Bitcoin prices must break $100,000 for crypto miners to stay profitable

A Seeking Alpha analysis reveals that Bitcoin prices must not only more than triple to $100,000 but should be sustained above this level for miners to remain profitable in 2024 and beyond.

Considering what lies ahead, mining farms, especially those whose shares are listed on bourses in the United States, including Riot and Marathon, are at a critical juncture. There could be a shake-up unless there are changes in hash rate, difficulty, or electricity costs in light of scarce BTC.

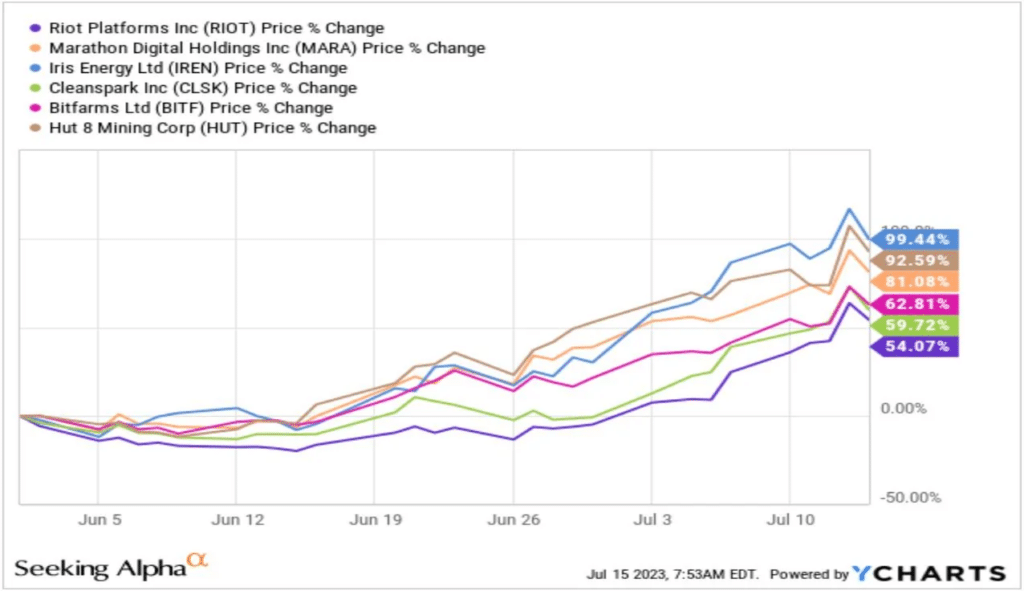

Uniquely in 2023, Bitcoin mining stocks have been superior. While Bitcoin’s volatility has been tapering and prices pinned below $31,800 registered in late H1 2023, stocks of Riot, Marathon Digital, and other popular mining farms have more than doubled in the last few months.

Usually, the performance of crypto mining stocks is closely linked to the performance of Bitcoin in the secondary market. When Bitcoin prices rise, crypto mining stock prices tend to soar and vice versa. However, this trend has been broken due to the divergence between crypto miner stocks and BTC prices in the better part of 2023.

In light of the upcoming halving event where miners’ rewards will be halved, questions are being floated on how much the BTC price needs to rise for miners to be profitable.

The report says BTC prices must surge above $100,000 for these miners to stay in business long-term. This 6-digit price prediction factors in the crypto mining dynamics and how these farms operate.

Specifically, the report shared on Reddit highlights the risks of Bitcoin mining since it reduces block rewards in half, significantly impacting miners’ revenue.

Assuming prices remain at spot rates, mining companies like Riot Platforms might have to issue new shares to raise money and secure operational funding. With the new shares, there will be dilution, forcing share prices down.

Experts predict that the hash rate, a measure of Bitcoin’s computing power, could also fall by as much as 30% halving. Analysts contend that though the network manages its supply economics with halving, miners will have to spend their input to confirm the same block; a move that will heap even more pressure on top miners and farms.