Bitcoin’s hashrate hits record high amid miner sell-offs

Bitcoin’s computing power has surged to record levels, even as miners ramp up BTC sales to cope with shrinking profit margins.

Bitcoin’s network strength reached a new milestone in early April, even as miners ramped up their Bitcoin (BTC) sales to stay afloat. On April 5, the hashrate achieved historic 1 sextillion hashes per second on a daily basis, according to data from BitInfoCharts.

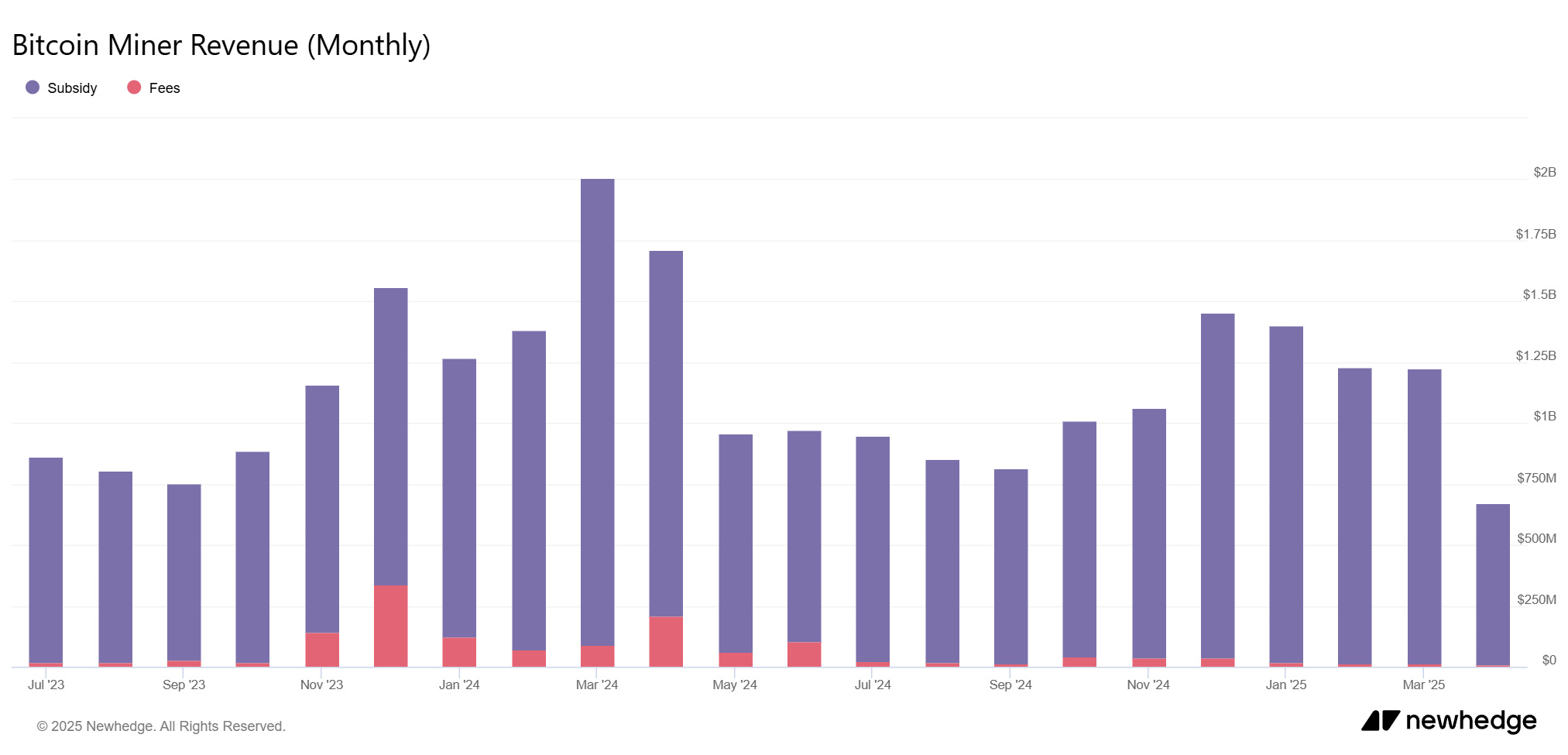

But while hashrate climbs, miner revenue remains under pressure. Bitcoin miners’ revenue in March dropped nearly 50% from March 2024 to roughly $1.2 billion, according to data from blockchain analytics platform Newhedge.

Miners earn rewards from two sources: block subsidies and transaction fees. With the latest halving in April cutting rewards to 3.125 BTC per block, fees have become more important. But with fees staying low and blocks often empty, miners are seeing shrinking margins.

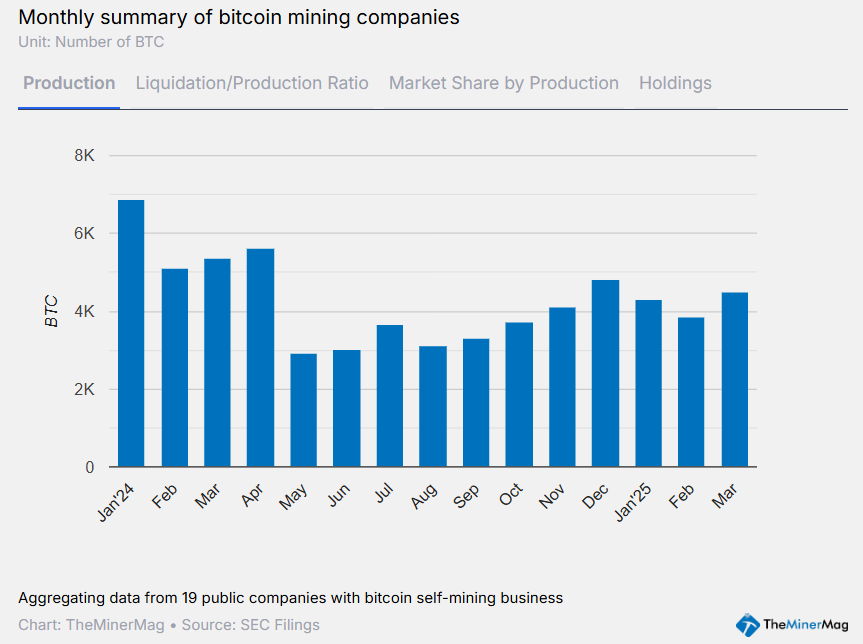

According to data from TheMinerMag, publicly traded miners sold more than 40% of their Bitcoin production in March — the highest level since October 2024. The report notes that the uptick in sales “suggests that miners may be responding to tightening profit margins amid persistently low hashprice levels and growing trade war uncertainty.”

Some firms went even further. Per the report, HIVE, Bitfarms, and Ionic Digital sold “more than 100% of their March production,” while others, like CleanSpark, appear to be adjusting their strategy.