BitMEX: Unknown organization controls 47% of Bitcoin hashrate

Bitcoin mining is becoming increasingly centralized, BitMEX analysts said.

The report says mining has become dangerously centralized, with one organization holding the coins mined by nine major pools, controlling about 47% of the network’s hashrate.

The document refers to a publication by a user under the nickname mononaut on X. According to the user, the unnamed custodian accumulated bitcoins from AntPool, F2Pool, Binance Pool, Braiins, BTC.com, SECPOOL, and Poolin.

The same custodian controls the entry addresses of ULTIMUSPOOL and 1THash and also receives mining rewards from Luxor. Many participants in these pools provide hashrate for the AntPool transaction accelerator, which was used by a large custodian.

In an article for Bitcoin Magazine, crypto analyst Alex Bergeron pointed out the high degree of centralization of mining in the Bitcoin blockchain. Bergeron explained that the pools are trying to adjust the payout scheme and completely eliminate income deviations from the equation.

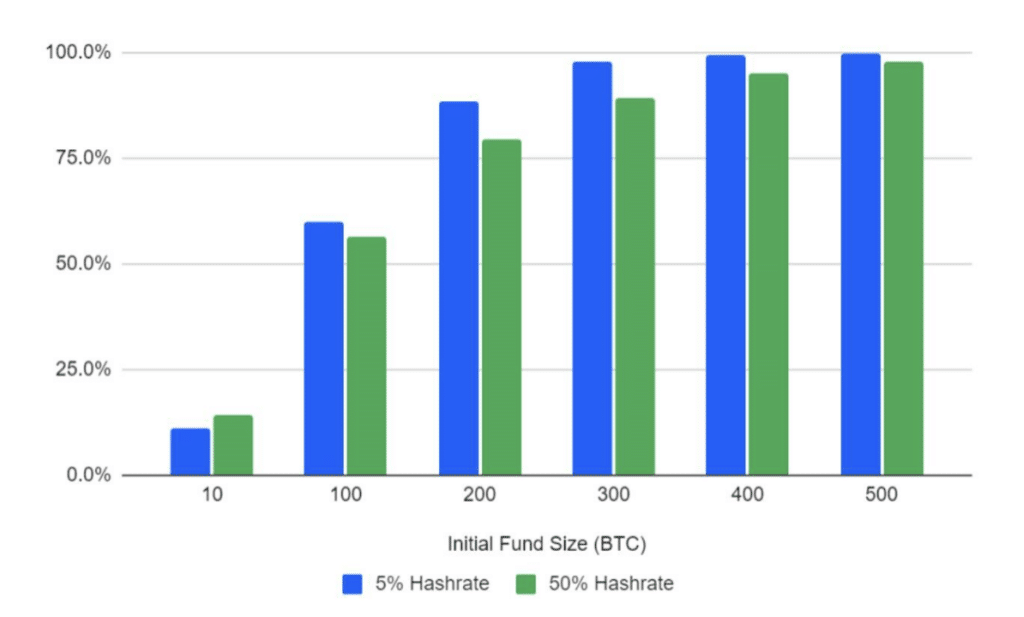

BitMEX researchers have calculated that the minimum fund of a mining pool that controls 50% of the hashrate should be at least 400 Bitcoins (BTC), giving the platform a 95% chance of survivorship within a year. For the risk-free existence of a pool that controls 5% of the capacity, a reserve of 500 BTC is required.

CryptoQuant CEO Ki Young Ju previously found no signs of Bitcoin miners capitulating despite the recent halving of the block reward as a result of the recent halving. According to the CEO’s observations, the income of cryptocurrency miners fell to the levels of early 2023.