Bitcoin reaches $63k as miner selling pressure declines

Bitcoin’s (BTC) one-month bearish momentum seems to have ended as the miner selling pressure declines.

BTC is up by 2.2% in the past 24 hours and is trading on the verge of the $63,000 mark at the time of writing. The asset’s market cap is sitting at $1.24 trillion. Bitcoin’s daily trading volume increased by 57%, reaching $21 billion.

According to data provided by CryptoQuant, the BTC miner selling pressure and “concerns” have cooled down significantly over the past month — falling from a peak of 14,000 BTC in May to below the 1,000 mark as July starts. The analyst wrote:

“Miners’ selling pressure has decreased significantly, and their selling volume is being digested quickly.”

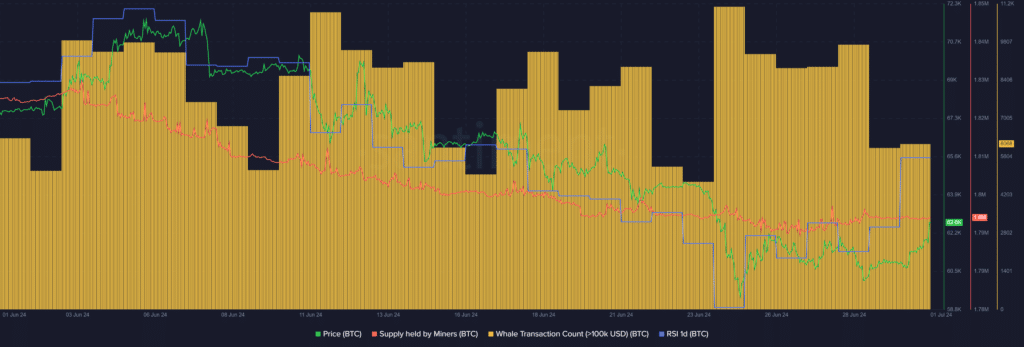

According to data from Santiment, the amount of BTC supply held by miners declined from 1.83 million coins to 1.8 million tokens over the past 30 days. This shows that the retail accumulation phase for Q3 might soon start.

Data from the market intelligence platform shows that the number of whale transactions consisting of at least $100,000 worth of Bitcoin recorded a minor increase over the past 24 hours — rising from 5,923 to 6,068 unique transactions.

As the whale movements consolidate, lower price volatility would be expected for the largest cryptocurrency.

Moreover, the Bitcoin Relative Strength Index (RSI) is currently sitting at 44, per data from Santiment. The indicator shows that BTC is neither overbought nor oversold at this point and a gradual price hike could potentially happen.