Bitcoin’s current price is ‘insufficient’ to motivate holders, Glassnode says

Although the volume of Bitcoin supply in profit has hit levels last seen in 2021, it is still ‘far insufficient to motivate long-term holders,’ analysts say.

While Bitcoin (BTC) is trying to reach the $40,000 mark, analysts at Glassnode say the crypto so far does not have enough momentum to motivate long-term holders to unload their bags.

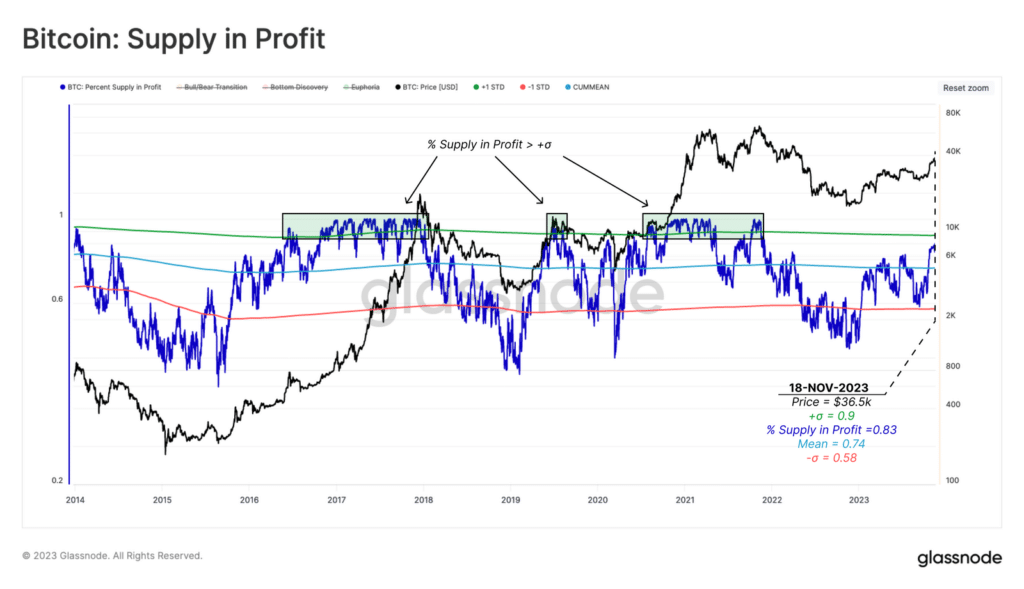

In a new digest published on Nov. 21, Glassnode noted that with the recent spike of Bitcoin’s price, over 16.3 million BTCs are now in profit (~83.6% of the circulating supply). This figure is similar to the 2021 bull market highs, analysts added.

Even though the market appears to be greedy at current price levels, Glassnode noted that most investors are still underwater as the magnitude of unrealized profit has not yet reached a “statistically high level coincident with the heated stages of the bull market.”

“This suggests that whilst a significant volume of the supply is in profit, most have a cost basis, which is only moderately below the current spot price.”

Glassnode

While a cohort of short-term investors declined to a new all-time low, decreasing their holdings by 2.3 million BTC, long-term investors appear to be unwilling to sell their holdings, waiting for a higher unrealized profit, analysts claim.

And it seems that long-terms investors would have to wait a few months longer before favorable conditions arise.

As crypto.news earlier reported, an anonymous Dutch investor and quantitative analyst, PlanB, best known for his stock-to-flow (S2F) model for BTC, believes the cryptocurrency is likely to stay in the $32,000-$64,000 range until the 2024 halving. According to PlanB, the real bull run will come after the halving “unless earlier ETF approval” is granted.