Bitcoin under pressure at $110K as whales dump and institutions pull back

Bitcoin’s momentum is stalling as major investors reduce exposure and institutional inflows shrink. With billions in whale selloffs and cautious corporate buys, the asset is facing a critical test at $110K.

- Whales have dumped over 100,000 BTC in recent weeks, the largest selloff since 2022, intensifying downward pressure on price.

- Institutional BTC purchases have slowed, with Strategy’s monthly buys plunging from 134,000 in November 2024 to just 3,700 in August.

- Bitcoin is consolidating between $110K–$115K, with low volume and weak trend signals.

Bitcoin (BTC) is facing mounting pressure around the $110,000 mark, with data showing a sharp decline in whale accumulation and weakening institutional demand.

Bitcoin whale sell-off hits highest level since 2022

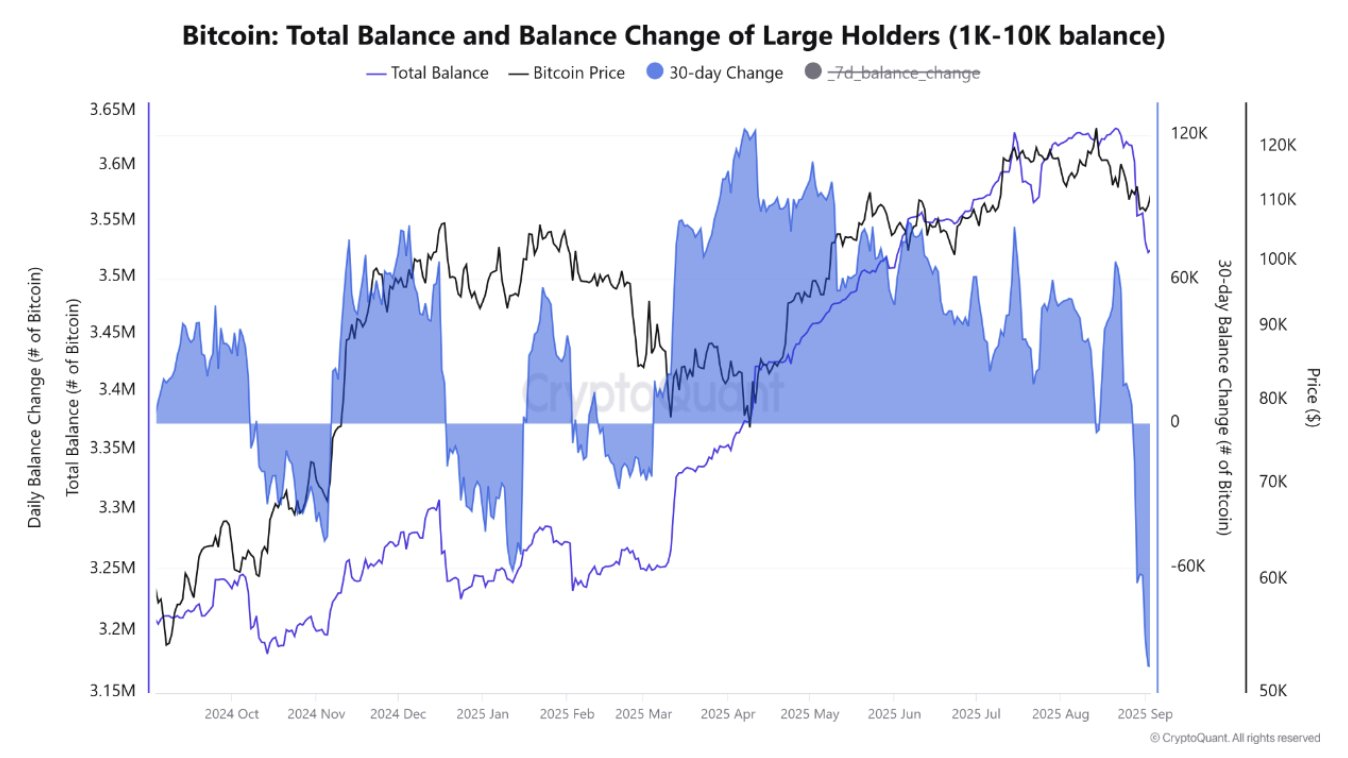

According to CryptoQuant analyst Caueconomy, the Bitcoin market is experiencing the largest wave of whale selloffs since 2022. In the past 30 days alone, whale reserves have declined by more than 100,000 BTC, equivalent to roughly $11.1 billion at current prices.

“This selling pressure has been penalizing the price structure in the short term, ultimately pushing prices below $108,000,” Caueconomy noted.

These large holders appear to be reducing exposure amid growing market uncertainty. Caueconomy also warned that the trend is not over, stating that current whale portfolios are still in decline, which could continue to weigh on Bitcoin over the coming weeks.

Adding to the concern, another analyst Maartun revealed on Monday that long-term holders offloaded 241,000 BTC, one of the largest since early 2025. The sheer scale of this selloff suggests that even seasoned holders are beginning to lock in profits or reduce risk exposure.

Institutional activity cools despite record holdings

A separate trend of declining institutional interest is also unfolding. Although Bitcoin treasuries currently hold a record 840,000 BTC in 2025, the growth rate has sharply declined. According to CryptoQuant, Strategy, the biggest holder with 637,000 BTC, experienced a decrease in its monthly purchases, which were 134,000 BTC in November 2024 and only 3,700 BTC in August 2025.

Bitcoin buys by other companies also slowed during this period, reaching only 14,800 BTC, far below this year’s peak of 66,000 BTC. Although the number of transactions is still high, the size of those purchases is shrinking. Strategy’s average transaction size dropped to 1,200 BTC, while others averaged just 343 BTC, down 86% from early 2025 levels.

This trend suggests caution and possibly liquidity constraints. Institutions are still active, but they are buying less per transaction, showing hesitance in current market conditions despite headline holdings being at all-time highs.

Price action signals range-bound trading as bulls lose steam

Bitcoin is trading at press time at $111,134, per market data from crypto.news. The crypto market giant is down over 10% from its all-time high of $124,128 and remains in a range of consolidation between $110,000 and $115,000. In the meantime, technical indicators are giving neutral signals. The ADX (Average Directional Index) is 16.10, which indicates a weak direction in line with the current sideways movement.

BTC must overcome $115,000 to continue the bullish trend, with $120,000 or $125,000 as potential targets. Conversely, a decline below $110,000 can pull BTC to the $105,000 mark once again.