Bitcoin’s ‘relief rally possibly ends after bullish surge

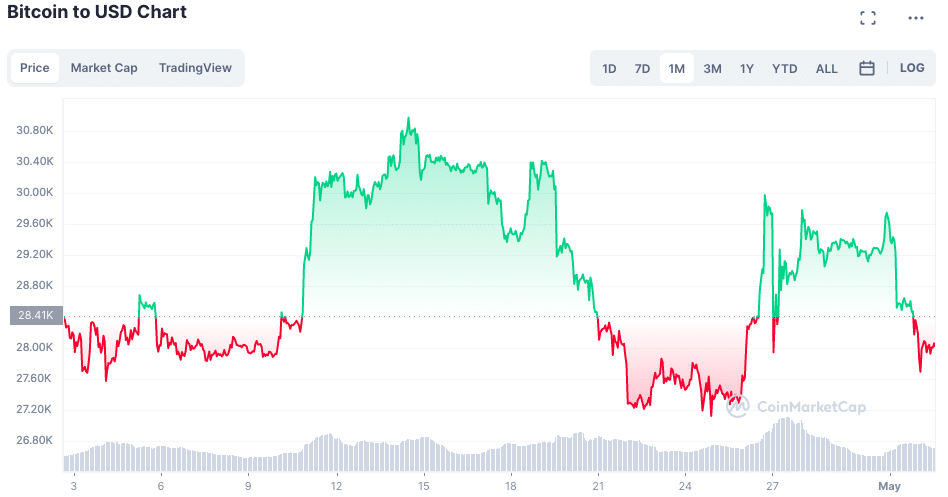

As of April, bitcoin’s price has remained steady at around $28,000 since March 23rd, marking a significant increase from its starting point of $17,000 at the beginning of the year.

Now, crypto traders and investors focus on whether bitcoin’s current price is still on the uptrend or if the relief rally is nearing its end. At the time of writing, bitcoin is sitting at 28,000, a 1.3% decrease in the last 24 hours.

A missing trend reversal

In cryptocurrency, relief rallies refer to temporary price increases after a significant market downturn. In the case of Bitcoin, it experienced a sharp drop in its value earlier this year, which led many investors to panic and sell off their holdings.

However, in recent weeks, Bitcoin’s price has been slowly climbing. This recovery may be seen as a relief rally because it provides some relief to investors worried about the cryptocurrency’s long-term prospects.

According to a recently published video from DataDash, we are in a long-term range of previous historical support that will likely serve as resistance again, like in June. This is a time-tested range of price action where we would expect some price resistance.

However, looking at longer-term time frames, it starts to get “very scary for the bulls.” The expectation is that a trend reversal or blue flip should occur as we cross into May, as we have accelerated far beyond the indicator. Instead, it has been red for three, almost four consecutive months, suggesting “we are not ready.”

Although there is no end-all for indicators, the one highlighted by DataDash is a time-tested momentum indicator used in forex markets, commodities, and many other markets long before crypto.

A source of confusion

However, looking at just the timeframe for the week, the momentum indicator still shows blue, which DataDash suggests may confuse investors.

Overall it is very difficult to trade a relief rally since it is hard to say how far it will go. These rallies are often short-lived and followed by further price drops. Therefore, investors are encouraged to monitor these indicators cautiously before taking on significant leverage positions.