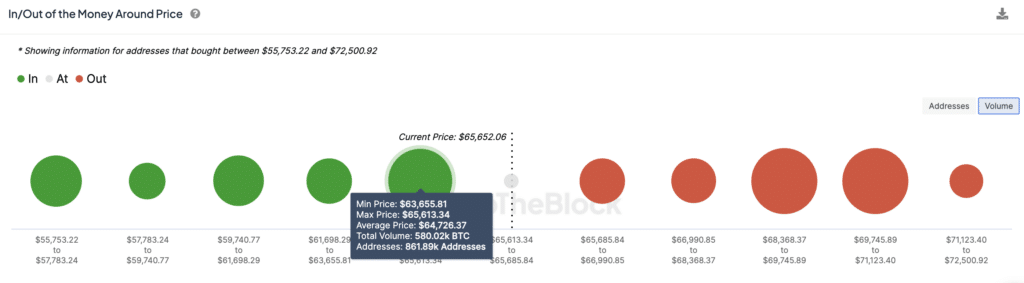

As seen below, 861,890 addresses had acquired 580,020 BTC at the average price of $64,726. If they hold their positions, Bitcoin could instantly enter a recovery phase.

Also, the markets could flip bullish once again if BTC price can reclaim the $70,000 area. But in this scenario, the bears could form major resistance at the $68,000 territory in the near-term.