Bitcoin rally & Fed’s distrust: $393 billion balance sheet expansion

The Federal Reserve’s recent $393 billion balance sheet expansion may be linked to the ongoing bitcoin price rally and a growing distrust in the traditional banking system.

The Federal Reserve’s balance sheet has grown by an impressive $393 billion in just two weeks, which has led to speculation about the reasons behind this expansion. One notable angle to consider is the potential link between the ongoing bitcoin price rally since January 2023 and the Fed’s growing distrust in the traditional banking system. The crypto community closely watches these developments, examining the potential consequences for bitcoin and other cryptocurrencies.

Bitcoin’s price has experienced a remarkable rally since January 2023, capturing the attention of investors and the financial world. As the cryptocurrency‘s value continues to climb, some experts suggest that the Federal Reserve’s decision to expand its balance sheet might respond to the growing distrust in the banking system, which has become increasingly evident in the face of bitcoin’s success and the implosion of multiple banks.

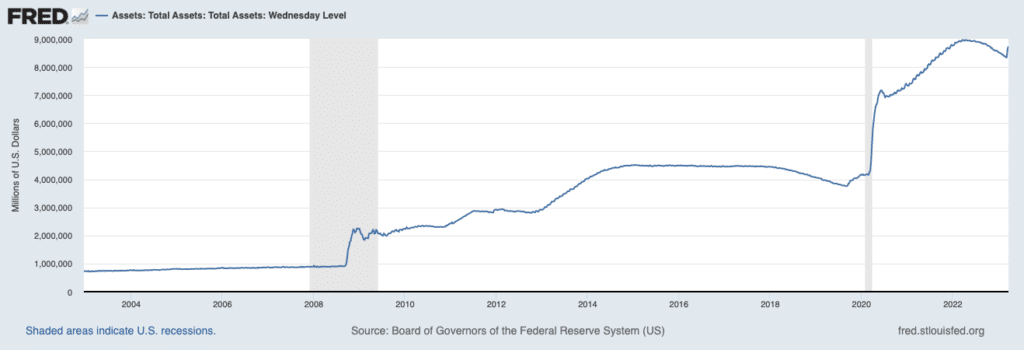

The Federal Reserve has been injecting liquidity into the market and stabilizing the economy through its asset-purchasing program, causing its balance sheet to reach an all-time high of $8.77 trillion. This massive expansion has led to increased scrutiny. Many financial experts questioned whether losing confidence in the banking system drives the Fed’s actions. The concurrent rise in bitcoin’s value has only fueled this debate further.

As bitcoin continues to be viewed as a hedge against inflation and a store of value, its price rally may have exacerbated concerns within the Federal Reserve about the stability of the traditional banking system. Consequently, the Fed’s balance sheet expansion might attempt to counteract this growing uncertainty and maintain control over the financial landscape.

While it is important to note that a definitive correlation between the Federal Reserve’s balance sheet expansion and bitcoin’s price rally has not been established, the ongoing financial events have intensified the discussion around cryptocurrencies and their role in the global economy. Market participants will closely monitor the Federal Reserve’s actions and their potential impact on the cryptocurrency market, particularly bitcoin.