Bitcoin traders face $26m in liquidations as BTC is back to $20k

The bitcoin (BTC) futures and perpetual markets recorded total liquidations to the tune of $26 million in the past 24 hours amid market uncertainties triggered by the asset’s recent rally, as it faces fierce rejection at the $21,000 zone.

Shorts represent 64% of total liquidated positions

Among the liquidated positions, shorts account for a whopping 64%, with $16.8 million worth of assets wiped out in the past 24 hours across all mainstream exchanges. This is possibly due to a resurgence of bearish sentiments within the derivative’s scene, as investors anticipate a bitcoin price correction following the two-month high of $21,200 on Jan. 14.

These investors have entered short positions in this regard. The CryptoQuant BTC Taker Buy Sell Ratio also indicates this trend of rising bearish sentiments. With a current value of 0.97, the metric suggests a dominance of selling sentiments within the market. Data from Coinglass further reveals a 50.27% dominance of shorts in the past 24 hours.

Moreover, these short positions have re-emerged despite a massive wave of previous liquidations after the asset rallied above $19,500. Over $141 million in bitcoin shorts were liquidated in the 24 hours leading to Jan. 14 across several exchanges, including OKX, Binance, ByBit and BitMex.

BTC holds steady above $20.8k

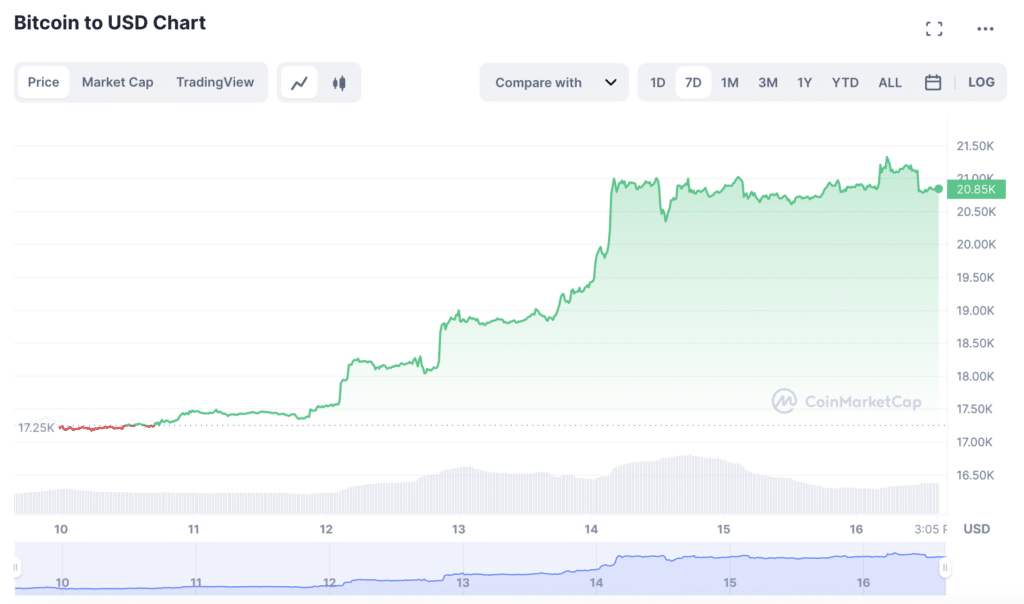

Meanwhile, despite the bets against it, BTC has managed to hold above the $20.8k price point, currently changing hands at $20,848 as of press time. The asset retained a 20.96% gain in the past week despite closing yesterday with a 0.40% loss following a 7-day winning streak.

After conquering the first crucial resistance at $21,103 early this morning, BTC met a rejection that brought it below the pivot at $20,834, threatening a dip to its support levels. Notwithstanding, the asset quickly staged a comeback, intending to retest the first resistance point. Bitcoin’s second crucial resistance level sits at $21,323.

However, some market watchers warn of a looming correction that could see BTC retest lows below the $20k level before it surges to new highs. Notably, Il Capo of Crypto believes the asset could still see new lows before the bear market reaches its terminus.