Bitcoin drives record $2.4b weekly digital asset investment inflows

Bitcoin was a pacesetter as the U.S. dominated inflows to crypto-based products between Feb. 12 and Feb. 16, with 2024 YTD numbers hitting $5.2 billion.

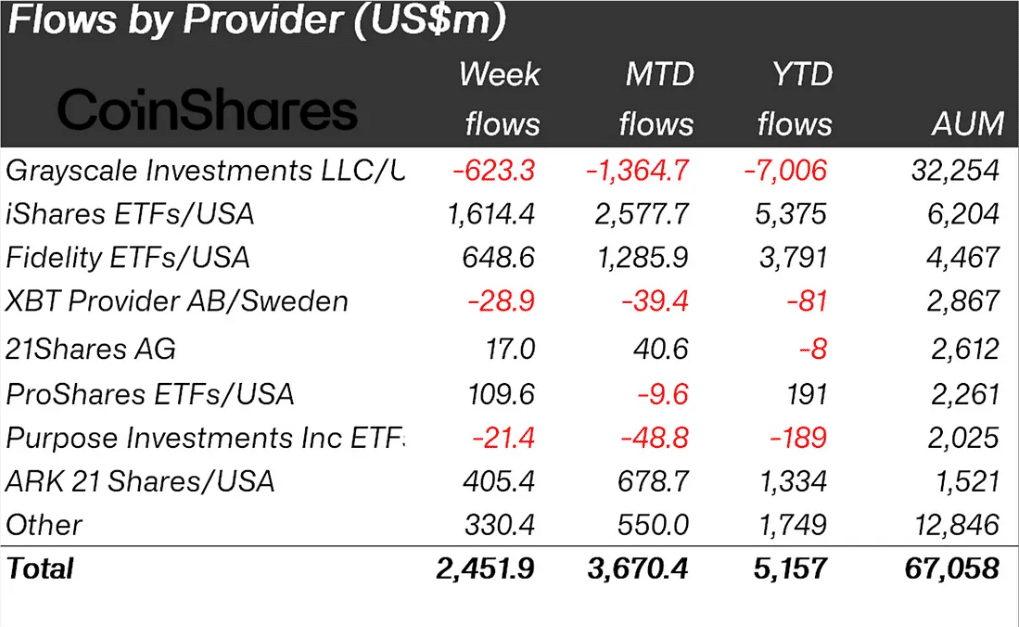

Digital asset investment vehicles took in $2.4 billion weekly, setting a record for weekly flows and returning assets under management (AUM) to levels last seen in December 2021 at the peak of crypto’s previous bull cycle. Total AUM rose to a 780-day high at $67 billion.

CoinShares data showed that Bitcoin (BTC) and the U.S. accounted for about 99% of the week’s inflows, signaling demand for spot crypto products from issuers like BlackRock and Fidelity. In under two months, the two Wall Street giants account for over $10 billion of the roughly $14 billion amassed by new spot Bitcoin ETF providers.

Bitcoin ETFs have clocked $5 billion in net inflows since Jan. 11 and nearly $2 billion in total value traded, while Grayscale’s GBTC has lost $7 billion.

Inflows into these spot BTC funds show investors are betting on higher prices, but some traders are also hedging their bets and looking to generate profits from short-term price downturns. According to the report, investors added $5.8 million to Bitcoin’s short positions.

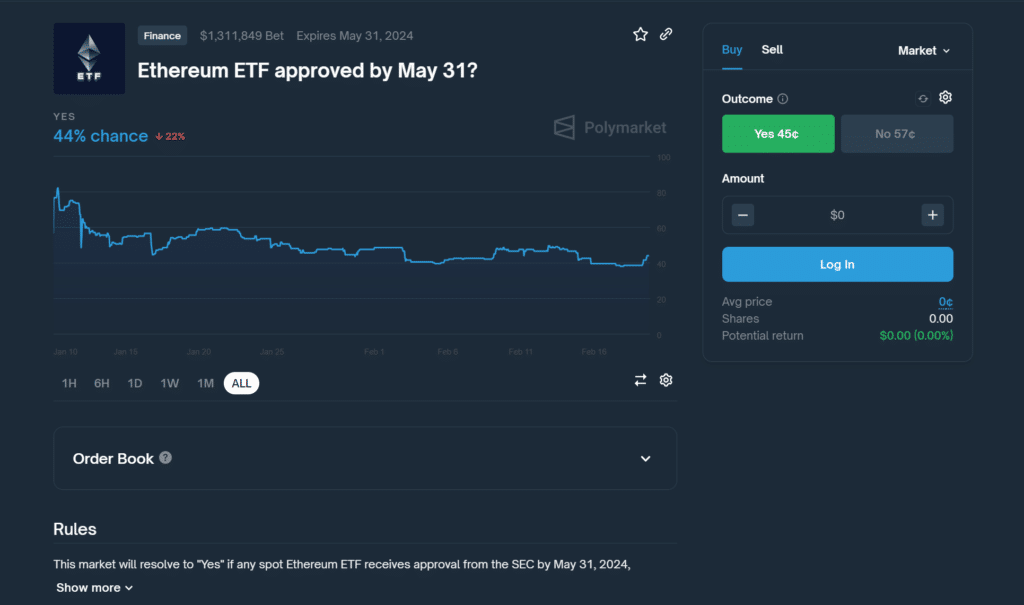

Ethereum (ETH) posted the second-largest fund intake at $21 million in inflows as investors and speculators await a decision from the U.S. SEC on spot ETH ETFs. Punters on decentralized prediction venue Polymarket have locked $1.3 million in a smart contract titled “Ethereum ETF approved by May 31?”.

Successful spot BTC ETF issuers have submitted bids for the same product underpinned by defi’s leading blockchain asset. However, SEC chair Gary Gensler has hinted that Ethereum ETFs may not turn out like their Bitcoin counterparts, as decisions on these products have been pushed back to May.

Other Commissioners like Hester Peirce, known as “crypto mom”, have urged the securities regulator to avoid another debacle.