Bitcoin slips despite tariff pause, stock market crash resumes

Bitcoin and stocks fell after reality set in on Wall Street, with recession fears starting to drive the market narrative.

Both stocks and crypto markets declined during the trading day, giving back much of the previous day’s rally. On Thursday, April 10, the S&P 500 traded at 5,233.61, losing 223.36 points, or 4.31%. At the same time, the Dow Jones was at 39,296.45, dropping 1,312.00 points, or 3.23% from the day prior. The Nasdaq declined 4.66%, or 790.22 points, trading at 16,333.49.

The declines came after the third-biggest daily rally in the S&P 500’s history, and the best day since October 2008. At the time, the market reacted to Donald Trump’s 90-day pause of much of the unprecedented US tariffs on its trading partners. However, reality soon set in, and traders are now pricing in the risk of a global recession.

While the U.S. tariff pause substantially improved the short-term economic outlook, recession risks remain. Economists and analysts note that the trade war is far from over. For instance, Trump has maintained 124% U.S. tariffs on China, the country’s largest trading partner.

Notably, Goldman Sachs puts the odds of a recession at 45%. At the same time, the investment bank believes that core inflation would peak at 3.5%. Mark Zandi, chief economist at Moody’s, puts his estimate of the likelihood of a recession at 60%.

Bitcoin, Ethereum slip, while ETF outflows continue

The stock market decline also impacted crypto prices. Bitcoin (BTC) traded at $79,195.25, losing $4,000 from a daily high of $83,541, while Ethereum (ETH) dropped to $1,506.76, down 5.38%. XRP (XRP) 3.82% while Solana (SOL) lost 6.00%, trading at $1.94 and $109.92, respectively.

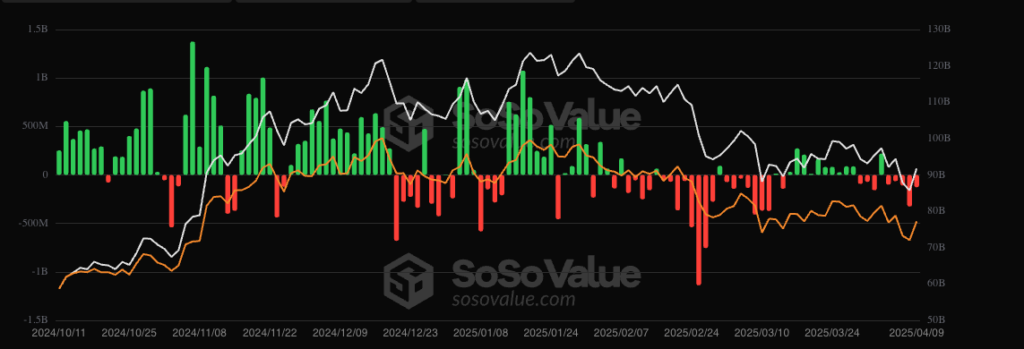

Despite the previous day’s rally, crypto ETFs continue to experience outflows. On Wednesday, April 9, Bitcoin ETFs saw a net outflow of $127 million, after net outflows reached $326 million on Tuesday.